Women are seen as more diligent when it comes to saving, but that usually doesn’t translate into investments.

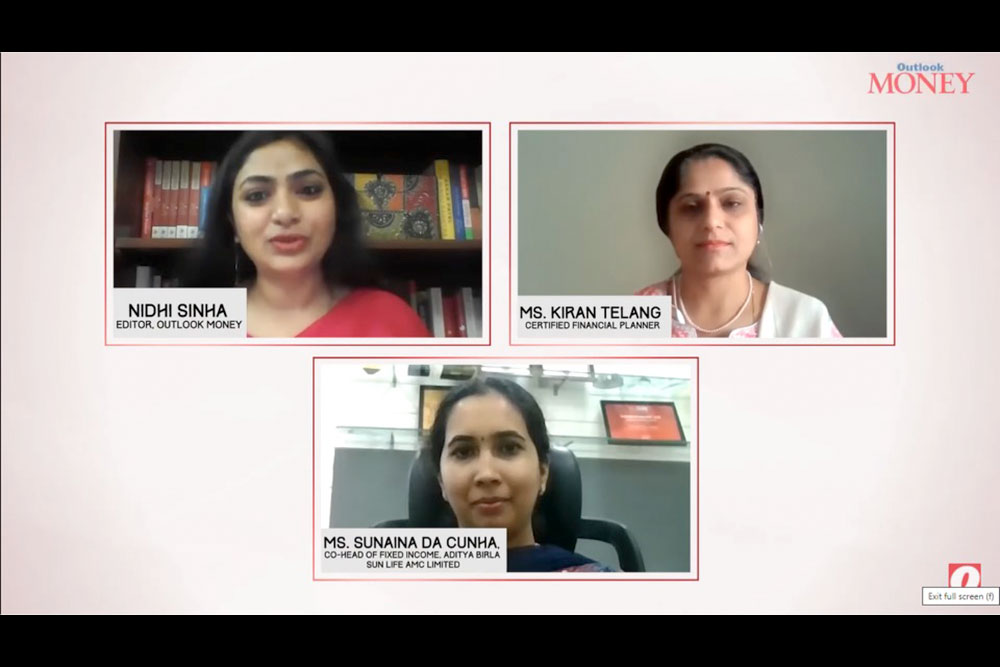

In a recent panel discussion on the role of women in financial decision-making, which was part of the FORHER campaign of Aditya Birla SunLife Mutual Fund for women empowerment, in association with Outlook Money, the experts discussed why it is important for women to take part in financial decision-making.

The panellists for the webinar were Sunaina da Cunha, head of fixed income at Aditya Birla Sunlife Mutual Funds, and Kiran Telang, a registered investment advisor with the Securities and Exchange Board of India. The discussion was moderated by Nidhi Sinha, editor, Outlook Money.

Da Cunha mentioned how women have traditionally managed the household budget, but these savings have been in the form of cash, gold and jewellery and other informal market investments. “If they are diverted into more formal investment channels, that will add another source of untapped capital to the economy. Increasing awareness about investments would be the way forward,” she said.

Telang mentioned about her experiences with women and investing while co-authoring the book, Money Wise Perspectives For Women. She said a woman who is a homemaker by choice may not be inclined to invest, but one who has to take up that role because of circumstances and is unable to take on a corporate or an entrepreneurial role will think of money, wealth, investment, and financial freedom. “That said, women must have a say in financial decision-making, such as for homebuying, the higher education needs of children, and the like,” she said. They should also know how and where to invest and create wealth in their own personal names in the long run, Telang added.

Investing remains the key to wealth creation, according to da Cunha, and women should start investing early in their careers. “Women are slightly more cautious in nature than men in terms of investing. So, I think the best way would be to be plan our investments on a regular basis in accordance with our goals. Our goals can be short-term in nature,” she said.

“For long-term investments, women can plan their portfolio with the help of a financial advisor. They can regularly monitor and calibrate it if it shows much deviation. They can also look out for books, information on blogs, websites and financial calculators to take help from,” da Cunha added.

She also emphasised on the need for women to set aside an emergency fund because that needs careful planning and time.

Telang said one way in which women can take charge of their finances is by participating in financial decision making. “When women come in for these financial planning meetings. I usually ask the couple to come together. There are some female clients who take charge of the finances, but there are many who don’t. They are scared because they don’t understand the technicalities. But when you explain it to them, it becomes that much simplified, and they feel happy about being a part of the entire financial planning process. That’s how they gradually learn. They don’t start taking ownership immediately, but they start to learn the processes.”

Da Cunha spoke about her experiences with women and finance in the rural hinterlands of India. “We have invested a fair amount of money in microfinance institutions and I have personally participated in a lot of these meetings and heard women tell their stories about how they have taken loans for some economic activity. The confidence they have built for themselves… They are not only independent, but also actually taking care of their family. It’s a silent movement towards financial freedom at the ground level,” she added.