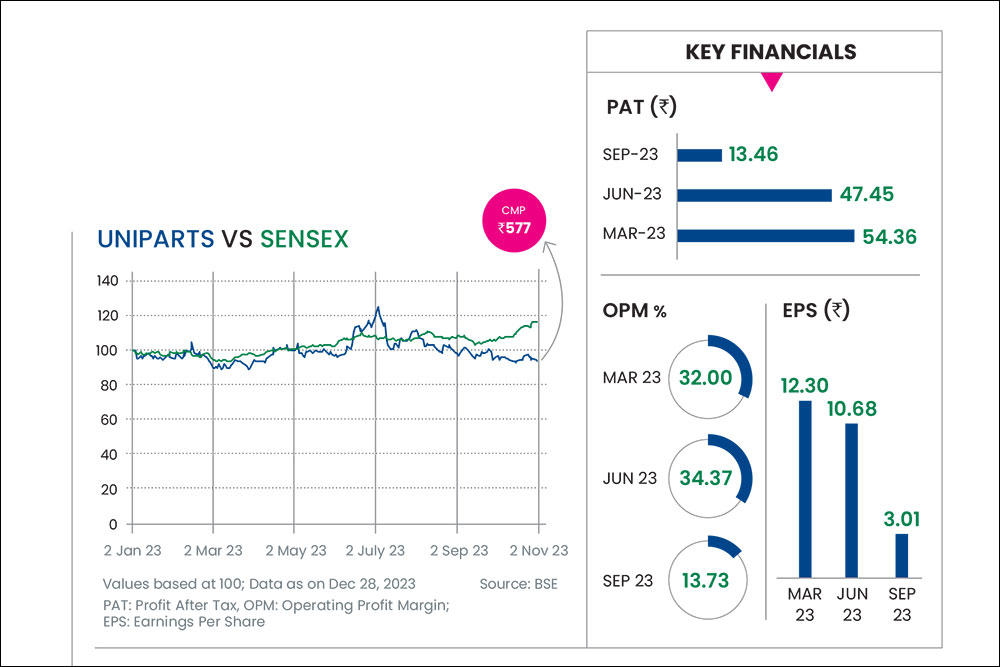

Company Name Uniparts India

Current Market Price Rs 577

Calendar Year Return 1.27%

***

Uniparts India is a leading supplier of systems and components for the off-highway vehicles (OHV), supplying key systems and components like 3-point linkage systems (3PL), precision machined parts (PMP) and hydraulic cylinders.

Investing Rationale

Full Package: Over the last many years, the company has evolved from being just a component supplier to a total solution provider encompassing complete assemblies of precision products, with in-house capabilities based on customer requirement, which includes product conceptualisation, designing, prototyping, testing, development and assembly to customised packaging and delivery. Its ultimate aim is to be an integral part of its customers’ global supply chain. So the company has been able to convert itself into a concept-to-supply player with presence across the value chain, offering fully integrated engineering solutions from conceptualisation, development, validation, implementation and manufacturing of their products. Most of these are complex, critical, and low-volume-high stock keeping unit products. The focus is on higher value addition products and enhanced service offerings to improve the margin profile, which has helped the company manage operating profits margins of above 20 per cent.

Facilities: Uniparts has five manufacturing plants in India and one in the US, with a market size of more than $10 billion, with huge aftermarket opportunity. The company has aftermarket retailers and distributors in North America, Europe, South Africa, and Australia.

Customer Base: They have 125 customers across 25 countries, including top 10 OHV players and top five in construction, forestry and mining. The company’s key clients in agriculture and CFM sector includes TAFE, Doosan Bobcat North America, Class Tractors, Yanmar Global Expert, and LS Mtron.

Four of the company’s top five customers have been around for over 10 years, while TAFE and Kramp have been their clients for over 15 years. Its key customers in the farm machinery space in the domestic market include Mahindra & Mahindra, International Tractors (ITL), TAFE, Kubota-Escorts, among others. It is a diversified customer based with long standing relationships. About 82 per cent of their revenue comes from overseas.

Earnings: The last quarter earnings were a bit disappointing due to channel inventory de-stocking but it’s expected to be on track by Q4FY24.

They have a healthy balance which is net debt-free with cash of Rs 100-plus crore. The management has guided a 15 per cent revenue compounded annual growth rate (CAGR) with earnings before interest, taxes, depreciation and amortisation margins increasing by 150 basis points (bps). I am expecting an earnings per share of Rs 58 for FY25 with a target price of Rs 700.