Some people mock this concept of a New Year’s resolution. The argument being that if you want to do something, you will not wait for a particular date in a specific month to begin it.

This reasoning is solid if you don’t consider the psychological aspect. The New Year gives a sense of renewal and an opportunity to hit the reset button. It promises a fresh start and the impression of a clean slate.

John Norcross, chairperson of the Department of Psychology at the University of Scranton, the US, is often cited for this, as he had pointed out that humans have practised it for a long time. The Romans made resolutions of good conduct to the god Janus, for whom the month of January is named, while the Babylonians began each year by pledging to pay debts and return borrowed items.

At the start of 2023, it would be nice to make a resolution to attain financial wellness. And by that, I am not referring to only money.

The Legend Of Hetty Green

In the early 1900s, Hetty Green was despised by some, but feared by many. In an age where women were not allowed to vote, she was a formidable character in high-stakes finance who built a reputation as a ruthless loan shark.

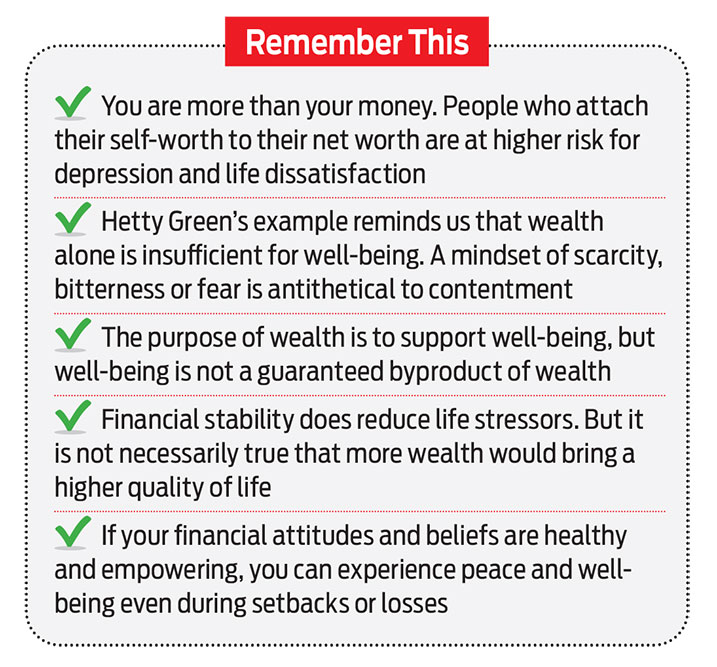

I have often written about Green earlier. Recently, my colleague and Morningstar’s director of financial psychology, Sarah Newcomb, used her as an example to discuss financial well-being (See Remember This to read her takeaways).

The lady was born into wealth, inheriting a few millions (varying accounts put it at $5-$7 million) in her early 30s. But being a brilliant strategist and shrewd investor, she converted that to $100 million in 50 years. That probably made her one of the world’s richest women during her day and the wealthiest one in America.

Unfortunately, her quirks and eccentricities were more newsworthy than her financial exploits. While she had the skill and laser-sharp focus to make money, she detested spending it. Her frugality was legendary.

She refused to turn on the heat, even in cold weather. Using hot water was deemed too expensive. There was no need to eat lavishly—Graham crackers, oatmeal, ham sandwiches, and pies that cost 15 cents were just fine. She bought broken cookies for her children because they were cheaper and returned the berry boxes for a 5 cent refund. She haggled with local merchants over every penny.

Why spend money on a decent wardrobe when her worn-out black shabby gown would serve the purpose? Her father gifted her $1,200 to shop for clothes as a teenager. She spent $200 and saved the rest. She instructed the laundress to wash only the hem of her dresses to save money on soap. Her black attire (gown, hat, veil, and cape—all in black) earned her the sobriquet, the ‘Witch of Wall Street’.

She refused to pay for decent medical care for herself or her children. Renting and constantly shifting homes was smart, since having a permanent residence would attract property tax (property tax collectors first had to establish proof of residency to collect personal property tax). Once on her mantle, she displayed a bouquet of “roses” made from dyed chicken feathers, because it was cheaper and lasted longer than a bouquet of real ones.

Her penchant for thrift was as disgusting as it was bizarre. It even turned out to be historical (she entered the Guinness Book of World Records as the ‘World’s Greatest Miser’).

Dubbed ‘Queen of Wall Street’, the ‘Witch of Wall Street’, ‘Hetty The Hoarder’, ‘America’s First Female Tycoon’, and ‘Wall Street’s First Female Financier’, the life of this idiosyncratic lady points to someone extremely discontent who could not even enjoy the wealth she created for herself.

Sarah Newcomb referred to Green’s story to illustrate that financial well-being is not only a number.

The Power Of Enough!

In May 2007, Vanguard’s founder John Bogle gave the commencement address at Georgetown University. He flagged it off by recalling a story.

At a party given by a billionaire on Shelter Island, in the US, American writer Kurt Vonnegut informs his pal, the author Joseph Heller, that their host, a hedge fund manager, made more money in a single day than Heller earned from his wildly popular novel Catch 22 over its whole history.

Heller responds, “Yes, but I have something he will never have . . . Enough.”

In his book Enough: True Measures of Money, Business, and Life, Bogle elucidates further: “Enough. I was stunned by the simple eloquence of that word for two reasons: first, because I have been given so much in my own life, and second, Joseph Heller couldn’t have been more accurate”. For a critical element of our society, including many of the wealthiest and most powerful among us, there seems to be no limit today on what enough entails. That message is what Joseph Heller captured in that powerful single word, enough.

Enjoy What You Have

Money is just a tool. A transactional tool. It is to get you what you desire. That could be status, security, lifestyle, a home, a car, a holiday, mental peace, etc. That is why accumulating money for the sake of it makes no sense. That’s because, money by itself is never an end in itself. It is earned and saved, and invested to serve a purpose.

Get clear on your purpose. Don’t look at anyone else’s. Only then will you understand contentment and the power of “enough”. And you will be well on your way to attaining financial well-being. Financial well-being will allow you to enjoy the emotional security that comes from knowing you have enough to weather life’s storms, rebound and, if necessary, rebuild.

On top of basic security and resilience, it is a sense of satisfaction and contentment in your life, a low desire to compete with others or impress society with your material capabilities.

If money is an end in itself, then you will never be satisfied. That is why it is essential to have goals because it gives you clarity on what really matters to you.

The author is an Investment Specialist at Morningstar Indiapsychology