From April 1, 2023, there will be no tax arbitrage between bank fixed deposits (FDs) and debt mutual funds that was a major draw for debt fund investors. The amendment to Finance Bill 2023 has removed long-term capital gains tax benefits on debt mutual funds. In other words, the indexation benefit that came with debt funds won’t be available anymore.

Like FDs, debt funds will also be taxed at your marginal tax slab rate. With FDs and debt funds now on a par, what should the investors do? We explore the future debt funds landscape and how it could affect buying decisions for investors.

What’s Changed?

In 2014, the government had changed the taxation of debt mutual funds by increasing the holding period from one to three years for tax rates on long-term capital gains to apply. So, an investor holding a debt mutual fund for more than three years had to pay 10 per cent tax without indexation or 20 per cent with indexation benefits on long-term capital gains. This was beneficial for investors in the higher tax slabs as the indexation benefit helped lower the tax outgo.

The indexation figures are published annually based on the cost inflation index (CII), which takes into account the prevalent inflation in the country based on the consumer price index (CPI).

Now investors need to pay tax on all gains at their tax slab rates, irrespective of the holding period. For instance, a person in the 30 per cent tax slab will have to pay that much tax instead of the lower rates earlier.

This will not only impact debt-oriented funds but also other categories which fall in the debt category for taxation purpose such as gold exchange-traded funds (Gold ETFs), and some fund of funds, domestic and international.

Is The Future Hybrid?

The change in taxation could mean two things. One, people may consider other debt products such as FDs, which are also taxed at the slab rate and give guaranteed returns.

Two, they may move to equity-oriented debt funds, whose taxation is better for those in the higher tax brackets. Long-term capital gains, above `1 lakh, from equity investments are taxed at 10 per cent after a holding period of one year.

It could lead to a decline in inflows with people preferring instruments that attract equity taxation. Says Chirag Mehta, chief investment officer, Quantum Mutual Fund, “We believe that this move will affect the inflows. On the flip side, the move could result in a flight of flows to balanced advantage funds and aggressive hybrid funds which invest in a mix of equity and debt, but are subject to equity taxation.”

The passive fund category of target maturity funds, which was gaining traction from retail investors in the recent past, may also see a dent.

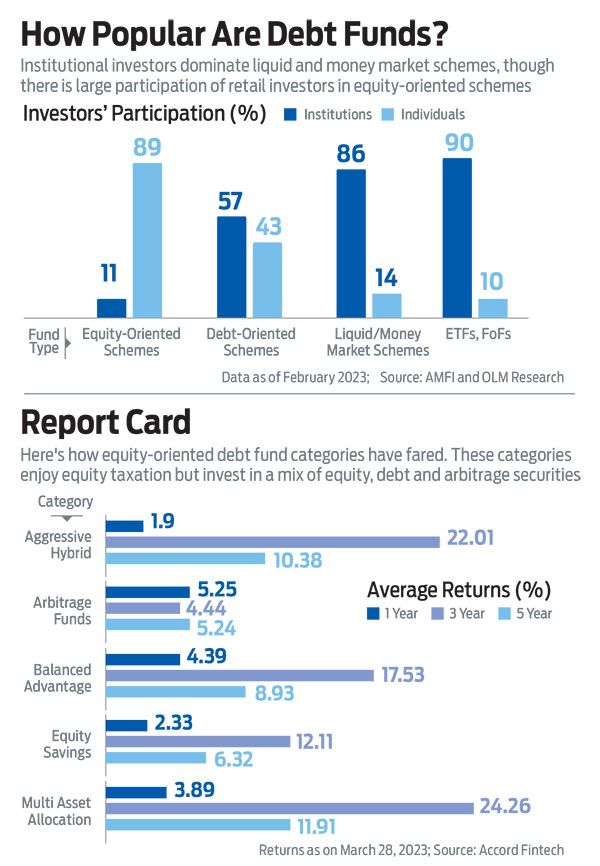

Even institutions, who are the major investors in debt funds, may try to find other avenues. According to data from the Association of Mutual Funds in India as of February 2023, liquid and money market funds account for 86 per cent institutional money. “This institutional money may move to arbitrage funds for better taxation,” says the head of marketing of a fund house, on the condition of anonymity.

What Should You Do?

It may be noted that existing investments in debt funds, international funds and gold funds, and even new investments made until March 31, 2023, will not be affected by the proposed amendments. These investments will continue to be taxed as per the current taxation rules on long-term capital gains once they complete three years.

But what about the next financial year when the taxation of debt funds and FDs will be on a par?

FDs are safer than debt mutual funds as they offer guaranteed returns unlike the latter, which are subject to market conditions, but some experts believe that debt funds still have an edge. “Beyond taxation, debt mutual funds will still have an edge over bank FDs when it comes to other aspects such as the benefit of deferred tax (interest on fixed deposits is taxed on an accrual basis). Also, the liquidity aspect can never be overlooked,” says Rahul Pal, head, fixed income, Mahindra Mutual Fund.

Also, debt MFs can potentially be a better compounder vis-a-vis bank FDs because of market-linked interest rates, which tend to be reflected in FD rates with a lag, adds Pal. Debt funds not only help you gain from accruals, but also from bond price movements.

The comparison between these two products will rest largely on performance and convenience.

kundan@outlookindia.com