Financial Advisory

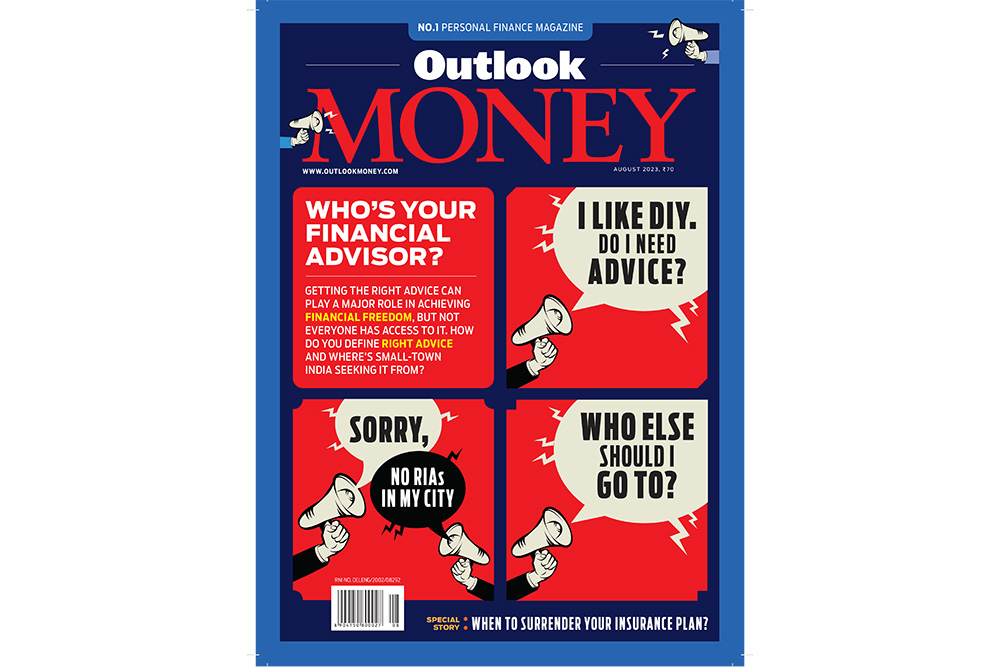

The Financial Sherpa You Need in the August 2023 issue has raised a valid point. Despite massive demand for financial guides, supply of Sebi-registered investment advisors (RIAs) is abysmally low. The article has been an eye-opener. I also used to take help from my friend who worked as an insurance agent. But now the space has become complex with many options that insurance agents are not necessarily aware of. Unfortunately, people in small cities like me are forced to adopt the “do-it-yourself” strategy. I wish someone can help me manage my funds so that it can generate returns and my financial goals are met.

Sharad Bhattacharya, email

NPS Benefits

The interview with Pension Fund Regulatory and Development Authority (PFRDA) Chairman Deepak Mohanty, published in the June 2023 edition of Outlook Money, was enlightening. Over the years, the National Pension System (NPS) has become one of the best investment vehicles to build a retirement corpus. While the product can be bettered, PFRDA should seriously reconsider compulsory buying of annuities with 40 per cent of the corpus upon retirement. Having said that, the low-cost structure of the NPS, coupled with its tax benefits, makes it a great product.

Arup Choudhury, email

FD Laddering

Ladder Your FDs To Create A Cushion Against Rate Changes story in the August 2023 issue of the magazine was interesting. I have invested in fixed deposits (FDs) for a long time but never used this laddering technique. It is because, whatever the interest rate scenario is, rising or falling, I felt I had the option to break the FD and reinvest it when the rates go up. Besides, I always thought tracking multiple FDs would be hard, given my busy schedule. I have invested a significant amount in my two FDs maturing later this year. However, the article has inspired me to try something new. I will certainly go for the laddering strategy this time.

Avni Sahay, email

Plan First

I retired in 2017 and get no pension as I have worked in a private company. After reading Why You Should Plan First, Invest Later in the magazine’s August 2023 issue, I realise that I may have made the same mistake as others by investing in IPOs and NFOs. I did it because everybody around me was doing it. It was neither planned nor in my best interest. Thankfully, I haven’t invested a big amount so did not lose much. The story rightly picked up the pattern that many times investment is not planned but done in conformity with others’ actions.

Kalyan Sahu, email