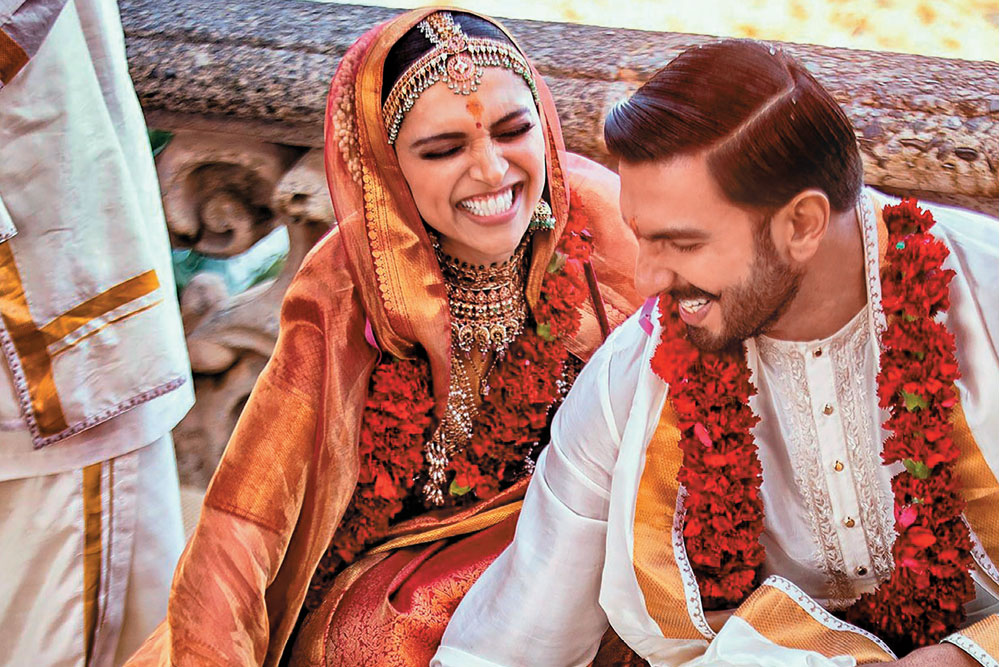

From Sabyasachi sarees to Frida Kahlo inspired makeup to missing names from the guest list, the high-profile DeepVeer (Deeepika Padukone and Ranveer Singh) November wedding was one of the most talked about event on social media. However, amidst all the glitz and grapevine, we conveniently missed out on the kind of awareness the couple showed by insuring the event with an all-risk covered policy. The insurance cover purchased by Singh from Oriental Insurance Company (OIC), one of the non-life companies promoted by the Government of India, however, was not a full-fledged wedding insurance policy but covered all the jewellery that they wore.

In India, weddings are an elaborate affair. Most of them last for three or four days and often turn out to be a week-long affair embodied with rituals, ceremonies and celebrations. And in such cases, the chances of any untoward incident cannot be completely ruled out. Wedding insurance ensures that the celebrations are carried out smoothly. However, very few know about such a policy and fewer bother to avail it. Tushar Joshi, Chief Life Insurance Advisor, explained, “There is no awareness about wedding insurance in India. Only a handful of event companies come forward to be insured for weddings or events.”

A comprehensive policy includes loss or damage to the insured property due to fire, theft, explosion, aircraft damage, earthquake, water damage, burglary, hold-up, robbery in transit, flood, storm and typhoon. It also gives cover against riot, strike and malicious damage. Sanjay Datta, Chief, Underwriting, Reinsurance and Claim Actuarial, ICICI Lombard General Insurance, pointed out the benefits of wedding insurance, “A wedding can be insured through an insurance that primarily covers cancellation of event, damage to property, personal accident and legal liability of the insured due to third-party bodily injury and property damage arising out of insured premises operation.”

The average wedding expenditure in India may range between `4 lakh and `10 lakh. For the high profile and Bollywood celebrities, it runs into crores. Still, most Indians consider wedding insurance to be an optional choice and rarely opt for it.

However, there is no dearth of options in the market. Some insurers offer wedding insurance policies exclusively while others offer them as event insurance or all-risk policy. In fact, in order to create more awareness, many insurers have fashioned unique ideas to meet customers’ demands. “Yes, there are policies which are exclusively meant for weddings but most companies sell wedding insurance as a part of event insurance,”added Rakesh Jain, Executive Director and CEO, Reliance General Insurance. Exclusions include non-appearance of any person or a group of persons, any contractual dispute or bridge by the insured persons or any participant and alterations of insured events without the prior approval of the insurer. In such cases, the policy gets terminated.

As far as the cost of a product is concerned, different factors are taken into consideration at the time of arriving at a fair premium. Insurers also offer extra cover for jewellery for an add-on premium, Joshi said. “In case of old, inherited jewellery or antiques precious ornaments, a jewellery valuation certificate from a government approved valuer is required. Based on the value certificate, the premium is charged. These valuation certificates are valid for three years from the issue date,” he added.

Total sum insured for a wedding insurance policy depends on the expenditure already incurred including wedding venue, hotel bookings, car rentals, decorators, guest lists and value of the jewellery. Premium is based on declared value or estimated cost. According to the estimated expenditure and value of the jewellery, the insurer calculates the premium. The number of days for the cover can be selected according to the requirement, he informed. Moreover, security arrangement like CCTV camera, nature of the venue - closed or open, the guest list, restriction on entry and the kind of security measures taken into consideration have to be mentioned at the time of taking a policy.

In case of events or exhibitions, cost of decoration, number of stalls, venue rental, advertisement, hotel bookings and expenses incurred needs to be declared at the time of taking the policy. Joshi informed, “Unlike Indian organisers, international companies do not consider event insurance as an optional feat.” They approach for event insurance for international expo, exhibition or fair. A smart choice can reduce the stress and risks, explained Joshi. In the first week of December an international exhibition was held at International Exhibition Center, New Standard Engineering, Goregaon, Mumbai, and it was fully insured. “If any unfortunate event occurs, the policyholder should immediately lodge a police complaint and intimate insurance company. The loss would be assessed by the surveyor based upon the information and documentation submitted to him by the customer,” he further added.

After the wedding, the newly-wed couple begins a new life, probably in a new city and in a new home. Something so special is completely safe only when you have insured it.

A household insurance policy protects your precious collections, antiques, jewellery and other household items against any accidental damage. “With the increase in the number of natural calamities in India, having a home insurance is the need of the hour. It not only protects the structure of the house, but also the contents within. It is important to have an appropriate home insurance that will safeguard you from any financial burden in case of any loss,” said Sasikumar Adidamu, Chief Technical Officer, Bajaj Allianz General Insurance.

Few insurers have inbuilt cover for jewellery or valuables under household insurance policy. Also there is a separate policy for jewellery, valuables and artefacts, which is optional, where the customer can decide whether to opt for the same.

If the policyholder chooses to opt for an add-on cover, the jewellery and valuables remain protected anywhere in the country. Moreover, for an additional premium, the cover can be extended across the globe. Other important add-on covers include key and lock replacement, ATM withdrawal, robbery, loss of wallet, public liability and employee compensation. Even your pet dog can be covered under insurance policy, Adidamu added. It covers medical expenses for all diseases or accidents your pet may contract during the insurance period.

For ‘Under My Home – All Risk Policy’ from Bajaj Allianz General Insurance, the premium is based on the sum insured and the plan. This policy provides cover either on agreed value basis, reinstatement value basis or indemnity based on which the premium is charged. The value of real estate is considered and based premium is charged based on that.

Since the value of a flat varies from city to city, the premium also will vary accordingly. To give an example on an agreed value basis cover, for an 850 sq.ft. flat in Mumbai valued at `3.5 crore, the premium for the structure is around `15,000.

A flat of similar size in Kolkata may cost `50 lakh and the premium for the same will accordingly come down to around `2,000. (All these costs are excluding GST). Tushar Joshi owns a bunglow in Murbad near Mumbai and has insured it. All the electrical fittings, electronic appliances, domestic appliances, air conditioners, furniture and fixtures worth `65 lakh is insured at a nominal premium of `1,266 including GST for a year.

A policyholder can choose how much jewellery or valuable to be insured under My Home insurance policy. There is no maximum limit. Although for a sum insured exceeding a certain limit, a valuation certificate is required from an authorised valuer.

The policyholder can add content, jewellery and paintings, and for that the premium would again vary depending on their value. These limits vary from `2.5 lakh to `10 lakh depending on the plan opted under the policy. “The premium varies from company to company and from coverage to coverage. However in general for a sum insured of `25 lakh worth jewellery the premium varies from `250 to `500,” added Jain.

Apart from Bajaj Allianz, few other companies like ICICI Lombard, Bharti Axa, HDFC ERGO, SBI, Tata AIG also offer home insurance. Most of them offer protection against fire, flood, storm, cyclone, typhoon, earthquake, lightning, domestic mechanical, electrical equipment, electronic appliances, fire, lightning, explosion or implosion, aircraft damage, riot, strike, malicious damage, jewellery and valuables against accident, burglary and house breaking. However, insurance coverage varies from insurer to insurer and types of policies.

Uncertainties lie in every step of our life and it is our responsibility to minimise the risks. Insurance is the solutions for such unpredictable situations. It is always better to be insured than sorry.

yagnesh@outlookindia.com, nirmala@outlookindia.com