Company Name: RK Forgings

CMP: Rs 234

Market cap: Rs 2,534 crore

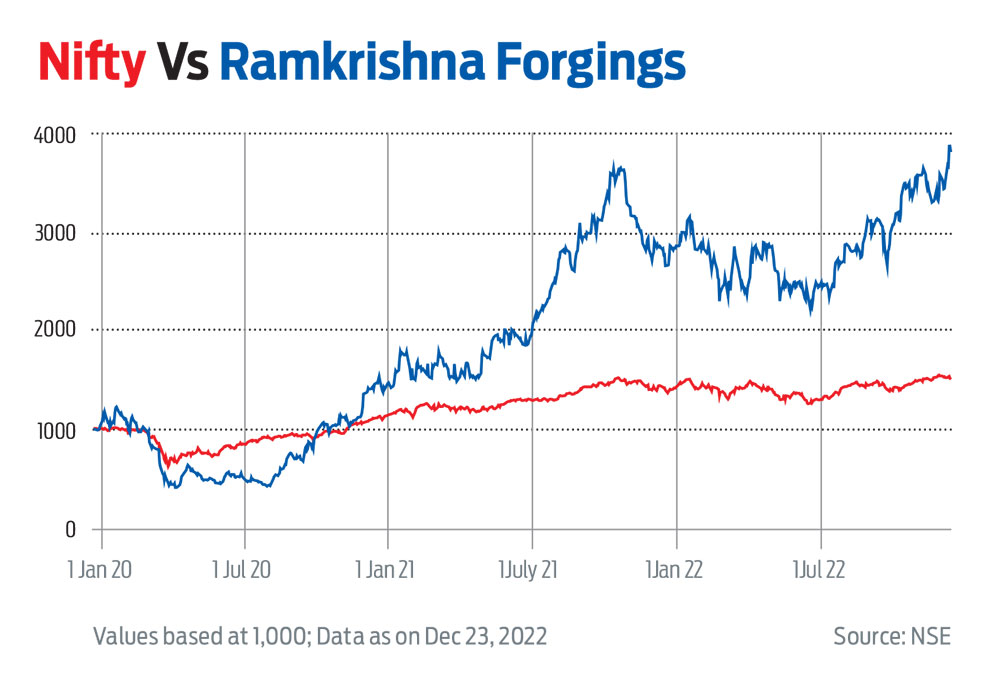

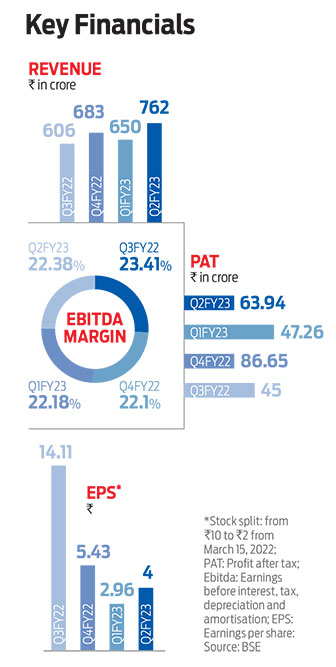

Ramkrishna Forgings is a three-decade-old company that has achieved commendable progress over the years and has now become one of the major players in the fragmented forgings industry. The company gave the best-in-class performance over the last decade with a compounded annual growth rate (CAGR) of around 16 per cent in revenue and 24 per cent in profit, with a solid 20 per cent-plus return on equity (ROE) currently.

Industry Dynamics

While the robust growth achieved hitherto was by largely servicing the automobile industry, a structural change in the sector with the gradual shift towards electric vehicles (EVs) is a potential challenge as the need for forged components would greatly reduce. The number of moving parts in EVs is minimal as compared to conventional vehicles.

The thrust towards infrastructure modernisation—both domestically and in the US—has offered good diversification opportunities to the forging industry, and a meaningful impact of the change into EVs would take several years to play out.

Moreover, the Indian industry and the company, in particular, are beneficiaries of China-Plus-One development, where the US is shifting its supply chains from China.

Company’s Initiatives

The company has prudently diversified its business into the earth moving, railways and energy sectors to sustain its growth, though automobiles continue to be the dominant segment it services. Over the years, it has created six state-of-the-art manufacturing facilities while employing the most modern technologies, which helped improve quality and productivity levels substantially.

Exports to the most quality-conscious and demanding developed markets have increased and now account for almost half the sales. Collaborative efforts are also underway at developing new EV products in these markets.

Performance and Valuation

With the capacity additions currently under implementation, the company is capable of doubling its topline in the next three years from the current trailing-twelve-months (TTM) sales of `2,700 crore. With a track record of prudent capital allocation, net debt to Ebitda at less than two times and a management guidance of 20 per cent plus revenue growth in the next three years, it is poised to grow its earnings more proportionately with the benefits of operating leverage kicking in, the current capacity utilisation being around 65 per cent.

The stock trades at 18 times TTM profits, at a substantial discount to its peers. Despite strong fundamentals, it trades at an enterprise value to sales of 2.1 times compared to an average of more than double this number at which its peers trade. It is confident of generating robust free cash flows over the next three years to become debt-free by 2025.

At current prices, based on the expected momentum and growth, the stock offers a good return potential along with reasonable safety margin.

Risks

A prolonged Russia-Ukraine war and the possible spread of the Covid pandemic, currently rampant in China, could pose serious challenges to its performance, besides risks in implementing the expansion plans.

***

Turning The Tide, Slowly But Surely

Company Name: HCC

CMP: Rs 16

Market cap: Rs 2,534 crore

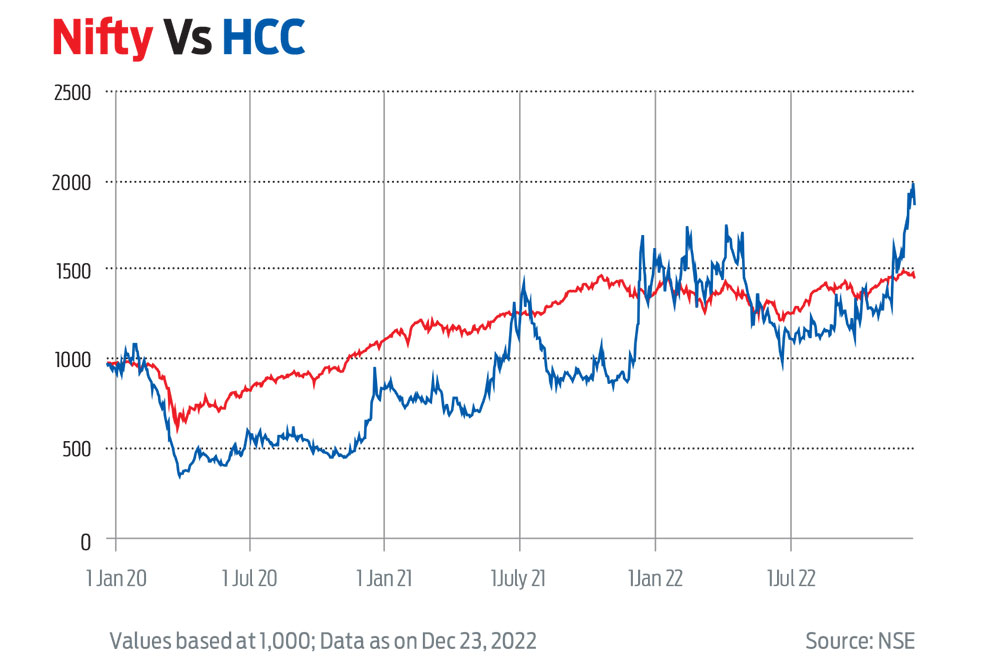

Hindustan Construction Company (HCC) is a 96-year-old engineering and construction company that has executed some of the marquee projects in India, including the likes of the Bandra-Worli sea link in Mumbai, the Mumbai-Pune Expressway, the Rajasthan and Kudankulam nuclear power projects, the Kolkata Metro Rail project, several oil refineries, dams, etc.

Despite the stellar track record in executing several prestigious large-value projects, misallocation of capital in outsized investments in real estate and build-operate-transfer (BOT) projects and the pandemic-delayed payments from the governmental agencies brought the company to near-bankruptcy.

After Herculean efforts, the company is now at the cusp of a dramatic turnaround, having addressed all the issues that were holding back its performance.

A Restructured Company

The company has recently completed reorganisation of its debt with its lenders that has significantly deleveraged the balance sheet and addressed its asset-liability mismatch, thus enabling it to bring a measure of normalcy in running its business operations.

The debt reorganisation involved a carve-out of around Rs 4,000 crore of bank debt to a partly-owned special purpose vehicle (SPV), along with a transfer of the economic interest in arbitration awards and claims up to Rs 9,200 crore. The arrangement involves a cap on the return to the external majority owner of the SPV with the excess returns back to the company.

Moreover, the Hindustan Construction Company has completed conciliation proceedings relating to some of the contested receivables from the government agencies and exited some of its BOT assets, thus generating the much-required liquidity to meet its working capital requirements.

Consequently, on a standalone basis, the company has a cleaner balance sheet with a positive networth and serviceable debt levels.

Business Prospects

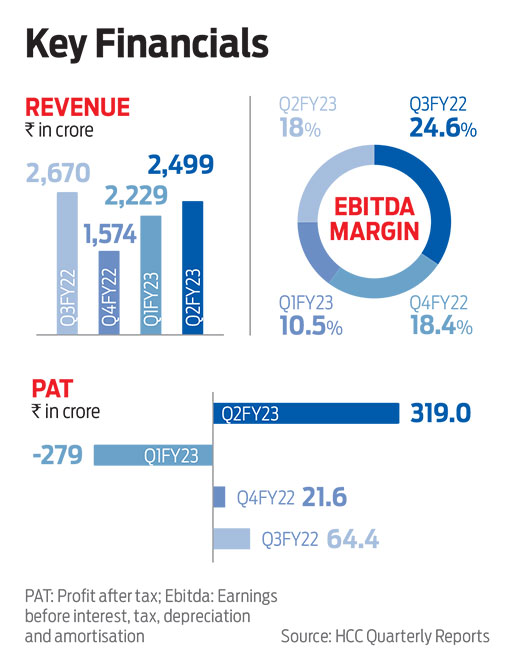

Given the company’s excellent competence on the engineering-procurement-construction (EPC) front, despite the financial constraints, it continues to win major high-value contracts in the hydro and urban infrastructure development space where it has an order backlog of nearly Rs 14,000 crore and much more at the bid submission and evaluation stages. These complex projects are under execution and should generate a sustained growth in topline, apart from cash flows and profits.

Turnaround And Valuation

In the September 2022 quarter, the company recorded consolidated sales of around Rs 2,500 crore with an Ebitda margin of 23 per cent and a net profit of Rs 319 crore. With around Rs 5,300 crore of awards and claims to be realised and the likely sale of BOT and other assets, as also reduced interest outgo due to debt restructuring, the company is set to achieve a remarkable turnaround in its fortunes.

This is, of course, not without the concomitant risks relating to delays in realisation of long-pending receivable claims, asset sales, and execution. On balance, however, given the significant efforts that have gone into pulling the company out of near-bankruptcy, the management is likely to strive hard to achieve normalcy in operations and generate sustained and profitable growth.

With a modest market cap of under Rs 3,000 crore, the stock could give significant returns, though it is meant for investors with an appetite for high-risk-high-return type of investment and commitment to long-term growth. The changing market dynamics, offering growth opportunities, and demand for sustainable projects requiring top engineering skills bode well for the company.