There’s no easy way to approach the subject of retirement in India. For a lot of people, retirement is a vague concept to be thought of and planned for some time in the far future. While awareness about savings has been slowly increasing, few think of channelising it to meet financial goals, especially retirement.

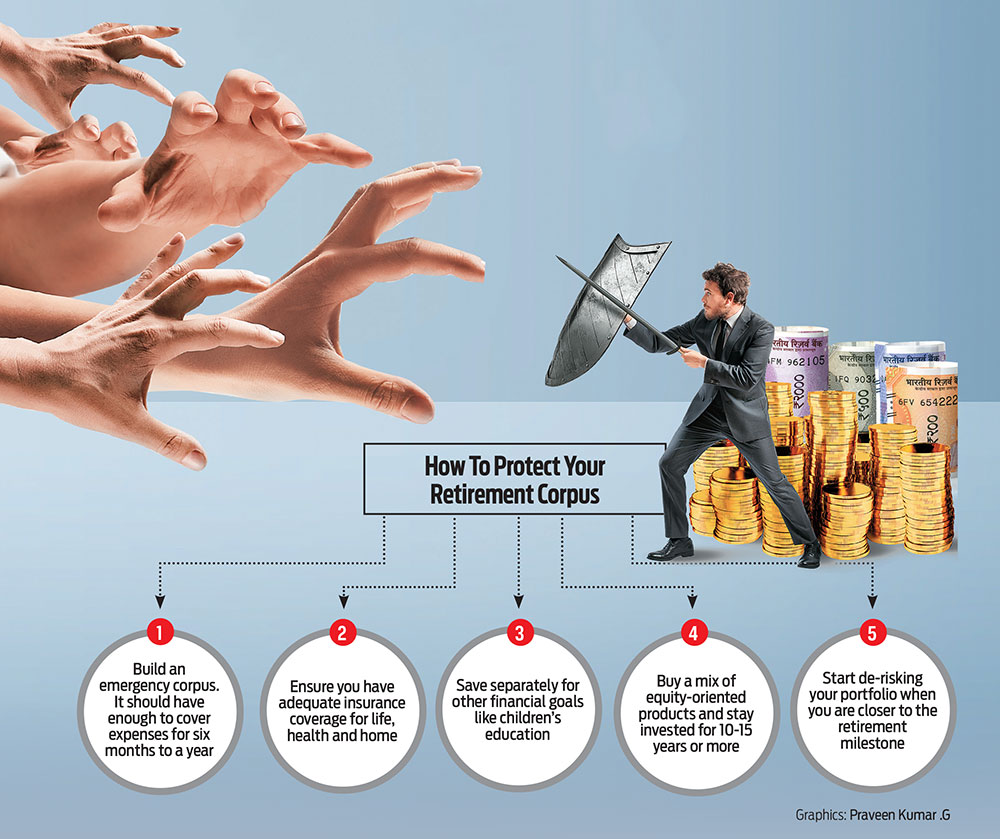

There are others who manage to build a kitty, but dither when other financial goals like children’s education stares them in the face and don’t keep enough for the last financial and life milestone that is retirement. Still others—and the number is large—manage to buy products that are not exactly suited for retirement, thanks to rampant mis-selling in the financial sector.

The fact that the goal of retirement planning is still not taken seriously in India is reflected in data as well. The New Pension System (NPS), which replaced the defined pension schemes for government employees in 2004 and was extended to the private sector in 2009, has garnered just about 15.5 million subscribers or roughly 1 per cent of India’s population in the 18 years of its existence. The assets under management (AUM) of NPS, though growing consistently as per data from NPS Trust, is Rs 6.97 trillion.

In the Rs 38 trillion mutual fund industry, the AUM for retirement solution funds is a trickle—just above Rs 15,000 crore. Mutual funds can be effectively used as a saving instrument for retirement (read Pointing In The Right Direction later in the cover story package).

With rising life expectancy and reducing dependency on the next generation, retirement planning is something that can’t be ignored. You may easily need a corpus that is able to last 20 years or more. “The average life of a person has increased from 42 years in the 1960s to 70 years today. While this is great news, planning for retirement has become even more important,” says Srinivasan Ramamurthy, fund manager, HDFC Mutual Fund.

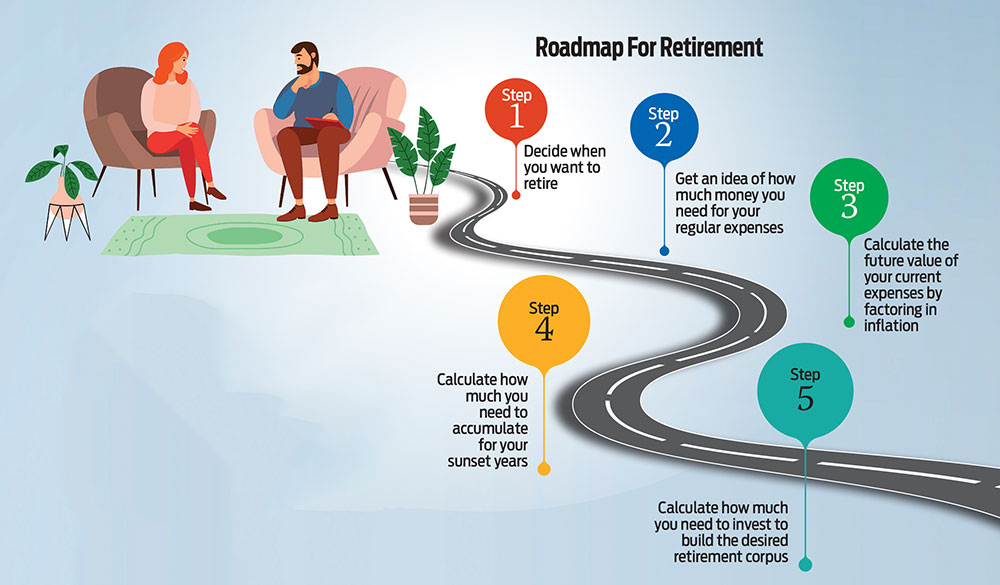

Preparing a retirement plan and putting in place a corpus, however, is only one part of the story. The other, and in some ways more critical, is deploying the final corpus in a way that it lasts you a lifetime while giving you regular income. Here’s a roadmap to help you fill the retirement corpus bucket (the accumulation stage) and then use it in your sunset years (the spending stage).

Accumulation Stage

Unless you have a tangible goal in front, the question if you are saving and doing enough will always nag you. So, the first step to retirement planning is to work out how much you will need for a comfortable retired life. Sounds easy but it is one of the most challenging steps, at least emotionally.

Work Out The Numbers

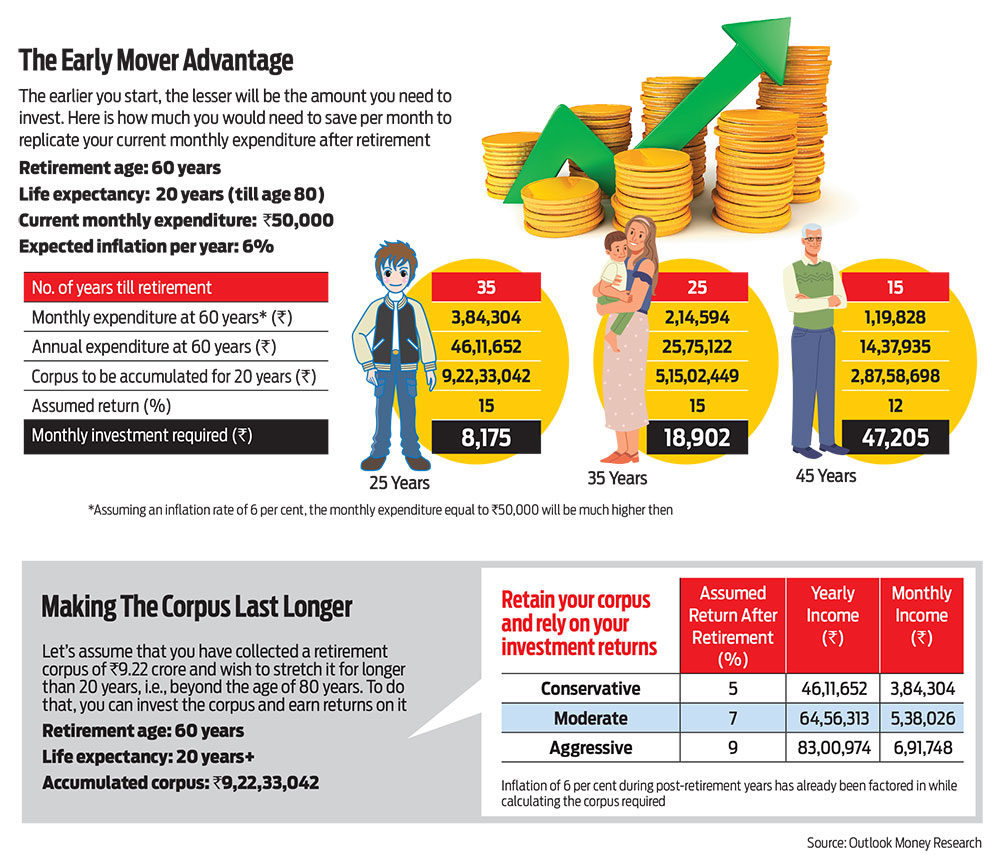

Given the pace of inflation and depending on the years left to your retirement and your current expenses, this number could be huge. For instance, a 25-year-old who plans to retire at 60 years and has a monthly expense of Rs 50,000, will need nearly Rs 3.84 lakh per month or Rs 46.11 lakh per year, assuming the inflation at an average of 6 per cent. Multiply this by 20 years and you will need a corpus of a little above Rs 9.22 crore.

That big a number can stump anyone, but disciplined saving can make it achievable. In the same example, the 25-year-old will just need to save Rs 8,175 per month to achieve the target, assuming a return rate of 15 per cent. If he increases the monthly saving by, say, 5 per cent every year, the corpus at age 60 will be much larger, at Rs 15.76 crore.

There are several online retirement calculators that can help you find out how much you would need and how much you should invest. A combi-nation of instruments and a disciplined approach can help you achieve the desired rate of return.

Do not get disheartened if you do not have enough to save. There are several factors that can affect that number—lower inflation, more savings in the future, longer working life, and reduced living cost if you, for instance, plan to move to a smaller city after retirement. Another tactic could be to become more financially disciplined, and reduce expenses and increase savings.

Start Early, Invest Regularly

One of the obvious ways to beat the numbers is to start early. “The ideal way is to invest regularly and to keep it away from your own reach because you tend to dip into it for other purposes,” says Shweta Jain, founder, Investography, a financial planning firm. For instance, in the earlier example while a 25-year-old would need to invest Rs 8,157 a month and a 35-year-old would need to invest more than double the amount and for a 45-year-old it will be six times (see The Early Mover Advantage).

“When you are young, your biggest asset is time. So, you can probably go a bit aggressive on equity till the age of 45 years,” says Anant Ladha, founder, Invest Aaj For Kal, a financial advisory firm.

Select The Right Instrument

There are a plenty of financial instruments that can help you build a retirement corpus. An ideal strategy would include a mix of debt and equity.

- Debt Options: You can start with maximising your Employees’ Provident Fund (EPF) contribution. The current rate of return is 8.10 per cent per annum and contributions qualify for tax deductions up to Rs 1.5 lakh under Section 80C of the Income-tax Act, 1961. Moreover, it enjoys the exempt-exempt-exempt (EEE) tax status, which means the returns are also tax-free.

Public Provident Fund (PPF) is another effective debt instrument. It offers the same tax benefits as EPF. You need to invest Rs 500-1.5 lakh per year. It offers safety and is one of the best small savings schemes with the current interest rate fixed at 7.10 per cent; the rates are announced every quarter.

- Equity Options: Equities must be added to any long-term portfolio to give it a returns kicker. No instrument can match the returns provided by equity-related instruments such as mutual funds and stocks. “Building a retirement corpus is a long-term objective and involves our entire working life. Moreover, in view of inflation, we must invest in a portfolio of assets that compounds over a period of time and creates wealth,” says Ramamurthy.

In this journey of wealth creation, compared to traditional investments for retirement, mutual funds have been a cost-effective and flexible investment avenue for the long term, adds Ramamurthy. You can choose plain-vanilla equity schemes or solution-oriented retirements funds.

“During the accumulation period, for the most part, higher risk avenues like equity would be the ideal asset class choice,” says Col. Sanjeev Govila (retd), an investment advisor registered with the Securities and Exchange Board of India (Sebi), and CEO, Hum Fauji Initiatives.

- NPS: The retirement solution provided by the central government offers a combination of debt and equity depending on your choice and age. It provides tax deduction up to Rs 1.5 lakh under Section 80C and an additional deduction of Rs 50,000 under Section 80CCD (1b). “NPS is tailor-made for retirement. It also gives additional tax benefit to the investor and employer. Its compulsory lock-in and stringent withdrawal conditions impose discipline on the investor,” says Govila. “However, there are some drawbacks. The entire investment is done through only one service provider. (A part of) the pension received is in the form of annuity through an insurance company, and is fully taxable,” he adds.

De-Risk Your Portfolio

De-risking the portfolio before retirement is extremely important as it helps you reduce the risk on the accumulated corpus. When you are closer to retirement, prioritise the safety of your accumulated wealth by moving to safer options.

“You can do a systematic withdrawal plan three-five years before the goal to shift from equity to debt (instrument) or a bank account every month,” says Harshad Chetanwala, founder, mywealthgrowth.

Spending Stage

Once you have the nest egg in place and are finally ready to hang your boots, comes the next challenge—making your corpus last.

It is not uncommon to find elders giving away a chunk of their corpus to children for the latter’s education or housing needs at this stage. Before taking such a decision, remember that doing so could deplete your savings substantially. So, check the size of your retirement corpus before paying for some other goal.

Work Out The Numbers

If you find yourself at this stage with a corpus that was not as carefully calculated as discussed earlier, now is the time to work out the numbers. There are still some options available to either grow the corpus or make it work more efficiently (see Making The Corpus Last Longer). Figure out ways to continue saving for later years to fill any gaps. Remember that the last 10 years of your life may still be a decade away and you have that much time on your side.

Create Buckets For The Corpus

At the initial stages of retirement, you will broadly require a regular income for expenses and an emergency corpus. Post office monthly income schemes, interest from bonds, bank fixed deposits and other debt instruments can be used to provide for the initial stages.

Money that you will need at later stages can be invested in instruments that have better growth prospects. The importance of saving and ensuring that your retirement kitty grows even in your golden years cannot be denied.

“One can use the bucketing strategy to invest post-retirement corpus across bank fixed deposits, debt mutual funds, hybrid funds and equity funds. Such a strategy is based on your overall portfolio, the amount required every month and the years of withdrawal,” says Chetanwala.

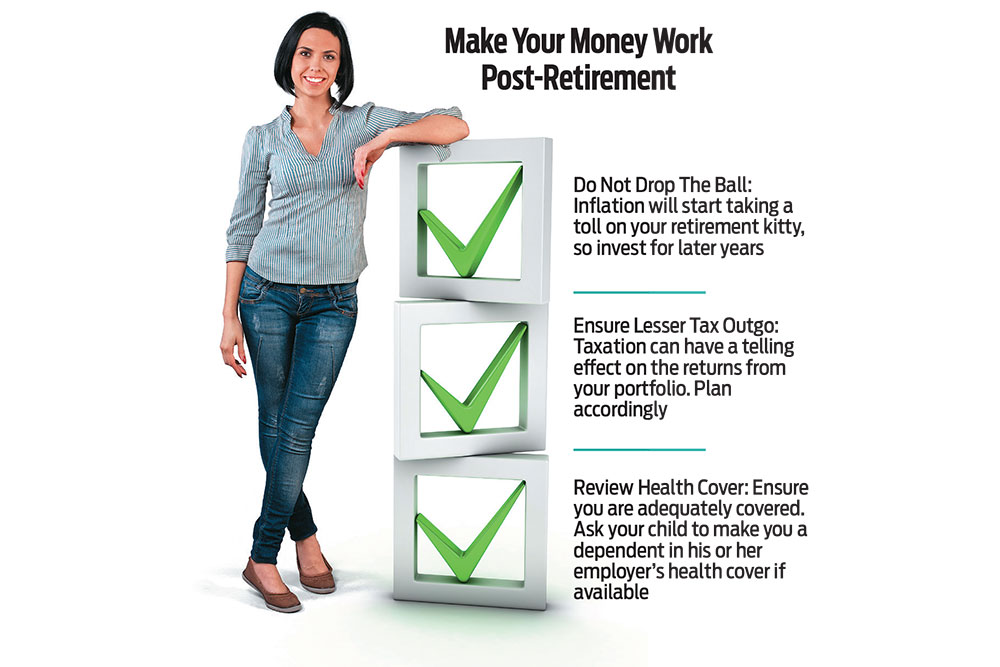

Have Adequate Health Cover

Review your health cover. Medical complexities tend to crop up as one gets older and increasing medical costs could cause huge dents in your retirement corpus.

If you did not have your own health cover during your working life because your employer provided you with one, then among the first things that you will need to do is to get a health cover for yourself and your spouse.

However, if you are in your 80s, then ask your child, who would most probably be employed, to make you a dependent in the health cover provided by his or her employer. This way, at least the blow of medical costs can be softened if it arises in the later stages of your life.

Keeping some amount aside for medical emergencies also makes sense.

Manage The Risks

- Inflation and Longevity: Your portfolio needs to grow considering inflation and longevity. You should ideally allocate some part of your portfolio to growth assets to manage these risks. “Even in the post-retirement stage, some equity allocation should always be there as it will help you generate additional returns on the portfolio,” says Chetanwala. You can invest in index funds, large-cap funds or balanced funds.

If you do not require all the money that you will receive by way of regular income, it is advisable to invest it further. For instance, you could create a ladder through bank fixed deposits and invest the interest income that you do not require to start a systematic investment plan (SIP) and so on.

- Taxation: Apart from inflation, the other factor that will have a telling effect on your returns is taxation. You will need to pay taxes on your pension, capital gains and interest income. However, here too, you can create a strategy depending on the stage of retirement you are at. Among the first things that you will need to do is take advantage of tax deductions under Section 80C. If you have a health cover, take advantage of the tax benefits available on the premium.

The Last Resort

In the very later stages of your life, if you feel that your portfolio will not be able to meet your requirements, as a last resort you can pledge your house under reverse mortgage.

While the odds are loaded against you when it comes to building a retirement corpus, you can still ensure that you lead a comfortable retirement life if you ensure that your portfolio works harder than you worked creating it. Enjoy the fruits of your labour to retire with grace and dignity.

With inputs from Meghna Maiti

kundan@outlookindia.com