The market’s reaction to the Interim Budget was expectedly neutral. However, there were some announcements that are likely to have a long-lasting effect. The government’s emphasis on infrastructure spending, green energy and innovation, including inviting the private sector to pariticipate, will boost these sectors

As Union Minister of Finance Nirmala Sitharaman rose to present the Interim Budget this time, the question that lingered on everybody’s mind was: would it be a populist budget or fiscally prudent?

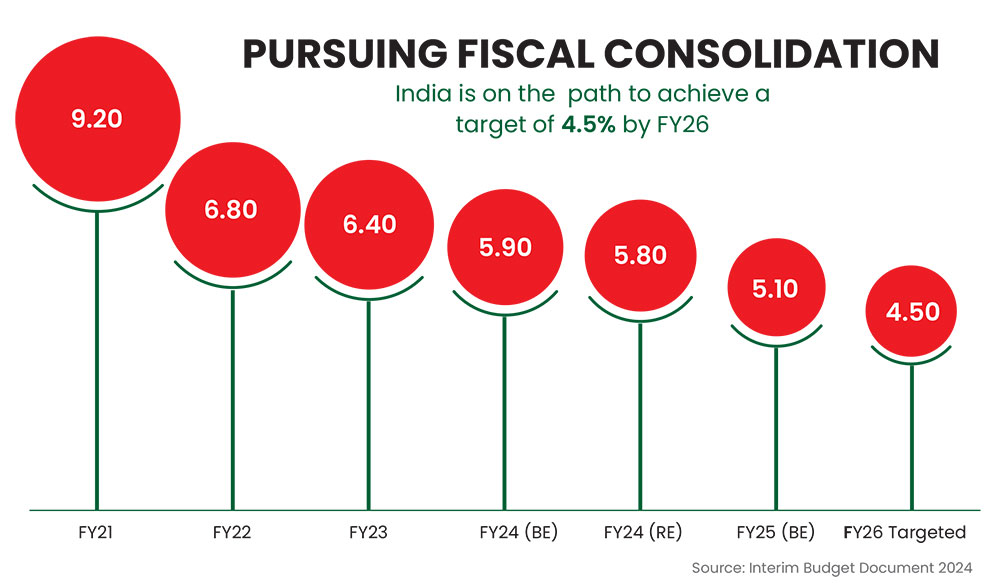

She chose the middle path. “The Interim Budget emphasises strategic continuity across multiple areas, avoids short-term populist measures and displays fiscal prudence with FY25 fiscal deficit pegged at 5.1 per cent, and a modest borrowing programme which bond markets may like,” says Vishal Kapoor, CEO, Bandhan Mutual Fund.

Market Neutral

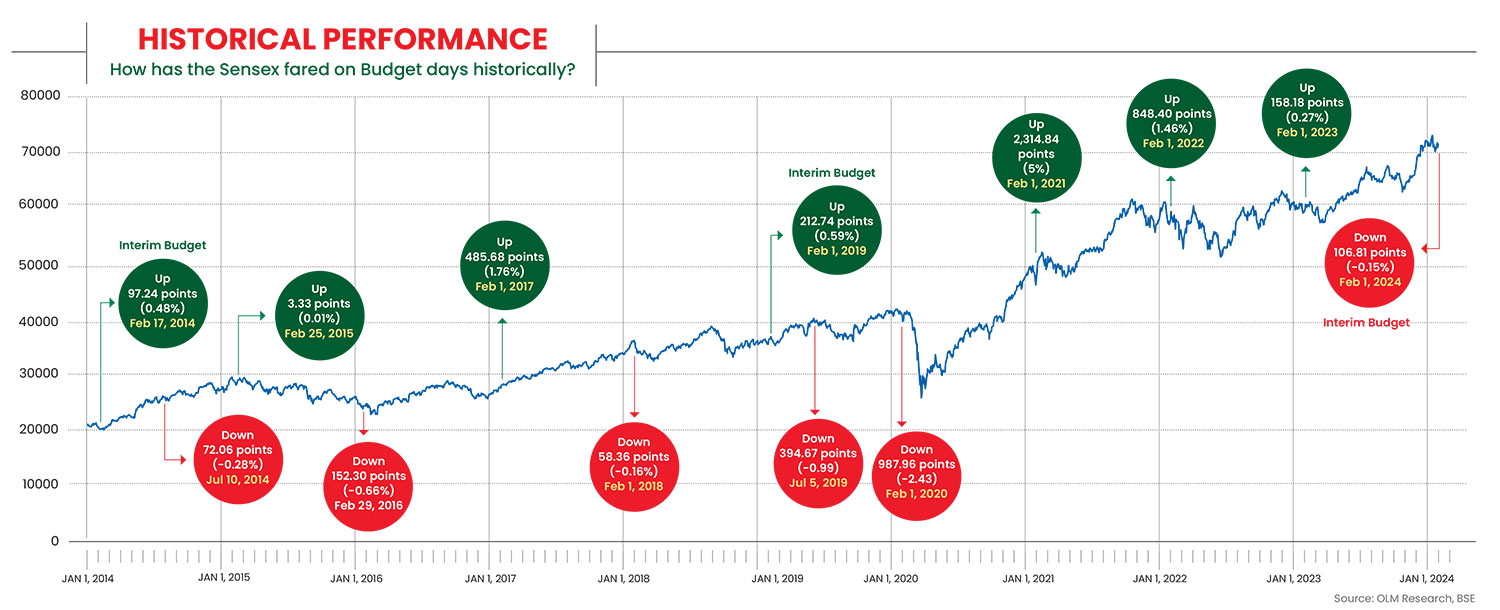

The market’s reaction was expectedly neutral. Historically, on Interim Budget days, the market tends not to exhibit aggressive behaviour.

Since 2014, on two occasions, the market closed on a positive note with a small gain. On February 17, 2014, the Sensex closed with a gain of 0.48 per cent, and on February 1, 2019, it gained 0.59 per cent. This time, the broadly tracked equity indices, the Nifty 50 and Sensex, experienced marginal declines after a volatile session. The Sensex fell 106.81 points (0.15 per cent) to settle at 71,645.30, and the Nifty 50 lost 28.25 points (0.13 per cent) and closed at 21,697.45 (see Historical Performance).

Notably, the Nifty PSU Bank index recorded the highest gain, surging by 3.10 per cent in response to the announcement of a modest borrowing target of Rs 14.1 trillion. This decision resonated positively within the banking sector, and contributed to a notable uptick in this space.

Another index that closed in the positive territory was auto. The announcement of an over-seven-fold increase in allocation for the auto sector’s production-linked incentive scheme for FY25, reaching Rs 3,500 crore from the current Rs 480 crore, sparked optimism.

The neutral stock market reaction signals an appreciation for the government’s strategic continuity and disciplined fiscal approach.

Booster For Infrastructure, Green Energy, Innovation

The major announcements revolved around the government’s achievement in the last 10 years. However, some of them will have a long-lasting effect on the market.

As observed in the past, the incumbent government’s focus is on infrastructure development. This time too, it increased capital expenditure outlay by 11.1 per cent, to Rs 11.1 lakh crore for FY25 (3.4 per cent of the GDP), compared to Rs 10 lakh crore in FY24.

The emphasis on infrastructure spending and capex growth indicates a forward-looking approach aimed at sustaining economic momentum. “The sectors poised to benefit from the budget announcement include rural and middle-class housing, green energy, and innovation-driven industries. The budget’s targeted resource allocation reflects a clear policy intent to boost these sectors,” says Anshul Arzare, CEO, Yes Securities.

Expansion of infrastructure is on the agenda, including the development of existing and new airports, as well as Metro Rail and NaMo Bharat initiatives. In railways, the plan is to enhance the safety, convenience, and comfort of passengers by converting around 40,000 normal rail bogies to Vande Bharat standards. All these initiatives bode well for companies engaged in the infrastructure and allied sectors.

“After two years of high double-digit capex allocation for the infrastructure sector, the pause button seems to have been pressed. Nevertheless, roads and railways continue to garner a lion’s share of the proposed expenditure this year. The government has also indirectly signalled the need for greater private sector participation to support growth in these core sectors,” says Jagannarayan Padmanabhan, senior director and global head, transport, mobility and logistics, consulting, Crisil Market Intelligence and Analytics.

The government’s target of constructing an additional 20 million houses in the next five years under PM Awas Yojana (Grameen), is a positive development for various sectors. This bodes well for building material players, including paints, pipes, fast-moving electric goods, and affordable housing finance companies. Additionally, the plan to support solar rooftops in 10 million households is favourable for developers and module manufacturers, as it will boost demand for rooftop installations.

“Although the risk of populism has abated at the central level, there have been targeted measures for the welfare sector, while emphasis on the infrastructure and green energy sectors has sustained. Increased allocation to innovation and research and development (R&D) will also improve economic capacities and productivity,” says Madhavi Arora, lead economist, Emkay Global.

Arzare says the emphasis on rural and middle-class housing aligns with the government’s commitment to inclusive growth, while the focus on green energy addresses environmental concerns. “It strategically supports sectors vital for socio-economic development and environmental sustainability,” he adds.

Booster For Innovation

A corpus of Rs 1 lakh crore will be established to provide long-term financing or refinancing with long tenure at low or nil interest rate, and encourage the private sector to scale up research and innovation in sunrise domains.

Experts are optimistic about this, considering the current lower rank of our country in the research and innovation index. According to World Intellectual Property Organization (WIPO), India retains the 40th rank out of 132 economies in the Global Innovation Index 2023.

The Road Ahead

The full Budget for FY2025 is likely to give a clearer policy road map.

Provisions that would encourage infrastructure, construction, banks and auto sectors, the engines of growth that typically power an economy due to their huge forward and backward linkages, would hold the key to sustaining optimism.

While there could be a difference of opinion about an imminent correction in the stock market, there is almost near unanimity that India has the potential to deliver better returns for investors in the long run, with volatility in the interim.

kundan@outlookindia.com