When it comes to building a retirement corpus, there are many financial instruments worth considering, including the mandatory provident fund deductions. But none matches the returns that equity-related instruments such as mutual funds (MFs) and stocks can give. While this is true, there are more risks involved with equity-related investments. Stock selection without due research can have devastating results and hence it is advisable to take the safer route of MFs, where professional fund management helps you build the corpus at a nominal fee.

While investing in these instruments, make sure that you pick products for the long term and keep your emotions under control.

Retirement-linked MF schemes come in handy for investors as they offer multiple choices according to the investor’s risk profile and age. Some even provide tax breaks.

The Ground Reality

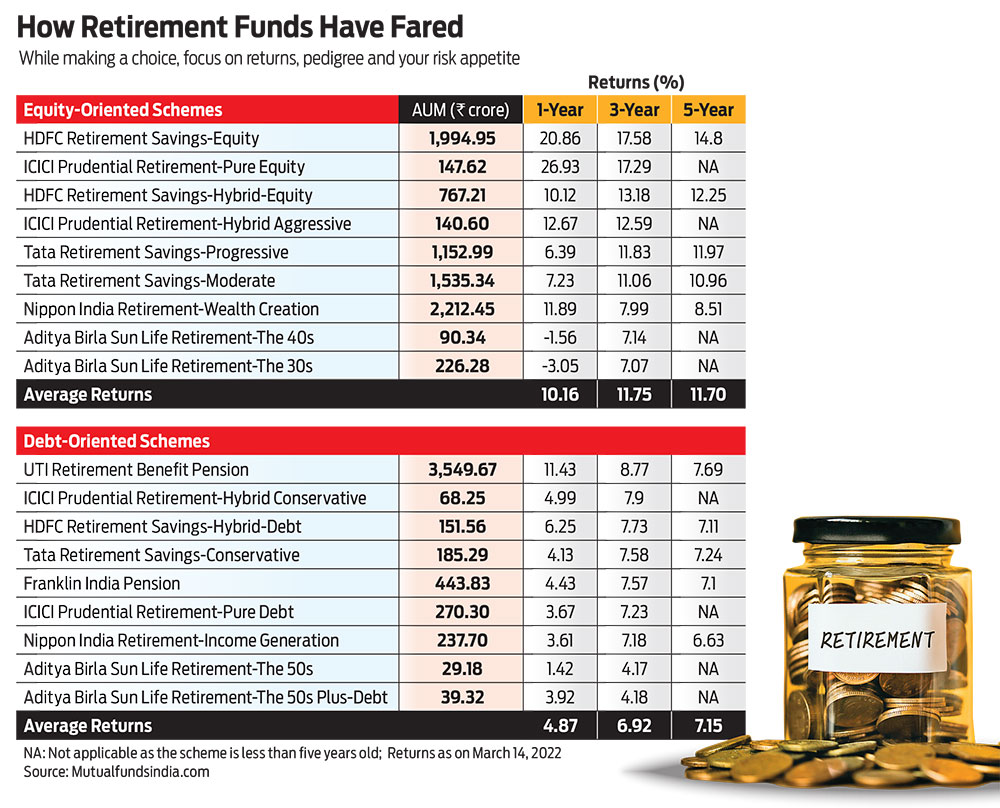

According to a survey by Nippon India MF, 78 per cent Indians don’t save enough for their retirement. Globally, retirement assets occupy a large space whereas India has one of the lowest retirement assets to gross domestic product (GDP) ratios. To give you some perspective, the US has 80 per cent assets to GDP ratio whereas in India it is only 15 per cent. As per the survey mentioned earlier, retirement funds account for only 12 per cent of one’s total savings in India; a number that points at the low inclination among investors to opt for retirement-oriented products. In India’s Rs 38-trillion MF industry, the assets under management (AUM) in retirement solution funds are a mere Rs 15,000 crore. The oldest and the largest retirement fund, UTI Retirement Benefit, has an asset size of Rs 3,549.67 crore.

Tax Benefit Dilemma

Experts believe that lower participation in retirement-oriented schemes is partly due to the tax structure. Some retirement schemes are government notified pension plans that offer tax benefits with an objective to help investors build a retirement corpus, while others are not. The last scheme to get notified for tax benefit was HDFC Retirement Fund, which was launched in 2016. This leads to confusion among investors as to whether they should go for a scheme that offers a tax break or with a scheme that does not.

The schemes that offer tax-saving benefit to investors have higher AUM than those that don’t. However, the main purpose is investing for retirement and not tax saving. Moreover, the tax benefit with retirement funds falls under the Income-tax Act’s Section 80C, which is overcrowded with many products. Therefore, it is advisable to look at other attributes of a retirement fund rather than its ability to give a tax break.

Remember that retirement planning is sacrosanct. India does not have a comprehensive social security and the number of nuclear families is increasing, which means there are fewer chances of familial support in later years.

Preparing A Retirement Corpus

Retirement has two phases—saving or accumulation and spending or withdrawal. During the wealth accumulation phase, don’t get distracted by any additional albeit secondary benefit that the product may offer as doing so may affect the accumulation. At this stage, your focus should be on wealth creation and nothing else.

Retirement schemes offer a transit across both these phases. “We all understand the power of equities in potentially delivering better inflation-adjusted returns in the long run. Retirement MFs combine the wealth creation possibility of equity and lower volatility of debt to provide a comprehensive solution. Compared with alternatives that offer higher predictability of returns but lower returns especially adjusted for inflation, retirement MFs can provide a better experience,” says Saugata Chatterjee, co-chief business officer, Nippon India MF.

If you cannot construct a customised retirement solution on your own, retirement solution funds are an option. “They are more suited for clients who want to go completely hands-off and simplify their retirement planning with a one-stop solution,” says Arun Kumar, head of research at FundsIndia, a digital mutual fund services platform.

Multiple Variants To Choose From

Except two fund houses, UTI MF (debt-oriented UTI Retirement Benefit Plan) and Franklin India MF (debt-oriented Franklin Pension Plan), all others offer equity- as well as debt-oriented schemes that you can choose from according to your risk profile. For instance, Nippon India Retirement offers two distinct plans—build the corpus through the Wealth Creation Plan and get the relative safety of debt through the Income Generation Plan during post-retirement years. Similarly, ICICI Prudential MF offers pure equity, hybrid aggressive and hybrid conservative retirement funds. On the same lines, Aditya Birla MF offers schemes as per your age.

Some of these funds also offer convenient features like auto transfer from wealth creation to income generation plans on reaching a pre-determined age as the goal shifts. Auto systematic withdrawal plan (SWP) and normal SWPs are simple and efficient tools of cash flow management in the post-retirement period.

The Final Word

Plain-vanilla MF schemes can also be used to construct a customised retirement solution portfolio. “This provides more flexibility in terms of the overall portfolio construct and choice of funds,” says Kumar. But it also means that you have to be more disciplined through market volatility. Many investors exit from schemes during market volatility fearing a loss or book profit when the market is up. In both the cases, you derail your retirement plan. Retirement funds come with a lock-in period of five years or the retirement age (usually, 58 or 60), whichever is earlier. A lock-in period deters investors from meddling with the investment by pulling out funds, but it also means that you can’t course-correct. Therefore, choose a retirement fund based on performance track record and fund house pedigree.

kundan@outlookindia.com