Saibal Chakraborty, 40, IT technical manager, and Shubhra Bar, 32, IT business analyst, decided to move abroad for better career opportunities and quality life way back in 2019. They applied for Canadian Permanent Resident (PR) status then, but were finally able to move to Toronto, from Kolkata, in March 2022.

More and more Indians are moving overseas for varied reasons. India remains the top origin country for the world’s migrants, according to a Pew Research report published in December 2022. “In 2020, 17.9 million international migrants traced their origins back to India, followed by Mexico with about 11.2 million and Russia with about 10.8 million,” the report said.

The migration process is usually lengthy; you may need a lot of paperwork, involving considerable costs. “The earlier you begin, the simpler it will be to handle any unforeseen circumstances. Start six months before your move (if you have the time),” says Peter Calabrese, CEO, CanAm Enterprises, a New York City-based multinational investment management firm specialising in EB-5 visa immigrant investment funds. This visa is based on investments made in a company of the country of emigration, subject to certain conditions.

Here’s a lowdown on what to expect and how to close the loop to ensure a smooth relocation process.

Know How You Plan To Migrate

For Saibal and Shubhra, the process to emigrate to Canada got delayed due to the Covid pandemic, but it was relatively smooth because the company they were working with in India arranged for a transfer. That may not be the case for everyone.

“Some people migrate at an early age as students, and join the workforce upon graduating from college. Some move as professionals at a later age after completing their education in their home country. There are others who move as entrepreneurs to establish a business. Lastly, you can invest to receive residency benefits,” says Abhinav Lohia, director, Global Business Development, Golden Gate Global, an EB-5 regional center based out of San Francisco. The company caters to Indians who want EB-5 or H1B visa to settle in the US.

Getting a job in another country is, of course, one of the most popular ways to take the first step towards emigration. According to the Expat Insider 2021 survey by InterNations, a global expat network, 59 per cent of Indians working abroad relocated for their career, which is higher than the global average of 47 per cent. About 23 per cent found a job on their own, 19 per cent were recruited globally, and 14 per cent were sent by their employers. Just 3 per cent went abroad to start their business, still higher than the global average of 2 per cent.

Let us take the case of the UK. For Indian nationals moving to the UK, the most popular route is the skilled worker visa. In 2022, Indian nationals received nearly 103,000 work visas, a 148 per cent increase over the previous year. Moreover, 46 per cent of all skilled work visas granted in 2022 went to Indian nationals, according to Yash Dubal, director, AY&J Solicitors, a London-based UK immigration solicitor who caters to Indians.

“However, skilled work visas are only issued to applicants having a qualifying job offer that meets specific criteria with a business that is allowed to issue a sponsor licence. They must also have the required English language proficiency,” says Dubal.

Another popular method to emigrate is by applying for student visa. This is more of an indirect route. Typically, after the student visa expires, students get a long-term visit pass for around a year to look for a job, which can ensure the next-level employment pass. After becoming a work pass holder for six months to two years, depending on the country you are in, you could apply for the Permanent Resident (PR) or citizenship status, according to experts. The cost of a student visa differs from country to country.

The other method is buying citizenship but not all countries allow it. The applicants need to obtain the EB-5 visa, granted subject to certain investments and conditions.

For example, to qualify for EB-5 visa for the US, an applicant must invest in a qualifying project sponsored by the United States Citizenship Services or USCIS-licensed EB-5 regional center, besides meeting other conditions. The investment is usually locked for a period of five to seven years.

It is the best way to migrate to the US, where you can get citizenship in a short time, says Calabrese. Remember that children under the age of 21 will get US residency in such cases.

“The common factor in all the scenarios is research. Students need to research university rankings; professionals the growth of their career and job stability; entrepreneurs the viability of their ideas; and investors need to figure out a qualifying investment,” says Lohia.

Prepare To Pay

The costs would vary depending on how you want to emigrate. For example, a professional moving within the same company may only need to spend on the tickets and shipping costs and the employer may bear most of the immigration cost. That’s what happened with Saibal and Shubhra.

But even before that step, there are other costs to worry about. These include visa and legal fees and saving up for the initial period of the stay. “I have friends who have come here (Canada) without a job. They needed to stay here for a few months to find a suitable job. The rent here is high and that means one needs to plan for adequate funds. Also, visa requirements stipulate that a certain amount of funds must be parked in one’s account. Besides, one must show proof of investments which need to be planned for in advance,” says Shubhra.

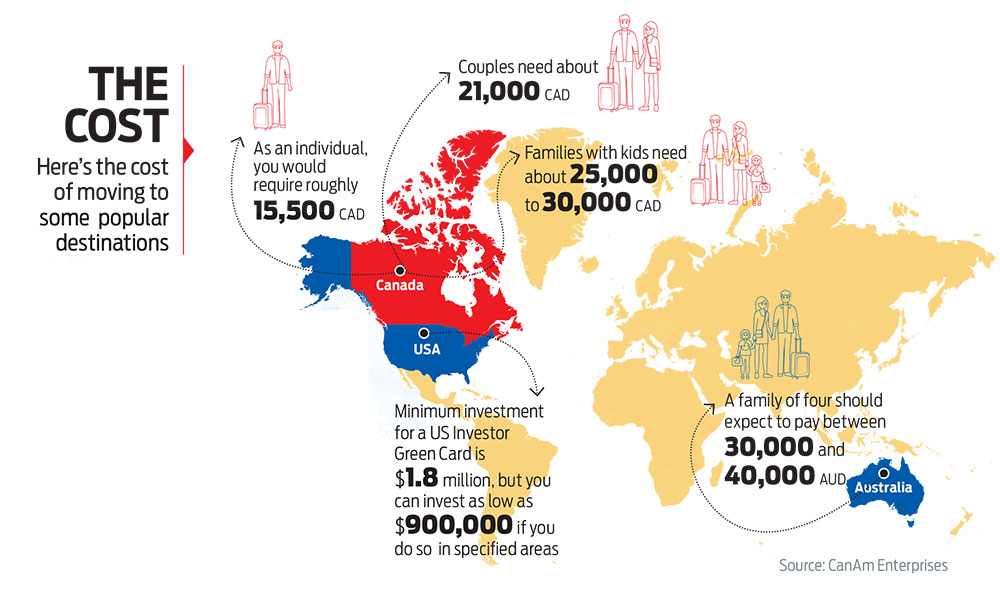

Similarly, to emigrate to Canada, an individual would need roughly CAD 15,500 (Canadian dollar). Couples need about CAD 21,000, while families with kids will need between CAD 25,000 and 30,000. For the US, the minimum investment to obtain an Investor Green Card is $1.8 million, but you can invest as low as $900,000 if you do so in Targeted Employment Areas, which have structural weaknesses.

Again, for Australia, a family of four should expect an expense of AUD 30,000 to 40,000 (Australian dollar).

“The investment for EB-5 visa varies. For example, for an EB-5 visa in the US, it is $800,000. Whereas, for Canada, it is CAD 1.2 million as per the Quebec Immigrant Investor Program with a processing time of up to 56 months. EB-5 is different from other citizenship and residency programmes as it requires heightened due diligence of source of funds and creation of American jobs as opposed to buying of a passport,” says Lohia.

Besides investment, there are administrative and legal costs of around $75,000 in the US. Attorney fees vary, too, from $10,000 to $20,000, says Calabrese.

For the UK, the costs varies for different visas. “The application fee for a skilled worker visa, for example, ranges from £625 to £1,423 (British pound). Applicants must also pay the healthcare surcharge, usually £624 per year, and must have at least £1,270 available to them,” says Dubal.

There are other costs too, like shipping, visa, legal, customs duties, hotel, medical, etc., says Calabrese.

Close The Loop

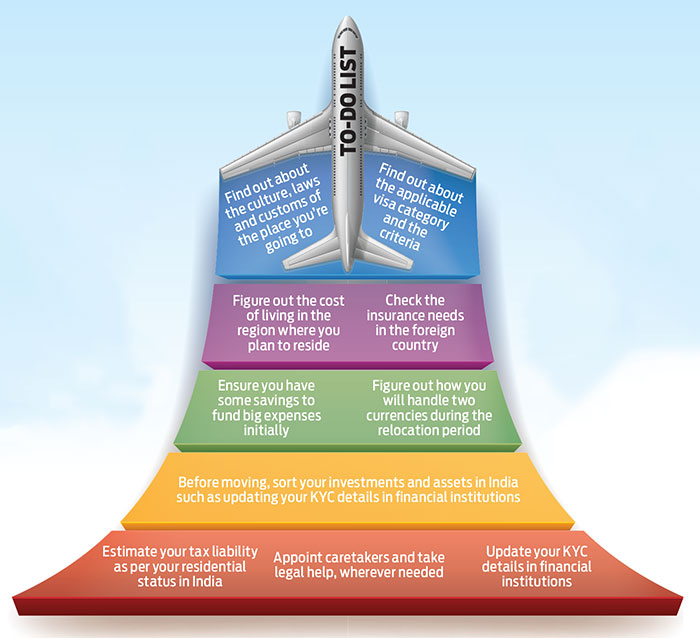

Whenever a household moves abroad, the first thing that changes is managing two identities—citizenship of the home country and residency in another till the emigration is complete. “The family must manage two currencies and all this while they don’t know if their move is temporary and how well they would settle in the new country. Familiarity with tax provisions in the home country and the country of residence is also vital,” says Nitin Rao, head products and proposition, Epsilon Money Mart, a financial planning firm.

It is also crucial to plan for big expenses. “The living standard is high abroad so keep liquidity handy, as you will be having new bigger expenses. Money can be put in a liquid fund or low duration fund,” he adds.

Don’t forget insurance. It is mandatory in most countries but check your policies to avoid paying for facilities you may not use. Saibal and Shubhra are covered under Canada’s universal healthcare system so they didn’t have to worry about it. Also, check what is covered and what is not.

Updating know-your-customer (KYC) forms with latest overseas addresses is a must at local financial institutions. Importantly, change your status as NRI to have continued access and correct tax and income records.Rules may vary from country to country. Do keep track of them.

Finally, don’t hold a lot of depreciating assets in India. While you may have to leave some of your assets, such as a property, behind, ensure you arrange a local caretaker.

Moving abroad needs you to sort out many aspects in a methodical manner. If you find it overwhelming, opt for specific agencies but compare their services and cost before settling on one.

meghna@outlookindia.com