Age, author Mark Twain is known to have stated, is an issue of mind over matter, and if you don’t mind, it doesn’t matter. Try telling that to senior citizens, especially the ones who are not so comfortably retired for various reasons, and more often than not, you will get a sharp retort. Superannuated seniors do mind. A medley of irritants perturbs them all the time, some of these upend the most well-laid retirement plans.

Take a straw poll, and you will no doubt identify their biggest worry: mis-sold financial products. Or, to see things through a differently hued prism, investments that seemed oh-so-right once upon a time. Hindsight, that old reprobate, has now rendered them effete. The reason is not far to seek, as some of those who have borne the brunt of it will regretfully but truthfully admit. In countless cases across the country, financial products have been brazenly mis-sold. Seniors, who constitute the market’s most vulnerable section, are particularly targeted.

The modus operandi for mis-sellers, not surprisingly, has been generally quite unpretentious. Target an individual (perhaps one who is nearing retirement or is otherwise attempting to devise a retirement plan), display a select array of products, tempt him with a few that yield high commissions and incentives and, of course, sell. All the while, scant attention is paid to the client’s real needs or, worse, his exact risk-return dynamics. The focus is on selling and selling alone. “Superior customer engagement”, is the usual argot—language that couches the mis-seller’s true intention.

In the dock are the usual suspects: product manufacturers and intermediaries. The latter include a longish list of players. Bankers, securities brokers, financial product distributors and sundry other agencies that derive their revenue from sales. Their practices, being executed relentlessly all over the financial landscape, have been perfected over time.

Ergo, you have a multitude of investors with sub-optimal portfolios marked by assets they will rarely need. An army of people who have purchased high-cost insurance policies but have no financial dependents to speak of. Or those who have invested in risky portfolio management schemes that have little regard for their ideal asset allocation. In each typical case, while the agency has collected attractive commissions, the investor has not derived any particular value from it.

To extend the logic further, the average mis-sold product (insurance, fund, portfolio management service or PMS, structured deals—it does not matter) does great disservice to the process of retirement planning. In fact, it compounds systemic inefficiencies by adversely impacting the hallowed principles of asset allocation. It hurts the investor’s overall portfolio, eats into his gross earnings and increases his expenses.

Mis-Selling Of Epic Proportions

The question “how commonplace is mis-selling?” will beget an embarrassingly terrible answer. It is everywhere. That is because it cuts across product lines and pervades all categories of investors, big and small. Estimates differ but the general consensus is that roughly a fifth of financial products are characteristically mis-sold—that is a high 20 per cent. So, one out of every five products is inappropriate for the average buyer.

Further, it can be safely assumed that retired individuals comprise a very large section of these buyers. Their plight is most apparent in the sphere of insurance. Endowment and money-back policies are typically the most retailed products. Commissions are attractive—a lot more than, say, what unit-linked insurance plans (Ulips) now charge after several rounds of changes to their structures. It is no surprise, therefore, that traditional sales channels are geared towards vending endowment and similar high-cost policies.

For mis-sellers, shiny projections are part of the arsenal. They lead you through a vapid tunnel. There is light at the end of it—or it just might be an oncoming train. New clients are smothered by layers of figures, all perfectly illustrative. It is easy for ordinary buyers to get carried away by statistical claims. Data, as many will agree, will admit to anything when flogged.

A similar scenario prevails in health insurance too. Many of us are not aware of the limits carved into our medical insurance policies. The quintessential cover will surely have exclusions, but does the policyholder know about these? Not when the agent has spoken most convincingly on the “affirmative” points—cashless treatment, hospitalisation coverage, restoration and the like.

Disguised As ‘Mis-Buying’

In recent years, vested interests have tried to shift the onus on the purchaser (that is, the investor) by terming it “mis-buying”. That, as countless real-life instances will reveal, is hardly believable. Ask yourself a simple question—why do investors acquire certain products and shun others?

It is clear that not all products displayed on the rack will be suitable for you. Some will simply not work in your favour. Some others may well be considered ineffective—and therefore avoidable. In principle, any product that does not fit your asset allocation strategy should be questioned. A product may also be inappropriate if it is too expensive or counterproductive for one already in your portfolio. Duplicates and me-too’s should be dumped as well.

Most investors who have little time to spare will be gladly “guided” by assorted product manufacturers, distributors and advisors. In many cases, unique associations with clients work in favour of the intermediaries. And, at almost every level, intermediaries have targets to achieve. In fact, targets are backed by incentives; the higher you reach, the better is your compensation. This plain conflict of interest prompts mis-selling. Therefore, a typical deal should rarely be billed as a mis-buy.

That rationale is of course pooh-poohed by influential sections. The average agency, it is argued, is not at fault—after all, the investor (retired or otherwise) has advisedly but consciously signed on the dotted line. At the end of the day, it is his duty to read the fine print. Poor research, faulty understanding, lack of appreciation are, thus, the primary responsibilities of the individual concerned.

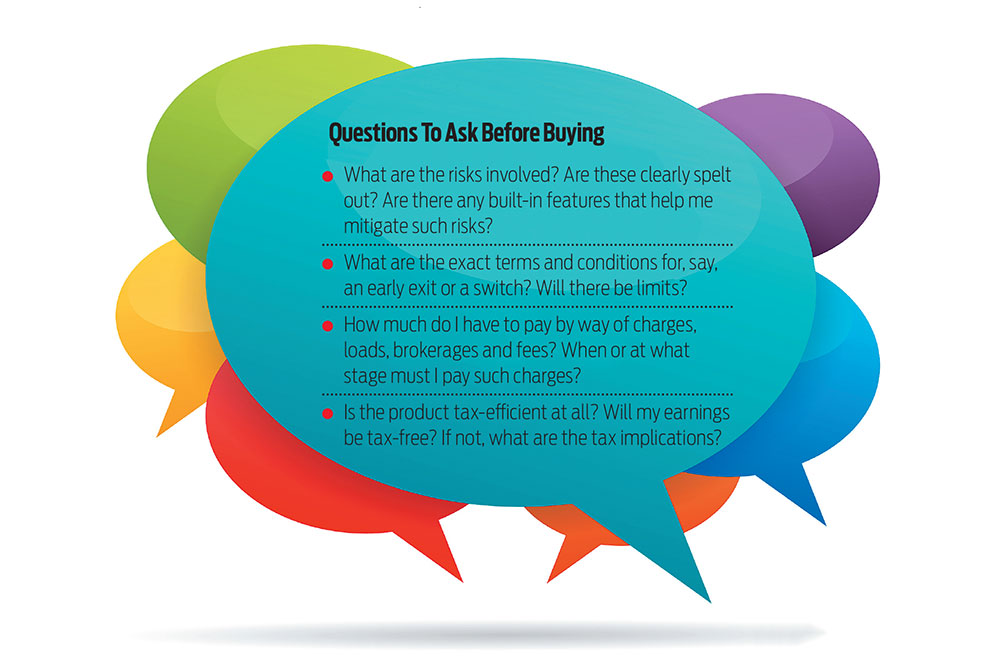

Such an argument, although evasive, packs a punch. Yes, it is indeed the investor’s duty to know the pros and cons. It is up to the client to know all the relevant details—and to do so, he must ask all the right questions.

No Beauty In The Broken

Well, to quote classical economist Adam Smith, the road from the City of Scepticism has to pass through the Valley of Ambiguity. Both locations, however, have their imperfections—the traveller must realise this and indeed internalise it as an inalienable fact of life. In other words, the retired individual must know that every product in his portfolio will have certain lacunae and loopholes.

A senior who has, for instance, a couple of dozen mutual funds and unit-linked insurance plans (Ulips), not to mention an armoury of pension and endowment plans, will probably be neck-deep in such lacunae. Some of these will clearly be me-too elements.

Such examples of duplication and miscellaneous other inefficiencies are far too commonplace. It is impossible for an ordinary individual to know the multiple layers of fees, charges, loads that such an unmanageable portfolio will inevitably entail. Perhaps, over a long stretch of time, a bevy of players may have met the individual. Invariably, one sale may have followed the other. In each deal, without exception, no attention whatsoever was paid to existing holdings.

For a jaundiced eye, the dark side of the story will reveal itself rapidly. Investors, even if they are on the verge of retirement, often purchase financial products simply to accommodate a friend in need. It is a young cousin who called me and sought my support, they say later. Or, my friendly neighbour wanted affirmative action when she introduced her niece to me, is a standard enough refrain. Mis-selling follows; it is as inescapable as tomorrow’s sunset. Ditto for a new relationship manager who has joined the local bank, an eager beaver who smiles every time an accountholder walks into his branch and even offers tea.

Lay retirees must understand this and keep aside all sentimental and emotional issues. In many cases, ego comes between them and admission of fault. No one confesses to a cardinal mistake—no one accepts the raw truth that certain product features were too incomprehensible for his standard. Factor X or Condition Y was far too difficult for me to grasp, is a sentence no one actually utters in the material world.

Need: Policy, Process, Public

A combination of three critical elements—3Ps—is the prescription for the ailment. Policy, process and public (awareness) may yet save the day. For the record, a considerable body of work has already been initiated by the lawmakers. The regulatory agencies have made it abundantly clear that they do not want mis-selling of any sort. A number of significant legislative measures have been rolled out over the years in order to contain the practice. Intermediaries have been asked to act in certain ethical ways, governance standards have been set, and censure awaits those who behave errantly. In the past, punitive action has been taken against some of the reprobates.

The crafty operator, however, is frequently a step ahead. In India, where the financial landscape is replete with players of all hues, it is extremely difficult to monitor the entire lot. Institutional framework is often challenged by human proclivity. Hordes of investment advisors, private bankers, relationship managers, product distributors aim at higher sales figures. Controlling divergent behaviour is nearly impossible. Policy, therefore, must be fine-tuned for all. A scabbard is effective only if it holds a sharpened sword.

That brings us to the second element, process. There has to be more stringent control over sales processes. The manner in which a deal flows from initiation to conclusion, starting with the very first interaction with the client, must be completely transparent. It must also be cost-efficient, especially because product pushers typically tend to recover costs from clients. Moreover, the entire process must be done under the watchful eye of the top management. Reporting standards must be maintained diligently.

The third element, the public, is of vital importance. Mis-selling will be minimised if there is greater awareness. Individual investors must insist on clear communication, full disclosure of all conditionalities, factual reporting, display of physical evidence and the like. This must happen with all—bankers, portfolio managers, investment consultants, insurance agents and others. Zero tolerance for malpractices is the biggest goal here.

Conclusion

This story, I am afraid, will rank among those tales that do not have happy endings. Even as newer financial products get dished out by various agencies and sales channels, large sections of the buying public remain naive. Red flags are not being raised in sufficient numbers, the right questions are not being asked. Both the newly-retired and the veteran retiree still purchase insurance for the little investment value (a debatable point, admittedly) it guarantees, but not for the sake of covering their risk. Sector funds are still being acquired without considering their narrow investment universe, they are certainly not like simpler and more broad-based funds. Branded PMS is bought with little regard for the elevated fee structure.

Clients’ lack of understanding is underscored even in the contemporary world, marked as it is by greater financial literacy, financialisation, financial inclusion, impact investing, governance, service orientation, media advocacy and the whole works.

Well, the times, they are a’swinging. Internet-based selling techniques may yet democratise the system a bit more. The securities and insurance watchdogs may tighten the screws along with the other regulators. Legislative reforms can only prove helpful. Perhaps these will finally save the day for the gullible retiree. For his sake, and for the sake of all those who will retire soon, let’s “cry havoc, and let slip the dogs of war”.

***

“The Policies Were Not Ideal For Me”

Parijat Pal Chowdhury, 65, Consultant in the beauty industry, Kolkata

Parijat Pal Chowdhury, 65, learnt a hard lesson after purchasing insurance policies that served no real purpose. While she blames no one in particular, she says consumers must learn about specific product categories and not have blind trust in the various intermediaries, including bank relationship managers. “The policies I came across were the most typical ones—endowment and money back. I didn’t realise that these were not ideal for me. I might have gone in for good term policies instead,” she says, adding that when she was looking to buy policies, she was not told much about the “risk”; the focus was on “returns”. “The impression I got was that these insurance policies offer superlative benefits.”

Some years ago, Parijat realised that the policies haven’t fetched her much. With passage of time, she now appreciates “the nuances of insurance”. “Anyone interested in taking a risk cover should understand the pros and cons first. There is considerable variety but, if you spend enough time on it, you will be able to pick up the best products.”

Senior citizens need to exercise greater caution, she says. “No one should regret afterwards, least of all seniors. Many of us have put in a lifetime of hard work, assembled a little pool of retirement assets,” she says, referring to her own multi-decade career as a consultant in the beauty and wellness industry.

Products that normally promise money-back amenities are often expensive, a fact that mis-sellers omit to mention. In most cases, unquestioning belief overshadows raw discretion. “The law is very customer-friendly and also has a lot of power to penalise the intermediary or the insurer. However, often, there is little evidence of mis-selling. So, one should always ask for official communication and in writing. That is the best defence,” says Abhishek Bondia, co-founder and managing director, SecureNow.in, a digital insurance platform.

***

“All I Want Is Quick Resolution And Compensation For All That Was Paid”

Girdhari Mohanty, 65, Retired government servant; Gitanjali Mohanty, 63, Homemaker, Gurugram/Faridabad

Photo by: Vikram Sharma

Kaveri Nandan

When Girdhari Mohanty took voluntary retirement in 2014, he and his wife Gitanjali Mohanty decided to settle in their 4-BHK house in NBCC Green View apartment. “The houses were competitively priced and we thought that being a government body, the quality of construction by NBCC (National Buildings Construction Corporation) would be better. It was a mistake,” says Girdhari.

In what is yet another example of mis-selling in real estate, the couple realised that the buildings in their apartment block were of a quality much lower than promised and had serious flaws. “Within just a few years, big cracks appeared in the buildings’ pillars and beams and it was found that chloride had affected all the material used for construction.” Based on two inspections by IIT-Delhi, the buildings were declared “unsafe” under the National Disaster Management Act, 2005.

“I put in my savings and retirement benefits and paid about Rs 1 crore apart from Rs 28 lakh on interiors and Rs 6 lakh on e-registration. I also took a loan,” says Girdhari. But all the effort and expenses came to naught as the couple, along with the other families, had to vacate their houses by March 1, 2022.

The couple now lives in rented accommodation in Faridabad. “We are being given about Rs 26,000 to pay for rent but I am paying Rs 30,000 as I needed a big enough house to accommodate my things. As of now, we have been promised rent compensation for six months, but what after that? I am paying a home loan EMI, I have a house but we still live on rent. There is so much uncertainty.”

The temporary rental support is as per the Real Estate (Regulation and Development) Act (RERA) rules. “The promoter is liable to rectify at his cost and consequence, structural or any other defect in workmanship, quality or provision of services or any other obligations of the promoter as per the agreement which is brought to the notice in writing within a period of five years from the date of handing over of possession (the Mohantys got the flat end-2017),” says Mani Gupta, partner at Sarthak Associates and Solicitors. Moreover, the housing society falls under the territorial jurisdiction of the Haryana Real Estate Regulatory Authority, Gurugram. A deeply unhappy and dejected Girdhari says all he wants is a “quick resolution and compensation for all that was paid along with interest.”

The author is Director, Wishlist Capital letters@outlookmoney.com