Following a period of impressive performance, the equity market has become volatile due to unfavourable geopolitical developments. Another factor contributing to this volatility is elevated valuations in certain pockets and profit-taking by investors.

Given the conditions, diversifying your portfolio with a balanced mix can help mitigate equity volatility without a fuss and alllow you to capitalise on emerging opportunities in debt too.

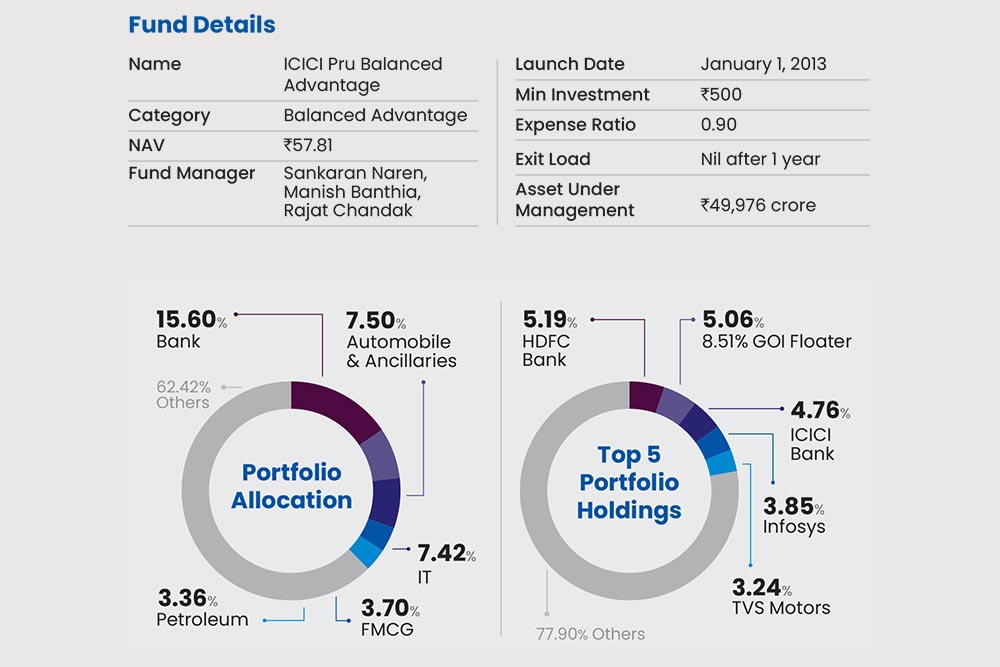

ICICI Prudential Balanced Advantage Fund (IPBAF) is one of the oldest schemes in this category that investors could consider. It has displayed a strong track record of skillfully managing equity and debt depending on market changes.

Portfolio

The fund maintains its net equity levels at 30-80 per cent and takes a counter cyclical approach. It uses an in-house model which works on the price-to-book value. Based on this, the fund manager increases equity exposure when valuations are attractive and reduces it when valuations are expensive. In the last six months, the fund has reduced the net equity exposure to 30-35 per cent from a little over 50 per cent, when equity valuations were at a higher level. As on September 2023, the net equity exposure stands at 36.80 per cent. In order to remain tax efficient, the fund uses hedging strategies to ensure that the equity exposure is above 65 per cent.

The fund follows a conservative approach. It does not go overboard on small caps to generate higher returns for higher risk. It sticks predominantly to large caps, with 7-10 per cent exposure to mid caps.

Performance

The fund has delivered consistent returns across market cycles. In the last 10 years, it has delivered returns on a par with Nifty-TRI despite being a hybrid fund. It delivered 13.30 per cent compounded annual growth rate (CAGR) as on October 20, 2023 against 13.53 per cent by Nifty-TRI.

OLM Take

Investors who have an investing time horizon of five years, and who do not want higher volatility in their portfolio may consider this fund as it can provide decent returns with lower volatility, if not superior returns, over the time frame.

kundan@outlookindia.com