You have worked hard throughout your life to save for your retirement years. You have your savings and investments in place—some bank deposits, a few equity stocks, mutual funds, and your Employees’ Provident Fund (EPF) and Public Provident Fund (PPF). You are possibly wondering how to organise all of these so that the money flow is consistent. The requisite amount should be there in your bank account at the beginning of every month.

Initial Step

The first step towards achieving this is to start with a proper housekeeping plan. You have to prepare an inventory of all your financial assets, so that you get a composite view. When you get one view of your savings and your investments, you can plan your future cash flows well, too.

You can invest your retirement kitty at one place with proper diversification, provided the avenue is safe. This will enable you to take a quick view of what you have, and get the requisite cash flows towards your monthly income.

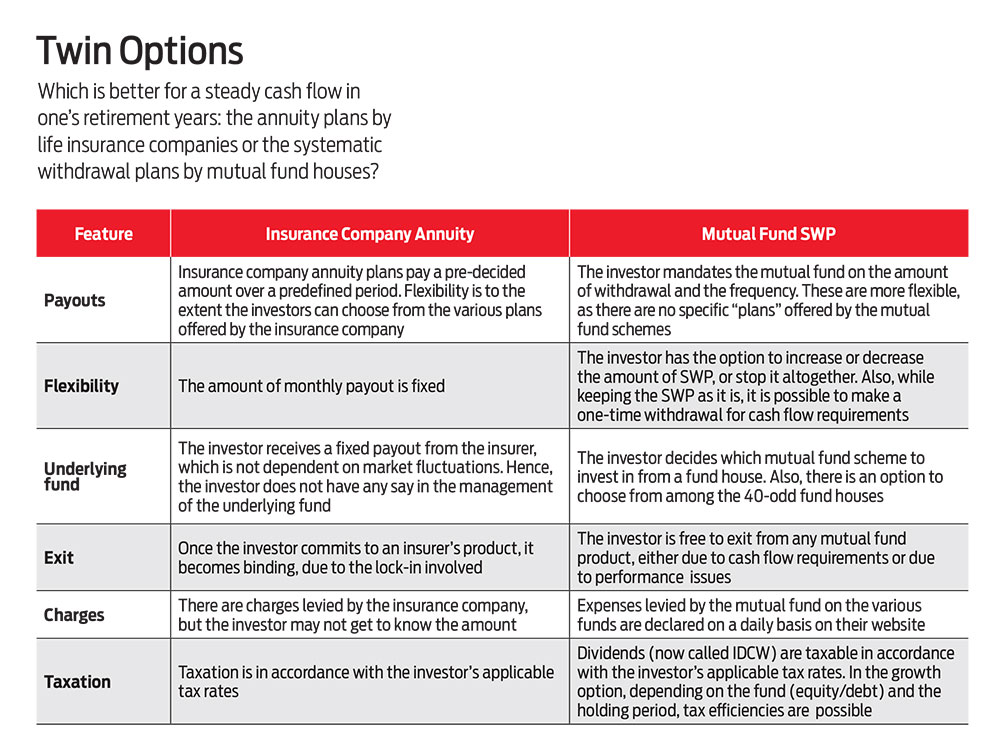

In this context, there are two products you can consider for investing and planning your cash flows. One is annuity products from insurance companies and the other is a systematic withdrawal plan (SWP) with your mutual funds. Both allow for regular withdrawals.

Annuity Plans

This is a product wherein you make a one-time lump sum payment to an insurance company. In exchange, they will pay you a pre-decided fixed amount every month, as long as you live. There are many permutations and combinations available in the product features.

An immediate annuity starts immediately after you enter into the contract with the insurance company. A deferred annuity starts after a pre-decided deferment period, such as, one or five years.

After your demise, the annuity will be paid to your spouse, and thereafter, your nominee will receive a lump sum payment of the initial amount you paid to the insurance company. The latter two features come as add-ons, though they add to the overall cost.

For instance, if the terms provide for return of the initial investment to your nominee when you are not there, the amount of monthly payouts will be calculated accordingly.

The amount of monthly payouts to you is decided by actuarial calculations based on the experience of the insurance company on their pool of customers.

Mutual Fund SWPs

You can either make a lump investment in one mutual fund scheme or have multiple investments in various mutual fund schemes. To facilitate an SWP, you will need to plug in SWP requests with all your mutual funds.

You will have to decide on the amount you need to withdraw, and the frequency of the payment. Also, even as you make the withdrawals, the balance will remain invested and will continue to earn market returns.

Annuities Vs SWPs

One basic difference between annuity plans and SWPs is that in case of the former, the insurer decides the payout on the basis of your investment and the features you have opted for.

In case of an SWP with a mutual fund, you have the full flexibility to either increase or decrease the amount of SWP. You also have an option of lump sum withdrawal.

If your fund is consistently underperforming, you also have the option to shift to another fund within the same fund house or reinvest your corpus with another mutual fund scheme. That said, the shifts will be subject to taxation in accordance with the prevailing tax regulations (see The Fork Ahead).

Note that mutual funds levy expenses on their schemes, within limits defined by the Securities and Exchange Board of India (Sebi). Expenses charged for running the funds are fully transparent; it is declared on the websites of the mutual funds on a daily basis. In insurance company annuity schemes, the expenses are charged to your scheme, but you don’t get to know the amount.

Conclusion

So far, we have discussed only two options for parking your “lifeboat” or “safety net” for your golden years.

As mentioned earlier, diversification is a basic tenet of managing a portfolio, including your retirement kitty. There is a rationale for discussing only two methods. In insurance company annuity, there is a committed amount every month, you are not exposed to market fluctuations. It is safe as well, as there is a commitment from a regulated insurance provider. In mutual fund investments, all your money should not be parked in one fund. It should be spread out over multiple equity and debt funds across asset management companies (AMCs).

What then, is the harm in continuing with your existing investments such as stocks, bonds, MFs, PPF, EPF and bank deposits? Well, there is no major issue as such.

However, there should be some order and logic to how you do things. If your investments are scattered across multiple disparate avenues, it is that much difficult to put them in order, as per the tenets of financial planning.

For smooth management, if you do it through easily manageable vehicles, it is that much better. Preferably, whatever be your decision, you should take professional help, i.e., consult a financial planner, who would build in a method to your money. If you are going by the do it yourself (DIY) method, it is advisable to have it less scattered and more organised through MFs or annuity products, so that you can enjoy your sunset years.

The writer is a Corporate Trainer and Author