Kolkata-based Subham (name changed), had two endowment insurance policies till recently. His father had bought these in Subham’s name around the time he started his first job. Subham, who turned 30 last month, kept paying a premium of Rs 50,000 annually for both the policies, with a sum assured of Rs 10 lakh in total, till about six years. The policies were for a tenure of 20 years.

Recently, Subham consulted a financial planner for his overall needs. After looking at his portfolio, the planner asked him to consider surrendering his endowment policies. After a careful analysis of the policy details, his financial goals, affordability, and other aspects together with his advisor, Subham decided to surrender the two policies.

Insurance agents sell endowment plans aggressively as they earn high commissions on them. The commission on these endowment plans could be as high as 10-25 per cent or higher in the first year and about 5-7 per cent in the next couple of years. The commission for term plans is about the same range, but since it is a percentage of the premium, the amount earned is lower.

Product wise, endowment plans give low returns and offer low coverage for relatively higher premiums. Nevertheless, like Subham, most of us are tied with such plans bought early in our lives because of the insistence of friends or family. So, what do you do if you already have an endowment plan? Should you continue or surrender them? If yes, at what stage does it make sense to surrender such plans?

The Case For Surrender

The need for surrender arises when you realise that these endowment plans neither provide adequate coverage or sufficient returns.

Low Coverage For High Premium: The purpose of an insurance policy is to provide you with a life cover. In other words, the sum assured should be enough to take care of your family’s financial needs in case something were to happen to you. A general rule of thumb is to have a cover 10 times your annual salary.

In Subham’s case, the sum assured from the two plans was Rs 10 lakh for a premium of Rs 50,000. A plain term plan would have provided him with a cover of Rs 1.5 crore for a premium of Rs 20,000. A sum assured of Rs 10 lakh was simply not enough to protect his dependents. After surrendering his endowment plans, Subham bought a term plan of Rs 1.5 crore to protect his wife and child.

Says Chenthil Iyer, founder and chief strategist, Horus Financial Consultants, a financial planning education firm: “Endowment plans rarely give sufficient life insurance cover because of their investment exposure. Even a Rs 10 lakh policy has a premium liability in excess of Rs 50,000 for a 20-year term. Imagine the premium one has to pay if s/he wants to buy a plan with Rs 1 crore sum assured. This is where pure-protection term plans come in handy. They give high coverage at reasonably low premiums. A 30-year old individual can take a Rs 1 crore cover for less than Rs 25,000 a year.”

Low Returns: Most endowment policies are sold as investment products. An investment should ideally give you returns that beat inflation. However, the returns on endowment plans are abysmally low. Adds Iyer: “In my experience, an endowment plan, though marketed as a guaranteed benefit plan by agents, provides a long-term below par return of 4.5-5.5 per cent per annum. Rarely does it breach the 6 per cent per annum mark.”

He explains through an example. Let’s say an endowment plan with a sum assured of Rs 10 lakh has a simple guaranteed addition of 5 per cent on the sum assured every year, over the policy tenure of 20 years. Note that endowment plans, typically, add bonuses that are paid at maturity.

The maturity value of this policy would be Rs 10 lakh + (Rs 10 lakh x 5 per cent) x 20 = Rs 20 lakh. The internal rate of return would come to 6.22 per cent. Assuming an inflation rate of 6 per cent per annum, the net returns from this policy will be 0.22 per cent.

Considering that endowment plans are long-term instruments, the returns are way below what equities provide. Investments in equity instruments usually provide 10-12 per cent over long periods.

Debt products like fixed deposits fetch around 7-8 per cent per annum, while long-term debt products, such as Public Provident Fund (PPF) offers 7.1 per cent per annum currently.

The Cost Of Surrender

If you do not want to get tied down with an endowment plan after reading the above, you may want to stop paying further premiums or surrender the policy. But you need to assess whether you would gain anything by doing so.

What You Get If You Stop Paying Premiums: If you are not happy with your policy, one of the options is to stop paying further premiums but wait for the policy term to get over before collecting the proceeds.

“If one waits till the original term of the policy, the paid-up value will be given to the policy holder as maturity proceeds. Paid-up value refers to a situation where you have proportionately paid the complete premium for a lesser sum assured and don’t wish to continue paying further premia,” says Vivek Jain, head, investments, Policybazaar.com, an insurance broking firm.

Let’s take the above example of a policy with a sum assured of Rs 10 lakh and a tenure of 20 years. If you pay the premiums for five years, you would have paid for a proportionately reduced sum assured of Rs 2.5 lakh.

Along with this reduced sum assured, the bonuses and guaranteed additions declared on the policy until then would be added to arrive at the paid-up value. After five years of the policy, bonuses worth Rs 2.5 lakh (5 per cent on sum assured, annually) would be added. In this case, the paid-up value would be Rs 2.5 lakh (reduced sum assured) + Rs 2.5 lakh (bonuses) = Rs 5 lakh. If the policyholder waits for another 15 years without paying premiums, which is till the end of the tenure, they will receive Rs 5 lakh.

However, note that your money will not earn any interest in these 15 years. In fact, inflation will eat into it.

What You Get If You Surrender: When you choose to exit a policy before the end of its term and take out the money, you are entitled to receive the surrender value (SV).

“This is calculated based on the number of years you have paid the premium, the amount of premium paid, the bonus earned, and the paid-up value. If the policyholder wants to take out the money anytime in between, the policy will have to be ‘surrendered’ and a penalty based on the surrender value factor chart will be payable,” says Iyer.

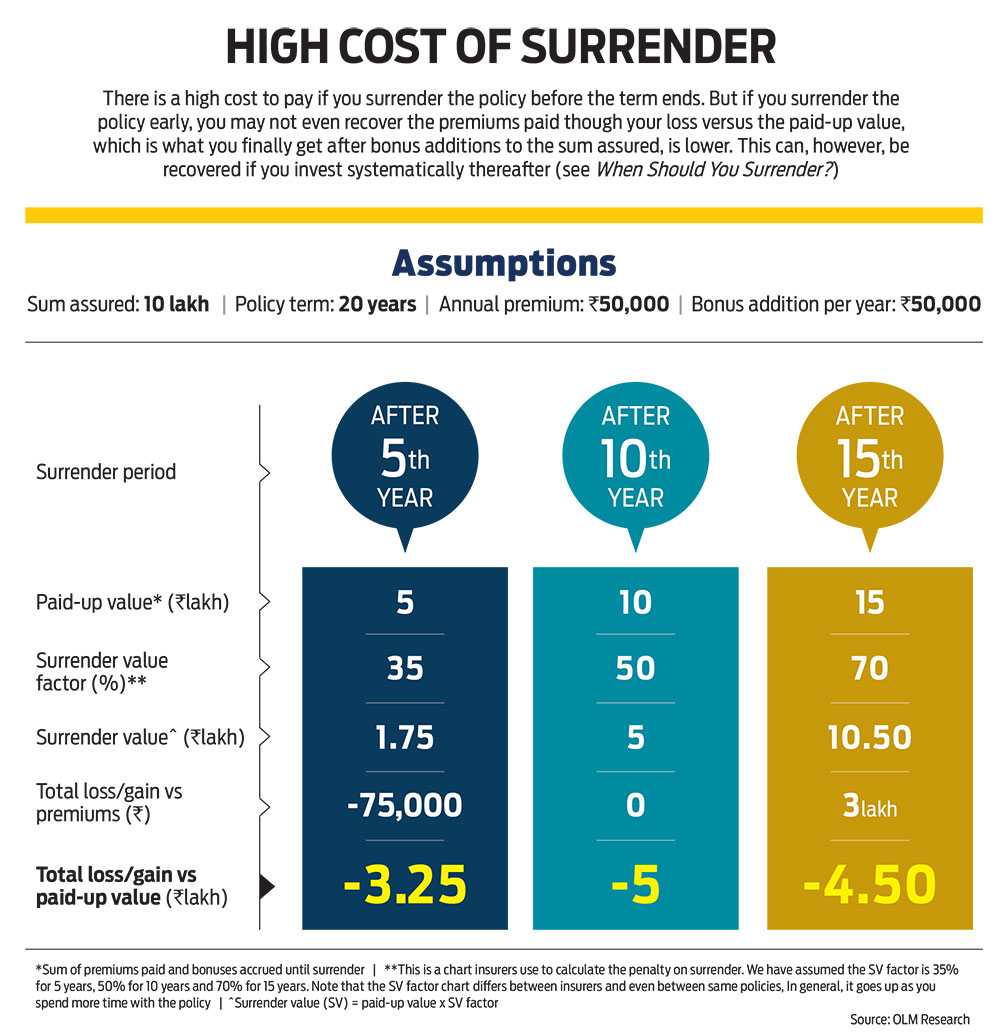

The SV is calculated using the SV factor chart. The amount receivable upon surrender is calculated as per this formula: SV = Paid-Up Value x SV factor (expressed as a percentage).

In the example mentioned earlier, if the policyholder surrenders the policy and the SV factor is, say, 35 per cent, they will get only Rs 5 lakh x 35 per cent or Rs 1,75,000, i.e., only 35 per cent of the paid-up value.

The SV factor keeps rising over the term and goes up to 70 per cent or more in the last few years of the policy. At later stages, the absolute loss versus the premiums paid reduces or reverses. But you stand to lose versus what you would have received as the paid-up value of the policy (see High Cost Of Surrender).

Says Nita Menezes, founder and CEO, Financially Smart, a financial planning firm: “Surrendering an endowment policy before its maturity date can result in serious losses. The policyholder may lose a significant portion of the premiums paid due to the surrender fees, and in some cases may not receive a bonus or other benefits. It is important to read and understand the terms of each policy.”

There is little parity across insurers and policies in terms of how SV is calculated. In some cases, there are separate SV factor charts for premiums paid and accrued bonuses. Also, some insurers may calculate SV based on the premiums paid and not the paid-up value.

The SV offered can either be guaranteed or special. The guaranteed SV is mentioned in the brochure and is payable after three years. It, however, does not include any bonus paid at maturity. Special SV includes bonuses, but at the insurer’s discretion, and is paid only in some cases of early exit.

When To Surrender?

The surrender penalty in insurance policies is quite steep. Says Nitin Mehta, chief customer officer and head, digital business, Bharti AXA Life Insurance: “Before you decide to surrender your life insurance policy, make sure you are fully aware of the potential financial implications. You can calculate your potential SV in advance so that you know what you are entitled to get before you terminate your policy.”

If you are surrendering a policy because you can’t afford the premium anymore, there’s nothing much you can do. But if you are looking to surrender for other reasons, such as low returns, a careful cost-benefit analysis through planning and reinvestment would help. It will also depend on how many years you have already paid the premiums for our calculations show that the earlier you surrender, the less you stand to lose.

Using the same example that we have used elsewhere (sum assured of Rs 10 lakh, policy term of 20 years and premium of Rs 50,000), let us consider three scenarios for calculation: when one surrenders the policy after the 5th, 10th and 15th years.

Let’s say, the policyholder surrenders after the fifth year, takes a term insurance plan with a premium of Rs 20,000 per annum, and invests the remaining Rs 30,000 in an index fund through an annual systematic investment plan (SIP) that gives an average annualised return of 12 per cent. This will grow to around Rs 12.50 lakh. If you add the SV of Rs 1.75 lakh (calculation shown earlier in the story), the final corpus after 15 years (the remaining policy term) will be Rs 14.25 lakh. If the policyholder were to reinvest the SV, too, the corpus will grow further. Over 15 years, Rs 1.75 lakh will grow to Rs 9.50 lakh at 12 per cent per annum, which means the total corpus will grow to Rs 12.50 lakh + Rs 9.50 lakh or Rs 22 lakh in total.

That’s higher than the Rs 20 lakh paid-up value of the policy over the full tenure, along with a much larger insurance cover.

If you had not bought an endowment policy at all and had bought a term cover and invested the rest in an index fund, the payout would be larger, keeping all other assumptions the same.

But what if you surrender after the 10th year. In this case, we reduced the returns, as the expected return from equities reduces if the tenure is lower. In this case, you earn slightly less than the total paid-up value of the policy, but still your term insurance offers a more comprehensive cover (see When Should You Surrender?).

Clearly, the earlier you surrender, the better it is for you.

Says Naval Goel, founder and CEO of PolicyX.com, an insurance web aggregator: “Surrendering an endowment plan and then buying a term insurance plan is a good idea. Some part of the SV should be kept fixed in the form of a term insurance and some portion of it can be used to invest. This can give higher returns while a big chunk of money is saved for the future.”

However, if you need a larger insurance cover, you must buy term insurance, irrespective of which stage you are at because that’s the first level of protection for your family.

meghna@outlookindia.com