It was in Budget 2020 that Union Minister of Finance Nirmala Sitharaman first introduced the new tax regime, which offered lower tax rates than the old tax regime. The catch, however, was that the new tax regime did not allow any tax deduction or exemption benefits.

Over the years, as tax rates remained more or less the same, few from the middle class took to this new simplified tax regime, as tax saving was higher in the old tax regime—though there is no government data on the subscriber base, anecdotal evidence suggests so. For a large number of people, mandatory investments and expenses such as the Employees’ Provident Fund (EPF) and home loan principal and interest payment takes care of the deduction limits under the old tax regime. In other words, this segment did not have to make any extra effort to save more.

The lack of changes in tax rates in the last Budget had raised expectations of some relief in Budget 2023-24. So, when Sitharaman reached the bit on personal taxation and said, “Now, I come to what everyone is waiting for—personal income tax”, there was a collective chuckle from the Parliament benches, and the common taxpayer waited with bated breath.

What followed was something that has cheered a large section of people, but left several others confused as well. Sitharaman made five major announcements on personal taxation and four of these were to do with the introduction of new tax benefits under the new tax regime. While the old tax regime remained untouched this time, the option to choose either regime in FY24 remains.

The announcements have certainly brought cheer to the those in the lower and the highest rung of the income ladder, but those in between have been left asking the question: will the revised rates, exemptions and rebates offered under the new tax regime give it an edge over the old tax regime?

Outlook Money ran some numbers along with Deloitte India to answer the big question that Budget 2023 has thrown up: Will the new tax regime be better than the old tax regime in FY24? The answer to this question is a bit complicated and will depend a lot on how much your annual taxable income is, and whether you avail of certain deductions or not.

What Should You Choose In FY24?

Sitharaman proposed to increase the rebate limit to Rs 7 lakh, effectively making annual income up to that amount tax-free. “At present, those with income up to Rs 5 lakh do not pay any income tax in both the old and the new tax regimes. I propose to increase the rebate limit to Rs 7 lakh in the new tax regime. Thus, persons in the new tax regime, with income up to Rs 7 lakh will not have to pay any tax,” she said in her Budget speech.

Clearly those in the lower income tax brackets benefit from the announcement. This may include young professionals who have just started working, and even a large section of pensioners. “It is the government’s goal to make the new tax regime with lower tax rates seem attractive to all freshers starting their careers. As the average age of India’s working force is 25 years, the majority of the population will be covered under the new tax regime,” says Sudhakar Sethuraman, partner, Deloitte India.

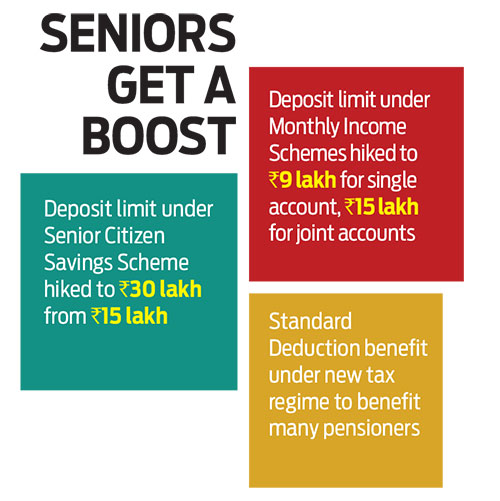

Given that the standard deduction of Rs 50,000 will be allowed even under the new tax regime in FY24, you gain under the simplified structure across all income categories up to Rs 100 lakh in terms of the amount of tax you save.

But that’s only one way to look at it. The game-changer here is the benefit of deductions and exemptions still available under the old tax regime.

Our numbers show that if you avail of deductions under Section 80C and Section 80CCD(1B) of the Income-tax Act, 1961 of Rs 2 lakh and home loan interest deduction on a self-occupied house property of Rs 2 lakh under Section 24(b), apart from the standard deduction of Rs 50,000, then you stand to gain or have more tax savings under the old tax regime if you earn Rs 8 lakh or more (see Old Vs New Tax Regime).

For instance, those earning up to Rs 9 lakh need to pay no tax, if they avail of all the deductions mentioned earlier under the old tax regime. The income limit that is tax-free under the new tax regime is Rs 7 lakh. Similarly, for an annual income of Rs 10 lakh, the tax payable under the old tax regime is Rs 23,400 as compared to Rs 54,600 under the new tax regime in FY24.

Also, people who fall somewhere in the middle of the income ladder may be better off with the old tax regime, provided they maximise most of the deduction benefits.

“People in their mid-career with more income will find the old tax regime more appealing. They can claim their house property deduction and other exemptions,” says Sethuraman.

When it comes to choosing between the two tax regimes, you would have to do your own calculations that account for deductions and exemptions you are able to avail of (see Existing Deductions).

The taxable amount can also make a huge difference. For instance, a person earning Rs 8 lakh per annum will save Rs 33,800 under the new tax regime as compared to Rs 31,200 under the old tax regime in FY24. There is a marginal difference between the two. However, go up to Rs 20 lakh annual income, and the difference is stark—the amount saved under the new regime is Rs 1,17,000 as against Rs 7,800 in the old tax regime.

The Nudge To Shift

The fact that the gains in the old tax regime is narrowing for those with incomes in the higher tax brackets in FY24 is also a nudge for the individuals in these segments to switch to the new tax regime, which is also hassle-free when it comes to compliance issues.

“The government wants to give a boost to the new tax regime, so that compliance will become a lot easier. In the long term, it wants to eliminate all exemptions and deductions, without making fiscal revenue collection losses,” says Sethuraman.

Until FY23, few opted for the new tax regime as the benefits outshone those available under the old tax regime. They still do for a lot of income groups, but the gap is narrowing, which demonstrates the government’s intention to make taxpayers shift to the new regime.

Sitharaman minced no words to make her intention clear while addressing a press conference after the Budget presentation on February 1, 2023. “We are not compelling anybody. Those who want to remain in the old tax regime can still remain there. But the new one is attractive, because it gives a greater rebate. It also provides for simplified and smaller slabs, lower rates of taxation, and slabs which are nicely broken down,” she said.

“We want to make the new tax regime, which is without exemptions, attractive enough for people to think that this will be the best option for them, because it gives them better rates. It doesn’t also make compliance a burdensome exercise,” she added.

But it can only be done in a phased manner. For FY24, the government has added sheen to the new tax regime by extending the exempt income limit, introducing standard deduction and other benefits (see Income Tax Changes). In future, these could be expanded on the back of technology.

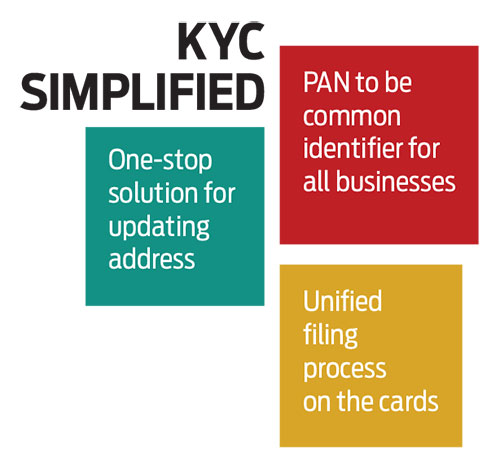

“Technology is going to play a crucial role here. To avail standard deduction extended to the new tax regime, the tax department does not have to check anything. With linking of Permanent Account Number (PAN), Universal Account Number (UAN) and Annual Information Statement (AIS), the government can track individuals’ PF contribution, housing loan value repaid, value of jewellery purchased etc. In the coming years, we may see the government providing 80C benefits (under the new tax regime), which can be tracked directly, such as contribution to the EPF,” says Sethuraman.

What this essentially means is that expenses and investments that are made by default—such as home loan principal and interest payments and contributions to EPF or the National Pension System (NPS)—may be counted in automatically, going forward.

In the process, however, other exemption heads, such as telephone bills may be completely done away with, Sethuraman adds.

What Should You Do?

When it comes to choosing a tax regime, you must run the numbers in the next financial year. For a large section of people, especially those who do not have a home loan, the new tax regime may work better.

Look out for Outlook Money’s April issue to figure out how to calculate tax on your income under both the regimes. If do-it-yourself (DIY) doesn’t work for you, consult a tax expert to get the numbers right.

If there’s little that you are saving by staying in the old tax regime, then you might want to assess if the difference is worth all the compliance burden that the old tax regime entails.

But if you find that you are better off with the old tax regime, remember to inform your employer that you want to stay with it. That’s because the finance minister has clarified that new tax regime is now the default one. What this means is that if you don’t opt out of it, your employer may assume you want to stay with it.

nidhi@outlookindia.com