Kiran Telang | Age 46 | Financial Planner

Assets Under Advice 100 Families

Practising Since 2006

***

The theme for International Women’s Day in 2023 is #EmbraceEquity. For author and certified financial planner Kiran Telang, embracing equity starts at home, and that includes their participation in the family’s finances. That’s because women bring their uniqueness to the family finances and have a role to play for an equitable household financial management, she says.

It All Begins At Home

How women deal with financial matters depends a lot on the openness of the family.

Telang says, “Many families do not carry out financial discussions with daughters. In fact, in many families, money is a taboo subject.” At other times, women themselves do not want to take on the added responsibility of dealing with finances, as they are already burdened with other responsibilities at home, she says. At the end, husbands perform financial duties and are the financial decision-makers in most households.

Telang insists that it is important for women to take a lead in financial matters, as it impacts everyone in the family.

“Even home-makers must have a basic understanding of the cash flow in their home and the monthly expenses. This way, when there is a surplus, they can decide where and how to invest it. This type of involvement is essential because investments can be for short- term, such as a vacation or holiday, or long term, such as for higher education for children or purchasing a home. All these financial goals impact the family in a major way,” she says.

Families are the starting point for the development of most of our habits, and thus, our relationship with money gets shaped at home. “Thankfully, there are families, however few, that have different value systems in place where the women do take charge of the family’s financial health, where the daughters also go along to the bank etc.,” she says.

Telang belongs to one such family. The Mumbai-based author of two books—Mindful Retirement (2018) and Moneywise-Perspectives For Women (2021)—learnt a lot of money basics at home. Telang developed an understanding about the importance of saving at home. Born to banker parents, she grew up watching both her parents diligently maintain the records of income and spending at home.

“As both my parents worked in the banking sector, my family was financially savvy. We were a typical middle-class Indian family and both my parents were huge savers and careful spenders. My parents were astute in their approach towards money and handled their financials well. The household mindset was spending within one’s means,” she says. Back in the 1980s and 1990s, most middle-class Indian families were financially disciplined. The economy was closed and there were limited investing instruments.

Like her parents, Telang pursued a career in banking after obtaining an MBA degree, but she wanted to do something on her own. The seed of her future career path, incidentally, was sown when she read an issue of Outlook Money magazine way back in mid-2000s. “I would read the magazine thoroughly cover to cover. That’s how I got to know about Certification on Financial Planning (CFP) as a career option. Being from the banking background, this felt like a natural fit,” says Telang.

Thus began her career as a CFP. “I obtained a CFP certification in 2007, and have a total of 17 years of practice in the personal finance arena,” Telang says.

Fighting Stereotypes

Stereotypes such as ‘women don’t understand finances’ and ‘it is better to leave it to the male members of the family’ can do a lot of harm.

Stereotypes are dangerous as they can affect the confidence of many women, she says.

“And then, even if they are earning a high income, they feel more comfortable leaving the decision-making to their spouse or parents”, she adds.

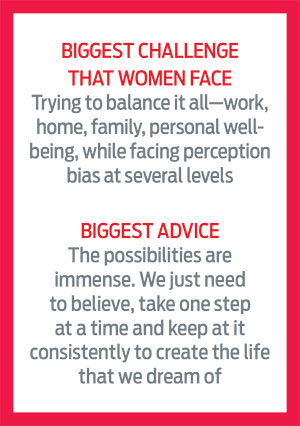

Calling out other challenges that women face, Telang shares other similar stereotypes that keeps women from taking charge of the family’s financial health even now.

“Girls are not good with numbers’ is one such example. These stereotypes are often passed around as ‘wisdom’ although they are a myth,” she says, adding that these can leave a lasting psychological impact on young girls, who may grow up believing it.

Telang cautions against the damage such stereotypes can cause to women.

“This is absolutely not true. Most of the times, women display equal levels of competence when dealing with their finances, if not more,” she says. She, however, adds that while stereotypes do play a role in hampering the confidence levels of women, but when they are pushed into handling their finances due to certain circumstances, such as the death of a husband, or in case of inheritance etc., they shine.

“Based on my experience, a lot of women, who have never handled financial aspects in their entire life, when pushed to take them up, were found to ask the right questions. They want to understand and are able to grasp the concept well,” she says.

One of the most prominent reasons why women don’t take financial decisions is that there is no equal division of labour at home, believes Telang. “One of the ways to resolve this is that women become a part of the decision-making process, as that is very important, even if the execution part is done by the husband,” Telang says.

Changing Contours

The good news is the equations may be changing, even if to a small extent.

Telang says there are remarkable differences in how younger women handle their finances versus their older counterparts, but adds that some of the common stereotypes remain a part of the popular psyche.

“More number of women in their 20s and 30s are part of the work force now and have higher access to wealth compared to those in their 40s and 50s. The former are also financially savvier than the latter. The most remarkable difference can be seen in the financial habits of both age segments,” she says.

When it comes to financial discipline, women in their 40s and 50s ace it, in Telang’s experience.

“A lot of these women are part of single income households. Since the income was limited, they have a smarter, more disciplined approach to meet their requirements. They are more enterprising with money management while balancing the inflow and outflow,” she says.

On the other hand, while women in the 20s and 30s have more wealth, they may be lacking some of the wisdom that the elder generation had perfected over time.

“With higher wealth, even the aspirations have gone up. Aspirations for travel, leisure, vacations, shopping, normalising loans especially, education loans, are commonplace now. So, it has become harder to have financial discipline in place,” says Telang.

This is an area that should be focused on as it is difficult to build financial discipline suddenly in later years, she feels. It is not uncommon for young women today to be financially more aware than the elders in the family, but for a brighter future they need to be disciplined too.

letters@outlookmoney.com