Vipin Gupta, Rajkot

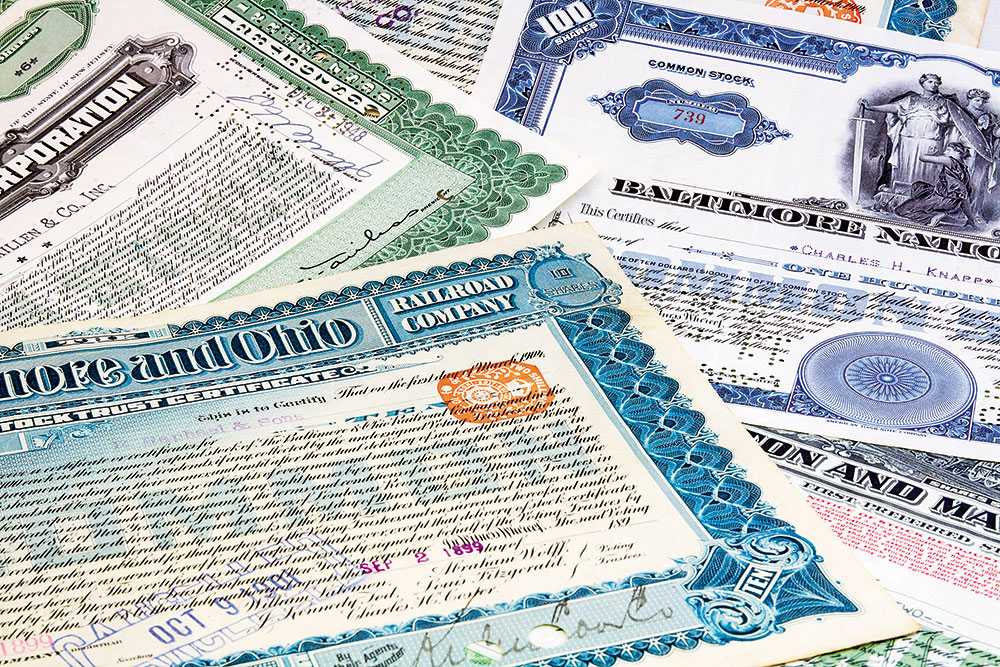

I am 56 years old. A few years back, I found some old share certificates in my house, which my late father had bought. To get them dematerialised, I contacted a known person and gave him money to dematerialise the shares. He took the details of the share certificates and copies of my documents, but did nothing. Who do I need to approach if I want to do it myself?

To dematerialise your shares, you should follow this process:

1. Contact your depository participant (DP) where your demat account is held to get a dematerialisation request form (DRF). If you do not have a demat account, open an acount.

2. Fill up the DRF with all the details, put your signature, and submit it along with the required documents and physical share certificates to your DP. The broker will stamp each physical share certificate with ‘Surrendered for Dematerialisation’. This step is very important.

The DP will process your request once it receives the DRF along with the surrendered physical share certificates. The DP sends the dematerialisation request to the concerned company’s appointed registrar and transfer agent (RTA). Once the dematerialisation request is approved, the relevant number of shares of the company will be credited to your demat account.

The documents required to be submitted are the physical share certificate, self-attested KYC documents of demat account holder/s, and bank attested signatures of all shareholders. If the shares are in the name of a deceased person, transmission forms are required along with the succession certificate, death certificate etc. If shares are lost, an FIR copy and a physical request letter for issuance of new shares signed by all shareholders are required. The DRF, transfer form, and KYC documents need to be submitted separately for different companies, and to the DP for further processing.

Hina Shah, CFPCM & Coach

Niranjan Patil, Aurangabad

I have been saving in mutual funds for more than two decades and have built a corpus of Rs 1 crore. At 50 now, I want to keep half of this for my retirement and half for my son’s education and other expenses. Shall I stay invested in equity-linked savings scheme (ELSS) or equity-oriented schemes, or withdraw and buy a deferred annuity plan? How should I plan?

It’s really good to see that your corpus has accumulated to Rs 1 crore over the last 20 years through mutual fund investment. However, it would be better to take assistance from an expert or a certified financial planner who will ascertain the monthly income you would need after retirement so that you can start investing accordingly henceforth through systematic investment plan (SIP) or lump sum mode based on your investible surplus.

It would be prudent to stay invested in equity mutual funds having wide exposure to flexi cap, diversified equity, hybrid equity schemes, and ELSS, depending on your risk appetite instead of withdrawing a part of it to buy a deferred annuity, as equity funds in the long run will create more wealth compared to a deferred annuity plan.

Also, it would be better to shift a part of the corpus to debt schemes near retirement age, to protect the gains and then start withdrawing for monthly requirements from the debt schemes, fixed deposits, etc. A part of corpus can stay invested in equity funds to beat inflation and also to buy an annuity.

Suhel Chander, CFP®, Handholding Financials