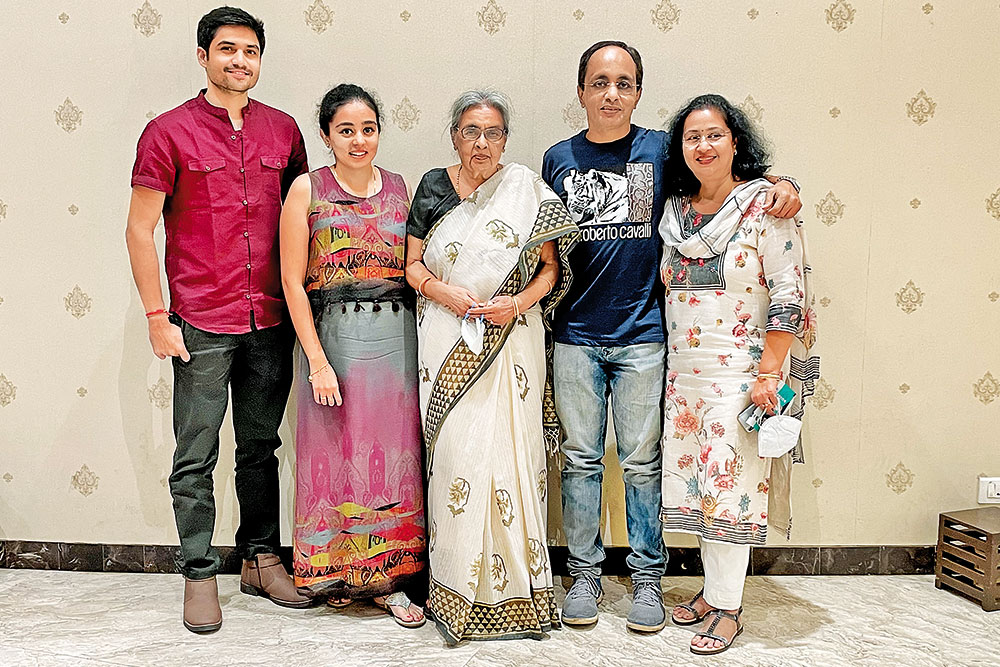

Fifty-six-year-old Alok Dixit is a Chhattisgarh-based dermatologist who believes in a holistic approach to skincare. His up-to-date knowledge of modern skincare treatments made him a well-known figure in the region. He and his wife, Richa Dixit, have a daughter, Devika.

Alok is a second-generation investor, and his engagement with Prateek Pitalia, one of the leading mutual fund distributors in the area, began after his father’s demise. Pitalia handles the Dixit family’s financial planning.

“I had various investment-related dealings with his father. However, after his demise, Alok, the only son, took charge of the family’s financial matters. I am glad our relationship continued with the second generation,” Pitalia says.

He explains personal finance is one of the critical aspects of every individual’s life. Hence, the financial advisor’s quality of work and customer interactions “play a pivotal role” in strengthening long-term relationships, without which no business can prosper, asserts Pitalia.

At first, Pitalia held several personal meetings with Alok and gave him a patient hearing to understand his thoughts and the family’s financial needs after his father passed away.

These conversations helped Pitalia develop an investment strategy for the Dixit family. “What I could gather from my interactions with Alok was that he was keen to identify the best funds for investment.” But, at the same time, Alok wanted to play it safe for his peace of mind, with 1-2 per cent returns over and above the fixed deposit (FD) earnings post taxes, says Pitalia.

Pitalia knew investments must be goal-based to ensure long-term financial discipline. Some of Alok’s goals that emerged from the discussions were Devika’s higher education, her marriage expenses, Alok and Richa’s retirement plan, and the smooth transfer of assets to legal heirs.

“The best part was Alok always made sure his wife was actively involved in the discussions. It helped her understand the decision-making process, which is important because women often face difficulties after losing the main decision-maker in the family. It always helps if more than one family member understands financial planning and management,” he adds.

Once the goals were set, Pitalia took Alok in confidence that he could reach the milestones through proper planning. Then, he prepared a detailed presentation of the cash flows and target amount for each goal with a specific tenure for Alok, using various investment tools and financial calculators, and keeping the inflation factor in mind.

For instance, Alok set the target amount for his daughter’s higher education in the UK at `80 lakh, while the target amount for the couple’s post-retirement years was `22 lakh tax-free annually. In addition, several other family goals, such as a car loan, expenses on real estate, and capital expenditure on advanced equipment at the clinic, for which Pitalia was constantly approached, also required planning.

“We focused on stress-adjusted and inflation-beating returns for a smooth investment journey for Alok,” says Pitalia. Asset allocation was the key. Pitalia helped work out the amount allocated in different buckets.

For example, liquid funds were used for parking the money briefly, and short-term debt funds, which were maturing in 2-3 years, were suggested for short-term financial goals. For medium to long-term goals, Pitalia ensured Alok had hybrid and equity funds in the portfolio.

Meanwhile, their discussions on financial planning became a routine exercise that helped Alok mature as an investor. As years passed, Alok’s knowledge in finance grew, and he realised the importance of long-term planning while understanding the nuances of investment and how to ride short-term market volatility. This is something that Pitalia always wants his investors to know, as he believes this can help people reach their investment objectives.

“Over time, as per Alok’s willingness and risk appetite, we increased the equity allocation to 35 per cent from 10 per cent. Looking at the broader asset allocation for perpetual portfolio growth, Alok’s equity exposure remained between 20 per cent and 50 per cent, while debt allocations were a minimum of 50 per cent and a maximum of 80 per cent,” says Pitalia.

Since the market has various cycles, hand-holding investors is one of Pitalia’s primary tasks. Alok, like any investor, would sometimes ask Pitalia about assets that gave the best returns and occasionally wished to freeze the plan, especially during a market crisis. It was here that Pitalia had to step in actively to hand-hold him and navigate through the harsh market conditions by constantly reminding Alok about his financial goals.

“We never encourage investors to review their portfolios frequently. We told Alok to avoid picking the recently best-performing assets for investment. It could be hazardous. We instil values and principles, like cash flow analysis, risk management, sticking to investment basics across market cycles, and most importantly patience,” says Pitalia, outlining his investment philosophy.

Meanwhile, he ensured Alok had adequate insurance coverage for life and medical emergencies. “Such covers do not let investors feel the pinch during tough times, which ensures that investment goals do not get derailed,” says Pitalia.

Alok takes a holistic approach to treat his patients for a better outcome, and Pitalia does the same as his financial doctor. While Alok’s investing journey took wings under Pitalia’s counsel, their partnership underscores the value of time and financial planning in achieving life goals.

***

Lessons To Be Learned

- Early financial planning helps prevent needless pain later on

- Builds resilience against ups and downs on professional and economic front

- Goal-based investing is vital for financial discipline, better outcome

- Use income to create wealth, then use it to create income

- Financial planning can help build a retirement corpus

- Stick to selected assets across market cycles

- Investors lose when they panic, not because the market panics

- Diversification helps in earning sustained returns, goal fulfilment

- Successful investors reach goals in time by planning

Prateek Pitalia, Chief Strategist, MUDRA Asset Services Pvt. Ltd

Disclaimer

The financial journey of Alok Dixit is based on the “personal opinion and experience” of Prateek Pitalia, chief strategist at MUDRA Asset Services Private Limited, and should not be considered professional financial investment advice. No one should make any investment decision without first consulting their advisor and conducting research and due diligence.