After Union Budget 2022, there is a growing concern among salaried individuals in India as no extra tax benefits were announced. In a recent panel discussion on ‘Union Budget 2022 & You’, which was a part of the investor education and awareness initiative of Aditya Birla Sunlife Mutual Fund in association with Outlook Money, experts discussed how it was important to move on with their financial planning now that the tax rates have remained unchanged.

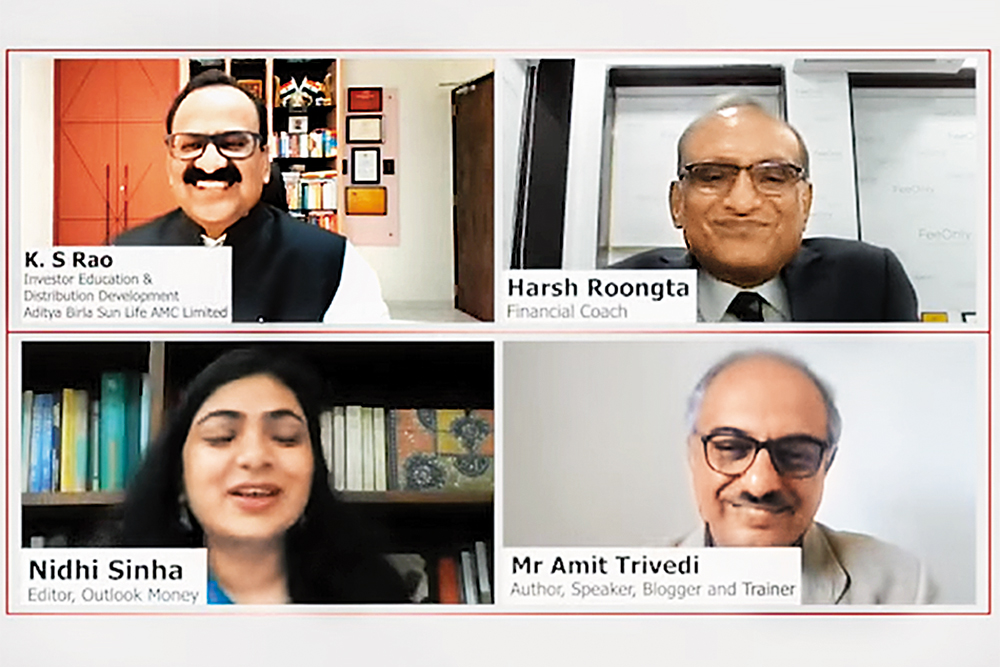

The panellists for the webinar were K.S. Rao, head, investor education and distribution development at Aditya Birla Sun Life Mutual Fund; Amit Trivedi, an author, speaker, blogger, and trainer; and Harsh Roongta, a personal finance and tax expert and a financial coach.

Talking about the impact of budget on the finances of salaried individuals, Rao mentioned there is no need to worry as the budget has no adverse impact on personal finances. “There is no negative surprise and that, in itself, is a positive. It is a big relief for the taxpayers that they don’t need to pay any extra tax,” he said. Even though there is no add-on benefit for the taxpayers, but no change is also a sign of relief for taxpayers in the long run.

The panellists suggest that it is important for individuals to plan their finances well and create well and they can do this using their own budget. “It clearly showed that you need to deal with your own financial planning and draw your own budgets. The majority of the people have no idea what their expenses are. Tax is also an expense,” said Roongta.

They spoke about how important it is to maintain a personal budget to ensure there is no overspending. They pointed out how often people fail to keep the balance between earnings and expenses and such behaviour leads to further financial complications. Roongta said it was better to have a separate expense account, to curb overspending.

The panellists pointed out how even paying tax can help in the personal budget. “Tax can also be a tool to create wealth. If don’t pay tax regularly, it can become the biggest liability for you. Plan in a way that you save throughout the year, so plan from the beginning of the fiscal year,” said Rao.

Roongta said the budget should be prepared based on the monthly income of the individual. “If there is a change in your income or in your expense, there is no need to change your financial habit,” he said.

While keeping a personal budget is important, it is equally important to make a plan to deal with inflation, advised experts. “You need to have assets that will have the potential to help deal with inflation,” said Trivedi.

He also spoke about the importance of diversification. “If the money is diversified well, the majority of the risks can be taken care of,” said Trivedi.

Speaking about the selection of the tax regime, Rao mentioned that such a decision should depend on the expenses and commitments of individuals. For those with house loans and other liabilities, the old regime makes more sense as it allows deductions, while the new regime doesn’t.

To watch the complete interview, visit: www.outlookmoney.com