Private sector employees often ignore the need for a health cover as they are generally covered by group health policies, which take care of their immediate needs. For the self-employed, the ability to leverage their business’s working capital to meet liquidity requirements for healthcare, typically, decreases after retirement. Thus, the need for a retirement health cover becomes all the more important as people retire early and live for longer periods.

There are three reasons for starting one’s health insurance journey early. First, it is economical. Most health plans now come with substantial no-claims bonus and some plans also allow for doubling the coverage by using this feature.

Second, health plans usually have a waiting period of 1-4 years. So, buying early ensures that the waiting period is over by the time one actually needs the plan. Also, there is the element of contestability period of eight years, after which the insurer cannot cancel the plan for non-disclosure, unless they can establish fraud. When a critical illness is diagnosed, insurers usually check the underwriting for suspicion of non-disclosure. But once the contestability period is over, they cannot typically dispute the proposal.

The third reason is to assure oneself of a clean plan with no caveats. A sedentary lifestyle and age lead to the onset of degenerative conditions, such as arthritis, diabetes and hypertension, among others. Once these conditions are diagnosed, insurers are usually reluctant to issue coverage. If they do, they typically apply a loading on base rates, or impose permanent exclusions related to diagnosed conditions. This defeats the purpose of buying insurance. That’s why one should buy a health cover early.

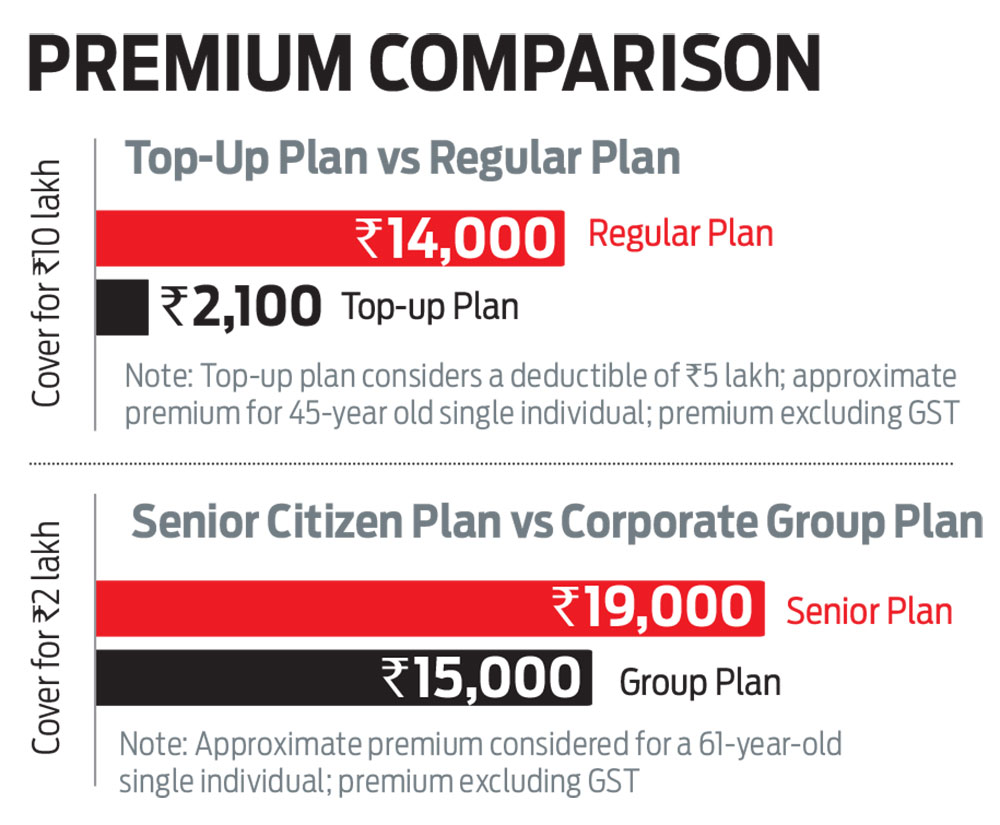

If you already have exhaustive health coverage from your employer with no sub-limits, co-pay, and cappings, then it is advisable to buy a top-up plan. They carry a deductible, which substantially lowers the premium compared to a regular health plan. Some insurers also allow top-up plans to be converted into a regular plan, provided you meet some conditions, such as the plan should have been bought before the age of 50, renewed for five continuous years, and the right to convert should be exercised before the age of 60. The key advantage here is that there is no revaluation of the health status. So, even if the person has developed a new health condition, the deductible could still be waived off. If the current coverage provided by the employer has limits, then buy a regular health plan.

If you are retired, then consider these approaches.

If you have children and they have been provided with employer health policies, then get yourself included in them. They typically cover all ailments immediately without any waiting period. They may, however, carry a co-payment or sub-limit option on a room, or cover a few specific diseases. Buy a regular health cover if you have no existing conditions. If that’s not possible, buy a senior citizen plan. They have lower waiting periods, but may carry co-payment on pre-existing conditions and sub-limits on a few diseases.

Lastly, get coverage in a group affinity plan. Many social, religious and professional associations provide coverage to their members. While the insurance is assured, many do not sustain for long due to adverse claims experience.

Buy a health cover early in life, as it will provide you with comprehensive coverage and peace of mind. Waiting until you are older to get a health cover can be expensive and complicated, and the options could be limited. So, start early and make a wise financial decision for a healthy future.

The writer is Co-Founder, SecureNow