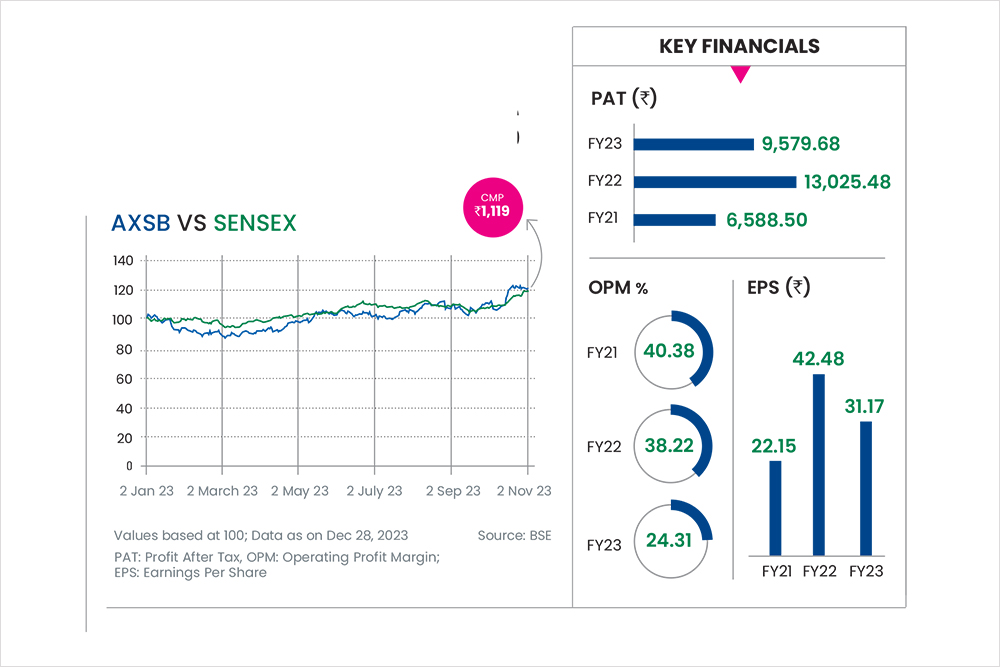

Company Name Axis Bank

Current Market Price Rs 1,108

Calendar Year Return 17.69%

***

Axis Bank is among India's leading private-sector bank, catering mainly to small business banking, small and medium enterprises (SME), Bharat Banking, and retail loans. With a network of 5,152 branches, it is focusing on Bharat banking, driven by higher growth and increased share in rural and semi-urban (RuSu) markets.

Investing Rationale

Q2FY24 Result: The net interest income (NII)/pre-provision operating profit (PPOP)/profit after tax (PAT) growth stood at 18.9 per cent, 11.9 per cent and 10 per cent, respectively, while growth on advances and deposits was 22.8 per cent and 17.9 per cent year-on-year (y-o-y).

The gross non-performing assets (GNPA) and net NPA (NNPA) were 1.73 and 0.36 per cent with provisioning coverage ratio (PCR) at 79 per cent. The return on assets (RoA) and return on equity (RoE) (annualised) in the quarter stood at 1.76 per cent and 18.67 per cent, respectively.

Improved Margins: The bank’s net interest margin (NIM) has increased y-o-y from 3.96 per cent to 4.11 per cent in 1HFY24 on the back of several initiatives, such as, improving the mix of retail and SME, reducing the portion of non-rupee denominated loans, lowering the share of low-yielding rural infrastructure development fund (RIDF) bonds, and improvement in current account savings account (CASA) ratio.

Increased Fee Income: During the quarter, the fee income grew 31 per cent y-o-y and 11 per cent quarter-on-quarter (q-o-q) with granular fees accounting for 93 per cent of overall fees. Retail fees grew 38 per cent y-o-y and 11 per cent q-o-q, with a 39 per cent y-o-y and 4 per cent q-o-q growth in retail cards and payments fees. The bank has successfully integrated the business it acquired from Citibank. It is expected to provide sustainable improvement in risk-adjusted returns.

Higher Than Industry Deposit Accretion: Axis Bank has delivered better-than-industry deposit growth and has improved the quality of its deposit franchise. Thus, it has gained an incremental market share of 6.2 per cent in terms of deposits in the last three years, with lower outflow rates and a higher CASA ratio. The bank is also focusing on accelerating deposit growth and expects the impact of these projects to reflect in the full potential of its deposit franchise in the next 7-8 quarters.

RWA Norms: The recent changes in risk weightage increase on select loans did not have a significant impact on the bank’s capital adequacy ratio (CAR) levels. As of September 2023, the bank’s capital to risk (weighted) average ratio stood at 17.7 per cent, indicating that there is no immediate need for raising fresh capital.

Reasonable valuation: We expect the bank to report return on asset/ return on equity (ROA/ROE) of 1.9/17.8 per cent by FY25, which will be led by an 18 per cent 3-year CAGR loan growth, stable NIM, improving cost ratios, and lower credit cost.