Aditya Channe, 24, who belongs to Sawari Jawaharnagar, a small census town in Maharashtra, always wanted to study abroad to pursue a career in digitalisation and worked steadfastly towards that goal. After doing a Bachelor’s in Technology in India, he worked in software development for two years before applying for an MSc degree at Montpellier Business School, France. So, when he got a partial scholarship for a course in Digital Transformation, he was elated. However, that also marked the start of a new challenge—to fund the rest of the expenses through an education loan.

Every year thousands of students plan to go abroad for higher studies from India. According to the latest data from the Ministry of External Affairs, the number of students going abroad increased even after the pandemic broke out. More than 1.1 million Indian students were studying abroad in 2021, it said. A report by management consulting firm RedSeer estimates that around 1.8 million students are likely to opt for higher education abroad in 2024 and their spending may reach an average of $80 billion annually.

Many such students look for education loans, but getting one is often not as simple as it sounds. Channe remained on tenterhooks for a month or so before his loan got approved. He was among the more fortunate ones as he was going to a known university and the loan amount was not very high thanks to a partial scholarship.

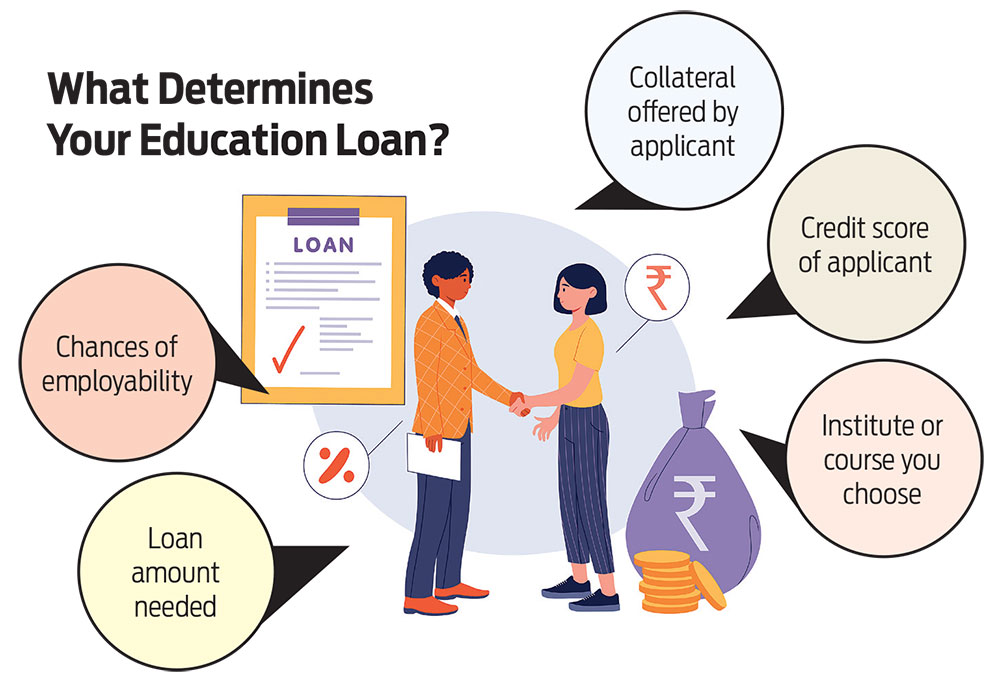

Usually, the road to getting an education loan is not that easy or short as lenders consider everything from where you are going to study to the loan amount.

As admission confirmations start pouring in for the new sessions abroad, know the challenges you may face while going for an education loan, what can make the journey easier, and assess if that loan is worth taking.

Getting Funding Is Not Easy

You may be depending on that loan to fund your own or your children’s education, but there are several factors that need to come together to make it happen. “Lately, the Indian banking sector has been disbursing fewer student loans. Many banks do not have a comprehensive list of approved institutions and universities,” says Sushma Sharma, global leader, career counselling division, LaunchMyCareer, a career counselling platform.

Finding A Lender: Lenders do not approve loans for every destination or institute, and even if they do, not every branch of the bank can process such applications. Channe initially wanted to approach a non-banking finance company (NBFC) as he thought it would be easier to get a loan there. “The process in NBFCs involves less documentation and it seemed a little quicker to me,” says Channe. NBFCs may have less stringent conditions than public sector and other banks, but none of the NBFCs that Channe approached had a loan product for his university in France. He finally approached the State Bank of India branch in his hometown. “But that was a rural branch. I was told that it will take very long to apply for a loan from a rural branch and that I needed to approach the branch in Nagpur (the nearest city to his hometown Jawaharnagar),” says Channe.

Getting The Right Amount: The loan amount for studying abroad is usually high, which often poses a challenge. “While applying to foreign universities, it is important to consider that expenses go beyond the evident tuition fees and living expenses,” says Sharma.

Students are also known to compromise as the desired loan amount was not available. “Although rare, but at times, due to the unavailability of the desired amount of loans/funds, students often change their course or university,” says Rajesh Varma Kutcharlapati, managing director, Fly Masters Education Consultants, an education consultancy firm.

Future Employability: Banks also look at the employability of the students after the course is completed and, therefore, factor in how well-known an institute is and how well-placed its alumni are. “Suppose one aspires to go to an institute like Cambridge or London School of Economics, but instead of applying to those universities directly, the student goes via an agency, he/she may end up in a lesser-known university, which may make it difficult to get the loan,” says Arjun R. Krishna, co-founder, We Make Scholars, an education finance marketplace.

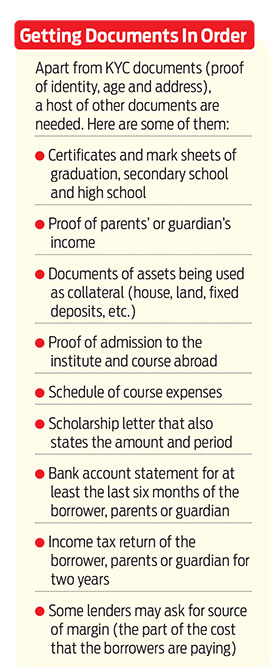

Detailed Paperwork: Another challenge is getting the paperwork together. Rabimba Karanjai, 33, who is currently pursuing his PhD at Rice University, US, recalls how complicated the documentation process was for his loan application at a public sector bank back in 2013 when he first applied for a loan to pursue MSc in Computer Science at the University of Texas at Dallas. “I submitted most of the documents the bank asked for, but the bank then asked for documents from the university specifying the cost and other expenses. It was challenging to get such documents from the university,” says Karanjai, who now has a PhD fellowship and also teaches part-time.

Need For Collateral: “For many Indian universities, students may avail a loan for a few lakhs, depending on the reputation of the university without any collateral, but for education loans for universities abroad, collateral is a must for those who want it from public banks,” says an official from the department of loans in Bank of Baroda (BoB), on the condition of anonymity. Collateral can be immovable property, provident fund or security deposits.

Some lenders may not need collateral but conditions will apply. “Many NBFCs and private banks disburse loans without collateral for Masters’ programmes. But the rate of interest may be high,” says Mehra.

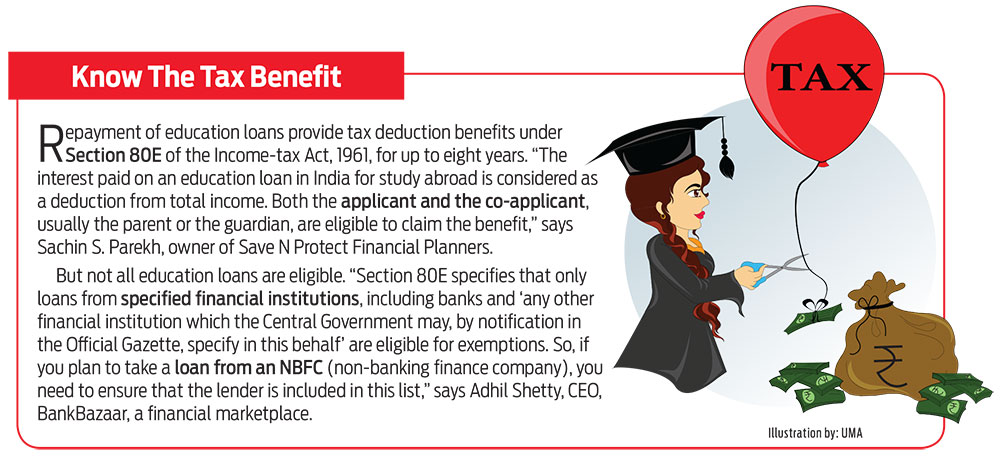

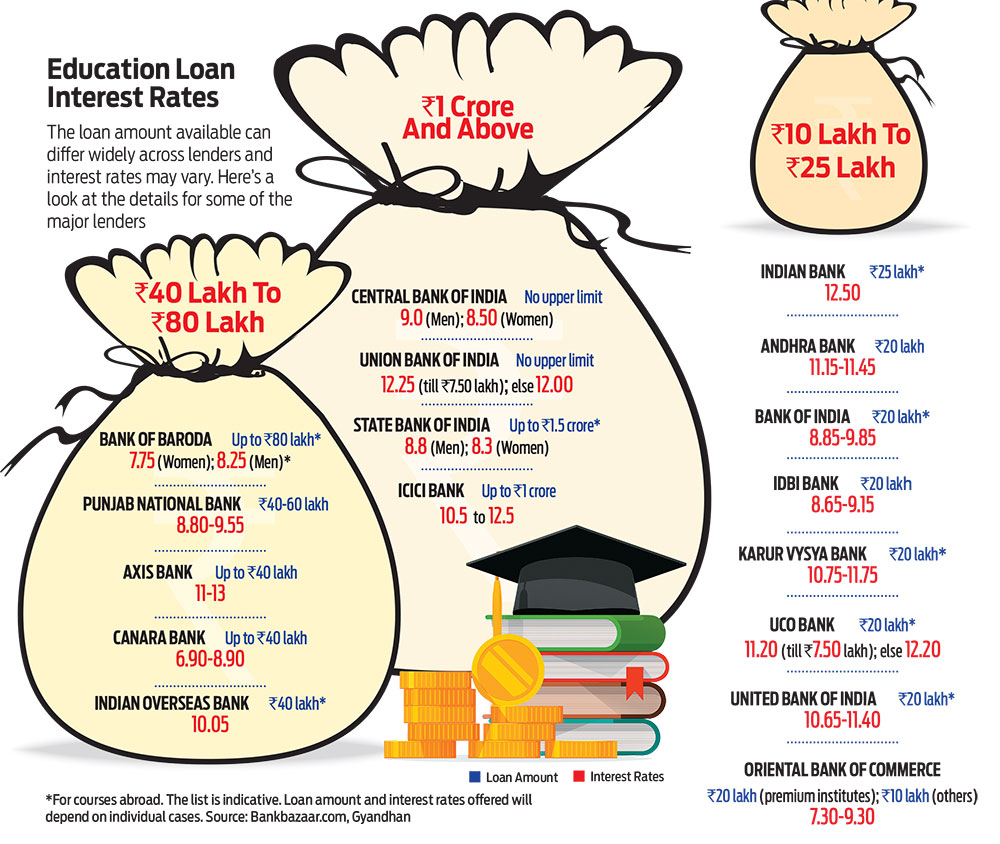

High Cost: While getting the documentation done properly may be the main challenge in case of public sector banks, the interest rates and processing fee may be higher at NBFCs and private banks. The interest rates range between 6.9 per cent and 12.5 per cent for public sector banks and between 10.5 per cent and 13 per cent for private banks (see: Education Loan Interest Rates).

Moreover, in many NBFCs and private banks, there may be little or no moratorium period. So, the loan repayment starts from the very next day of the loan disbursal. The moratorium period is usually the course duration plus six months or one year. Loan repayment is deferred for this period. A moratorium is provided to give adequate time to the student to find a job or sort out finances.

What Can Smoothen The Ride?

Institute’s Distinction: Often, students make the mistake of choosing a country or institute that costs less but is not very well-known. “In India, often students set the budget, then look for countries that are affordable and then choose the university. For example, if one feels one can afford Rs 20 lakh, then he or she goes for a university in Germany, while someone with a higher budget goes for a university in the US or the UK. However, in terms of getting a loan, both the fame of the university and the country matter,” says Krishna.

Besides, depending on the renown and success rate of the alumni of a university, many lenders may sanction a loan with no or low-value collateral. Public sector banks usually have a list of universities and courses for which students get certain benefits such as lower rate of interest or need to put up only low-value collateral, the BoB official quoted earlier said.

Wide Selection Of Lenders: A little known fact is that the choice of lenders widens when it comes to education abroad compared to studying in India. Apart from banks and NBFCs, there are international organisations such as Prodigy Finance and MPower Financing that give education loans. Various universities also help international students get loans in the respective countries.

“Private banks may be a better option especially for applicants who don’t have proper paperwork. For instance, students (or parents) whose assets may be in rural areas,” says Krishna.

Mehra suggests checking the repayment period, rate of interest and reading other terms and conditions before selecting a lender.

Good Credit Score: Like any other loan, a good credit score means higher chances of approval. So, make sure you pay all loans, including small ones, on time. “With buy now pay later (BNPL) options, often students postpone payment of a few thousands rupees but that can reflect on their credit scores and minimise the chances of getting an education loan,” adds Krishna.

Documents Are Important: Apart from having know your customer (KYC) documents in place, keep paperwork related to salary, income tax return (ITR) and collateral ready. “Often, people file back-to-back ITRs just to meet this criterion. Doing so may affect your loan process. So, before applying for the loan, both the applicant (if working before) and the person providing the collateral should have the ITR papers for the last few years,” says Mehra.

Keep the confirmation letter from the institute apart from other documents received from there.

Explore Scholarships: “Only 2-3 per cent of the total number of applicants gets full scholarship. But there are various academic bodies and institutions that give partial scholarships,” adds Krishna. He encourages students to look out for scholarships before or during the application process too because there are various schemes and opportunities of availing a scholarship along with a loan. “There are zero per cent loan products and grants available, such as the ones issued by the Tata Foundation, the Aga Khan Foundation and others,” adds Mehra. Organisations such as Gyandhan and We Make Scholars help students with loan plus scholarship schemes.

Is The Race To Go Abroad Worth It?

Although there is a growing demand for studying abroad, you need to keep in mind the professional or academic prospects once the course is over. This will help you assess the repayment potential before taking on an education loan.

Various studies have also shown that education loan defaults are rising. During a Parliamentary session in 2021, the government stated that nearly 9.55 per cent of education loans extended by public sector banks were categorised as non-performing assets (NPAs) in 2020.

Experts suggest working abroad after the course. “It is better if a student can spend a few more years in the other country and take up a job. Earlier, many countries allowed students just a few months to look for a job. But now many countries like the UK have introduced graduate route programmes under which students can stay and work or look for work for a couple of more years after their course,” says Kutcharlapati.

Opportunities in India, too, can be explored. “A graduate or post graduate degree from a recognised foreign university opens a vast array of career opportunities. Many countries have rolled out policies conducive for international students to stay back for a few years after the completion of their programme and gain international work experience. This experience, along with the degree from a foreign university, can open up lucrative prospects in India,” says Sharma.

After all, getting an education loan is only one act of the play; the second act is repaying that loan.

letters@outlookmoney.com