Insurance has been part of the financial lexicon for years now. What has changed to some extent though is how it perceives insurance.

Most of us saw our parents using life insurance policies as the only investment and savings tool, other than fixed deposits (FD), to fund education, weddings and other needs of the family. Then we bought or were made to buy our own set of similar insurance policies once we entered the workforce.

The first big change in how we perceived insurance—still largely as investment though—was when unit-linked insurance plans (Ulips) came in the mid-2000s. They promised market-linked returns and the exuberance at the time coupled with investors’ trust in older insurance institutions gave a leg up to these. But soon enough, people realised that these products were heavily front-loaded and agents were promising unreal returns. The 2008 crisis brought home the fact that markets were not always friendly and could erode both money as well as trust. People started going back to traditional policies.

But as markets recovered and mutual funds became a new and viable investing option for people, term insurance—the simplest and cheapest form of insurance that is meant for pure protection with no investment component—started gaining attention.

The 2000s was also the decade when aspirational India started buying more cars, and auto insurance became part of common parlance. Familiarity with health insurance for most was through the good-old schemes available to government employees, but it came in its own when Covid hit in 2020.

Over the past few years, as Covid hammered down the need for protection, both health and life insurance got a new lease of life. Coupled with the need for protection was digital innovations—again Covid forced the industry to dust off its processes and embrace digitalisation with renewed vigour. Then came a series of process changes—from digital know your customer (KYC) and online policy issuances to video-based inspections of damaged vehicles and bite-sized policies for small and immediate needs.

The Way Forward

Need-based insurance is the way forward, as the investing landscape matures and people have way more options. The other experiments in the making are based on the concepts of artificial intelligence and metaverse. It promises to open a wide range of possibilities and disrupt the way customers’ needs are predicted and experiences are enhanced, the way products are designed and supply chains are maximised. Convenience and customisation in terms of payments and services will become the buzzwords.

We explore the intersection of insurance and investment, besides giving a perspective on must-have covers. Kamlesh Rao, MD & CEO Aditya Birla Sun Life Insurance and Tapan Singhel, MD & CEO, Bajaj Allianz General Insurance, answer key life and general insurance questions, respectively.

Why Is It Important To Take Life Insurance? Which Policy Should I Buy And How Much Cover Should I Opt For?

Life insurance is a critical financial tool that provides peace of mind and financial security to both the policyholder and their dependants. One of the primary reasons why life insurance is important is its ability to offer a safety net to the family in the event of the policyholder’s untimely demise. Losing a loved one is already emotionally devastating, and during such challenging times, having the financial burden alleviated can make a significant difference.

Additionally, life insurance can help secure a family’s long-term financial goals. For instance, it can fund future education expenses for children, supplement retirement income for the surviving spouse, or even act as an inheritance for future generations. Aside from providing financial security, life insurance also offers certain tax benefits.

Additionally, life insurance can help secure a family’s long-term financial goals. For instance, it can fund future education expenses for children, supplement retirement income for the surviving spouse, or even act as an inheritance for future generations. Aside from providing financial security, life insurance also offers certain tax benefits.

A robust life insurance policy is the first brick of the consumer’s financial planning foundation. There are various types of policies that offer definite returns to fulfil financial goals, safeguard retirement plans and assure a regular stream of income even during risky times.

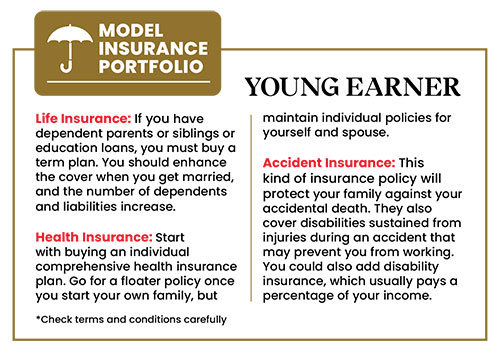

Your life insurance purchase could change depending on your life stage. The coverage depends on various factors, such as objective, income, and the needs of your dependents or any other financial obligation. However, an ideal life insurance cover should be 8-10 times of your annual salary.

Life insurers are continually innovating to provide diverse solutions. Asset allocation in unit-linked life insurance plans (Ulips) enables customers to choose multiple investment options according to their investment objective. They can invest in a mix of equities, debt, and other assets, thus offering potential growth along with the life insurance coverage.

The allure of asset allocation lies in its capacity to customise investment portfolios according to individual risk appetites and aspirations. For those inclined toward higher growth potential, allocating a portion of investments to equities can harness the volatility of the market to yield substantial returns over the long term. Conversely, a conservative investor may opt for a higher allocation in debt instruments, prioritising stability and capital preservation.

By integrating investment diversity and life insurance, policyholders can achieve a multifaceted spectrum of benefits. Not only does this approach foster potential wealth accumulation over time, but it also provides an invaluable safety net for loved ones in times of uncertainty.

Does It Make Sense To Buy Life Insurance Policies As Part Of My Investment Portfolio?

Kamlesh Rao | MD & CEO, Aditya Birla Sun Life Insurance Co. Ltd

Life insurance serves a dual purpose, offering both financial protection and a potential avenue for investment growth. The reasons for buying a life insurance policy might vary for every individual, but the objective would still remain constant—securing financial stability for ourselves and our loved ones.

Personal finance often conjures up images of high income, wealth-building, and achieving various financial goals. While investing in multibagger stocks or smart investment products can help grow wealth, one important aspect that is often overlooked is risk management. Every sound financial plan should prepare you for the worst-case scenario.

Risk management is the art of efficiently handling risks to improve the chances of achieving financial goals, no matter what the challenges arise. In the realm of portfolio planning, one of the most significant risks is death. You can navigate through various adversities while you are still alive, but it’s essential to consider how your family’s financial goals will be fulfilled if something were to happen to you.

Life insurance plays a key role in addressing this concern. It provides financial protection and support to your family in the event of your untimely demise. If you have loans or other financial commitments, life insurance can ensure that your family is not burdened with clearing the outstanding debts and can maintain their quality of life even in your absense.

Life insurance not only provides a cover, but also offers investment opportunities depending on your financial goals and risk tolerance. There are different types of life insurance plans, each with its own unique features. Some plans provide fixed returns that are tax-exempt, while others offer compounding returns that beat inflation. Additionally, some plans are linked to the stock market, and have the potential for higher returns.

Beyond investment benefits, life insurance also safeguards your family’s financial future in case you face major life disruptions such as disability or critical illness. It provides an added layer of security by assuring financial support to your loved ones if they were to lose your financial contributions.

In conclusion, while the portfolio approach involves wealth-building and goal achievement, it is equally important to consider risk management. Life insurance is a valuable financial product that not only offers investment opportunities, but also ensures your family’s financial well-being, thus providing peace of mind during both your presence and your absence. It’s vital to carefully assess your financial needs and preferences to choose the most suitable life insurance plan that aligns with your long-term objectives.

Given A Choice Between Investing And Buying An Insurance Cover, Which One Should I Give Priority To And Why?

Both investing and insurance coverage play crucial roles in achieving overall financial security and meeting long-term financial goals, and one cannot be ignored in favour of the other.

Here’s the argument for insurance coverage. Given limited surplus funds, prioritising insurance coverage is essential to protect yourself and your loved ones from unforeseen events. Life insurance provides a safety net in case of the policyholder’s untimely demise, ensuring that their family’s financial future is secured. If you have dependents or significant financial obligations, such as outstanding loans or mortgage, having life insurance coverage is critical. Life insurance can help cover outstanding debts, education expenses, daily living costs, and other essential needs in your absence, providing peace of mind to you and your loved ones.

While insurance coverage is a priority for financial protection, investing is also essential for long-term wealth building and achieving financial goals. Even with limited funds, starting early with small investment amounts can have a significant impact on wealth accumulation over time.

Investing allows you to participate in the growth of the financial markets and potentially generate returns that can help you meet specific objectives, such as retirement planning, purchasing a home, or funding education. By starting early, you can take advantage of the power of compounding, which will amplify the returns over the long term.

To strike a balance, consider a combination of term life insurance for protection and systematic investment plans (SIPs) or other disciplined investment approaches in assets, such as mutual funds to start building wealth.

Review your financial situation, goals, and risk tolerance to determine the appropriate allocation between insurance and investments. If necessary, consult a qualified financial advisor to create a personalised plan that suits your specific needs. Prioritising both aspects will contribute to a comprehensive financial strategy that will ensure your family’s financial well-being at present and secure a prosperous future.

Is it okay to just buy the mandatory auto insurance? What other components does it have and should I opt for them?

Tapan Singhel | MD & CEO, Bajaj Allianz General Insurance

A motor insurance policy, typically, consists of two components: third-party liability cover (TP) and own damage cover (OD).

The TP cover is mandated by law and is required for vehicle registration. It provides coverage to a third party in case of property damage, bodily injury, or death caused by your insured vehicle. This cover protects you from hefty fines and legal issues in case of an accident. The claim amount here is decided by the court and can be substantial sometimes.

The OD component covers the damages to your own vehicle. It includes coverage against natural calamities like floods, theft, fire, riots, and more. For example, if your vehicle gets damaged in floods, it will be covered only if you have an OD component in your insurance policy. Hence, it is always advisable to go for a comprehensive motor insurance policy that includes both TP and OD covers.

The OD component covers the damages to your own vehicle. It includes coverage against natural calamities like floods, theft, fire, riots, and more. For example, if your vehicle gets damaged in floods, it will be covered only if you have an OD component in your insurance policy. Hence, it is always advisable to go for a comprehensive motor insurance policy that includes both TP and OD covers.

Apart from these, there are add-on covers that you may consider including in your vehicle insurance policy. Some add-ons to consider are zero depreciation cover, engine protector cover, 24x7 roadside assistance and tyre safeguard, to name a few.

A zero depreciation cover eliminates the depreciation factor, which is typically applicable during a motor claim, meaning you will be reimbursed the full cost of damages without considering depreciation. It will also help in minimising your out-of-pocket expenses during claims. The engine protector cover is beneficial during situations, such as flooding, as it provides coverage against damage to the engine due to water ingression, lubricating oil leakage, and damage to the gearbox. The 24x7 roadside assistance add-on offers emergency services like changing flat tyres, jump-starting a dead battery, providing alternative travel arrangements, emergency fuel refilling, and towing facilities. The tyre safeguard add-on offers 100 per cent coverage for damages to your tyres, which can be useful if you frequently drive on poorly maintained roads.

If you have an electric vehicle (EV), a battery protection add-on is essential as the battery is a significant and expensive component of these vehicles. This insurance cover will also shield you against water damage and offer financial assistance for battery replacement cost.

But before buying a vehicle insurance cover, always compare the offerings from multiple insurers to assess what suits you best. Also remember to choose a credible insurer with a good track record in claim settlements.

As a rule of thumb, always read your policy document and ask questions to understand the exclusions and inclusions of your policy so that you can get the best for your vehicle from the policy.

I Realised The Need For A Health Cover After Covid. How Do I Choose The Best Policy? Will It Honour Claims?

First evaluate and consider your healthcare needs, budget, and coverage preferences. Choosing a policy that aligns with your specific requirements is important, given the diverse range of options available in the market today.

Buying a basic health plan at a young age is essential. Investing early ensures lower premiums and broader coverage, as age plays a significant role in premium calculation. Also, starting early allows one to serve waiting periods for specific ailments, thus ensuring comprehensive coverage later in life.

Even if you are covered by an employer’s group health plan, having an individual health cover is essential for continuous protection.

In addition to a basic health insurance plan, buying a top-up plan can be beneficial, too. Many people believe a modest sum insured is sufficient, but the reality of soaring medical costs suggests otherwise. A top-up plan complements the base policy by providing additional coverage above a specified deductible limit. Also note that aligning the top-up policy with the base plan ensures seamless coverage and financial security.

Critical illnesses have become more prevalent in India, and so, critical illness covers are a necessity. These policies, typically, pay a lump sum if the insured is diagnosed with a critical illness listed in the policy. As the list of illnesses covered varies among insurers, reviewing the coverage is very crucial. These policies are very important for individuals with immediate blood relatives who have suffered from life-threatening ailments.

A wellness rider is another valuable addition. This covers doctor and teleconsultation fees, OPD costs, investigation expenses, and preventive health check-ups. The coverage varies among insurers.

However, it is advised to practice utmost good faith when disclosing relevant information to the insurer since concealing crucial facts can lead to a claim rejection. Be honest about your medical history and current health status to harness the full benefits of health insurance, to ensure a seamless claim process.

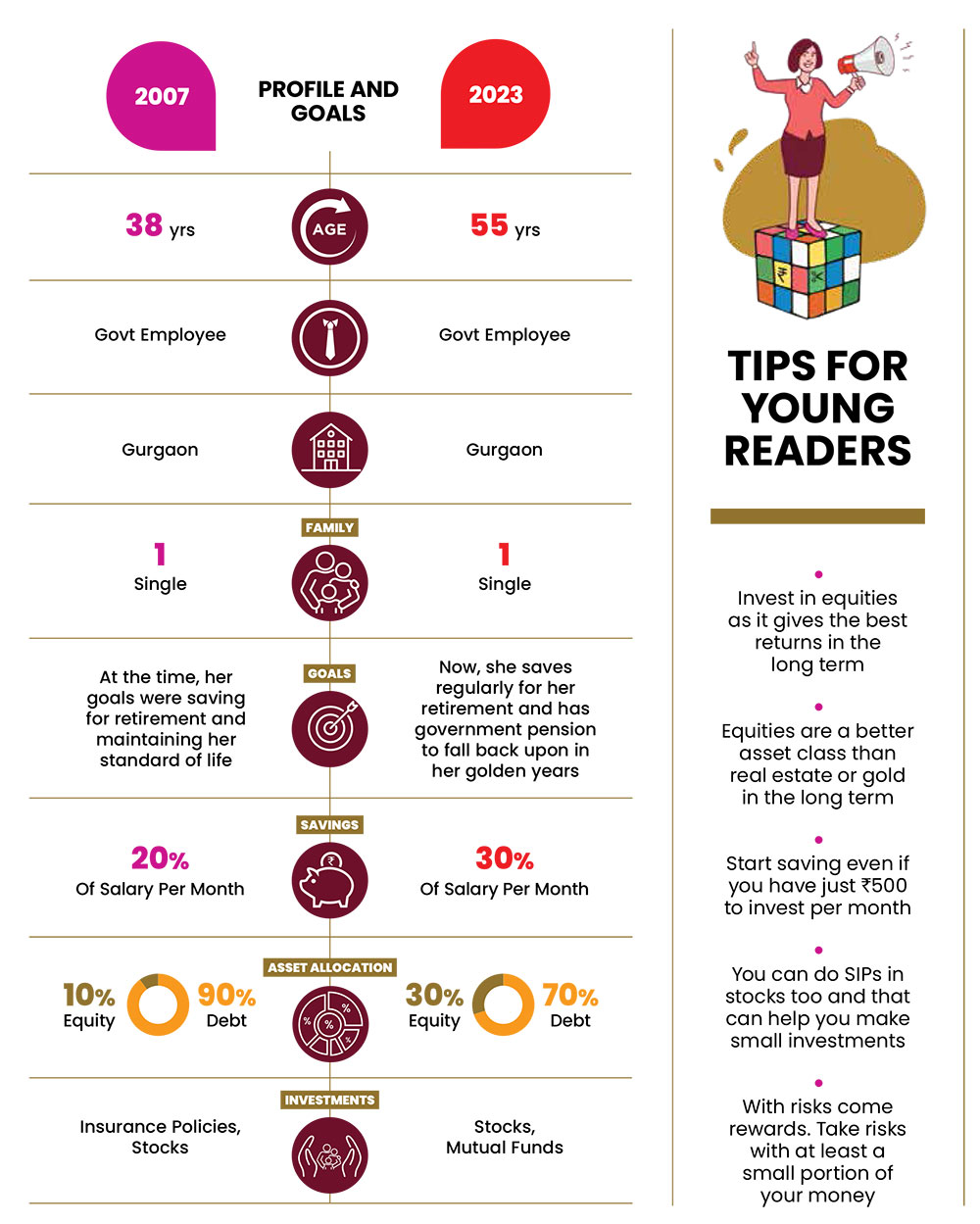

Minoti Desai in 2007 (Left) and in 2023

Then and Now

Minoti Desai

A little more than 15 years ago, Minoti Desai had a problem of plenty when it came to life insurance policies. She had several policies—a mix of endowment and unit-linked insurance plans (Ulips)—in her portfolio when she was featured in Outlook Money in September 2007. Over the years, she realised that even with so many policies, she was not on the path of making high returns. “I bought most of these policies in my 20s. At the time there weren’t enough options or awareness about other products,” says Minoti, who was a member of the Indian women’s cricket team and is now a government employee.

Over the years, she let some of her policies mature and surrendered a few; she has now stopped using insurance policies as investment products. Since she is single and her mother who lives in Indore is financially independent—she realised she does not need to buy any insurance for dependents, as she doesn’t have any.

She is now also aware how policies and investments are sold fraudulently and has come to her mother’s rescue a couple of times.

Now she invests only in stocks and mutual funds. “I realised that the returns from money-back and endowment policies are not enough to beat inflation, and changed my investing strategy. The kind of returns equities give in the long term is unparalleled,” she says.