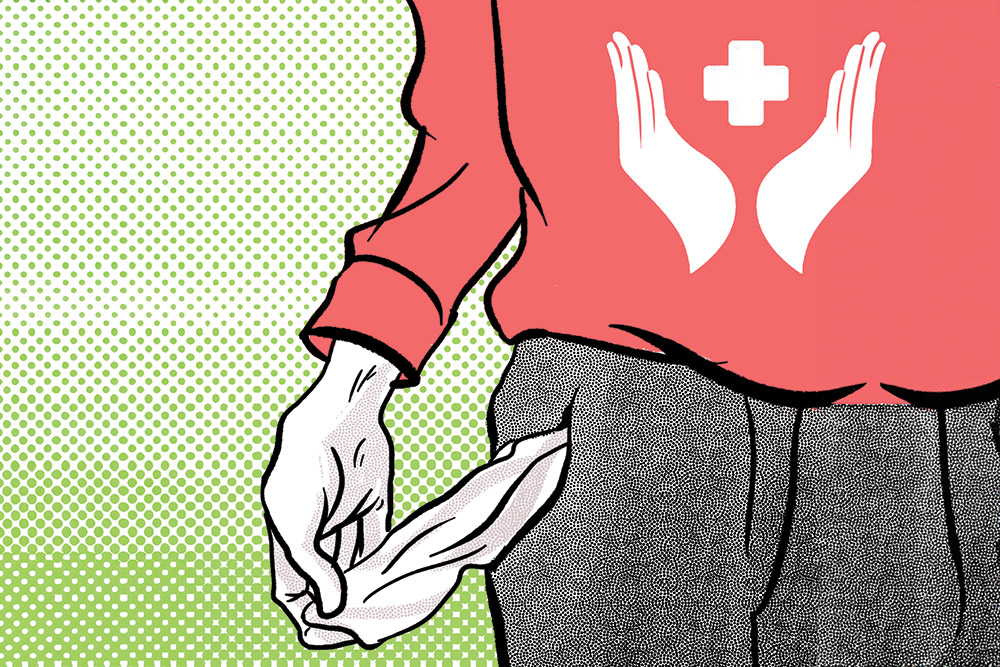

Health insurance policies cover your medical expenses, but it's important to understand that it does not necessarily eliminate all out-of-pocket costs. If someone claims that purchasing a health insurance policy will ensure no out-of-pocket expenses, it’s a red flag that the policy might be misrepresented or oversimplified.

Most health insurance policies have exclusions, deductibles, co-payments, and coverage limits that could result in out-of-pocket expenses.

Exclusions refer to specific conditions or treatments that the insurance policy does not cover, which means that any costs associated with these will have to be borne by you. Deductibles are the amount that the policyholder must pay before the insurance coverage kicks in. You may or may not opt for it depending on the policy. Co-payments are a percentage of the treatment costs that the policyholder must bear, and coverage limits are caps on the amount that your insurance policy will pay for specific treatments or services.

Many health insurance policies have sub-limits on certain expenses, such as room rent, which means that if the actual costs exceed these limits, the policyholder will need to cover the difference. It may also be applicable to newer treatments if the insurer feels a simpler procedure would be adequate for the ailment. Also, even in-network hospitals might bill patients directly for certain items, such as consumables (syringes, gloves and so on) that are typically not covered by the insurance policy.

Mahavir Chopra, founder, Beshak.org, an insurtech platform, emphasises the importance of understanding policy details. “It is important for customers to clarify from the policy wordings whether the insurer excludes any such non-medical items, which should otherwise be part of the essential services provided by a hospital.” This means that reading and understanding the fine print in your policy is crucial to avoid surprises.

Adds Chopra: “Many insurance policies include a ‘reasonable and customary charge’ clause, which protects the insurer from overcharging by hospitals.” This means that the insurer will only pay what is deemed a reasonable charge for a hospital of the same grade and locality. He adds that customers should not take the promise of 100 per cent payment at face value; instead, they should act prudently by comparing or verifying the hospital's charges with those of other hospitals.

“Consumers must recognise that while insurers may intend to cover 100 per cent of hospital bills under certain plans, this does not absolve them from the responsibility of making informed decisions when selecting treatments or hospitals,” Chopra advises.