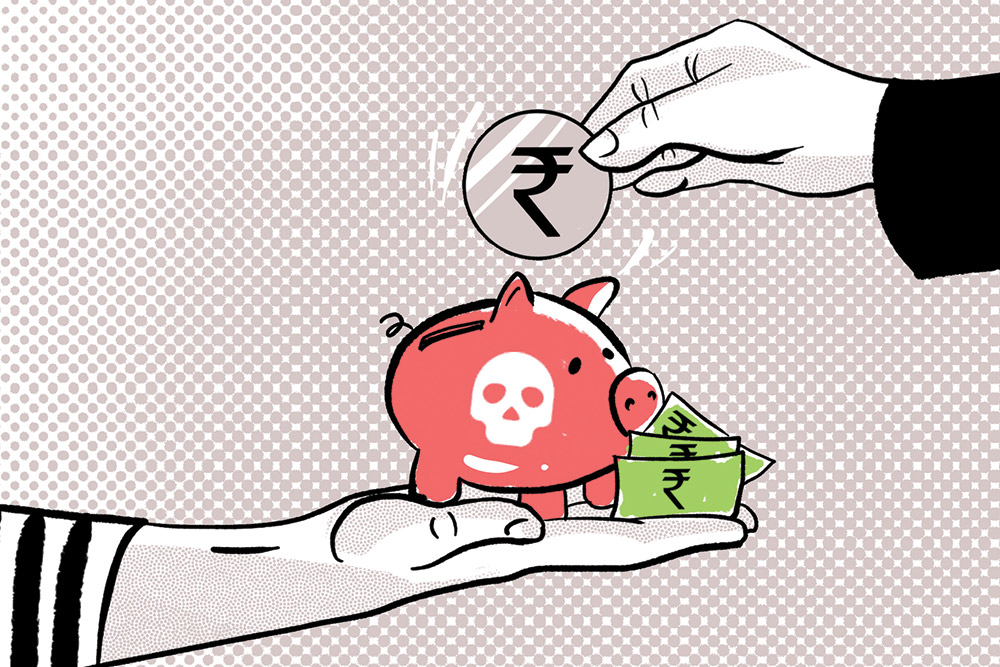

Scamsters have devised new ways to prey on victims, and one of them is to ask people to deposit money in a personal account.

For instead, it’s become common to receive online job offers that promise easy money. You may be asked to receive a certain sum in your account and transfer it out to another account after deducting a fee, which is your payment. In doing so, you end up sharing your account details, and before you realise it, you end up with financial loss. Similarly, they may ask you to deposit money in a personal account for some financial urgency.

Says Abhishek Gupta, CFA, founder and CEO, Abhiyaan Wealth, an Association of Mutual Funds In India (Amfi)-registered mutual fund distributor. “Be wary of requests to transfer your funds to personal accounts, even if presented as a means to achieve higher returns or avoid costs like goods and services tax (GST) or stamp duty. Legitimate investments rarely, if ever, require this.”

He adds that most formal investments—including mutual funds, equities, fixed income products, portfolio management service (PMS), alternative investment fund (AIF), and insurance—involve direct transfers between the investor and the company account (for example, an asset management company or broker). Advisors are required to act solely as intermediaries, never handling client funds directly.

“In rare cases where personal accounts might be involved (such as real estate or unlisted equities), extensive documentation should precede any transactions,” says Gupta.

It is important to always insist on official invoices for any fees paid to advisors or brokers. One should avoid making advance payments without proper documentation, and be cautious of requests to keep agreements verbal or informal to evade GST. Also, it is important to verify the credentials and regulatory compliance of your financial advisor or institution.

Another common example is where scamsters tell people that someone has mistakenly paid them money through Google Pay and then ask back for that money. You may also receive a fake screenshot to beguile you further. Once the victim sends the money to a given number, their accounts are compromised and money is stolen.

There could be other instances when someone may call you and ask you to deposit money to a personal account because a close relative of yours is injured in an accident and money is required to admit him or her to a hospital on an urgent basis.

So, the red flag is obvious: never send money to a personal account, unless you know that person.