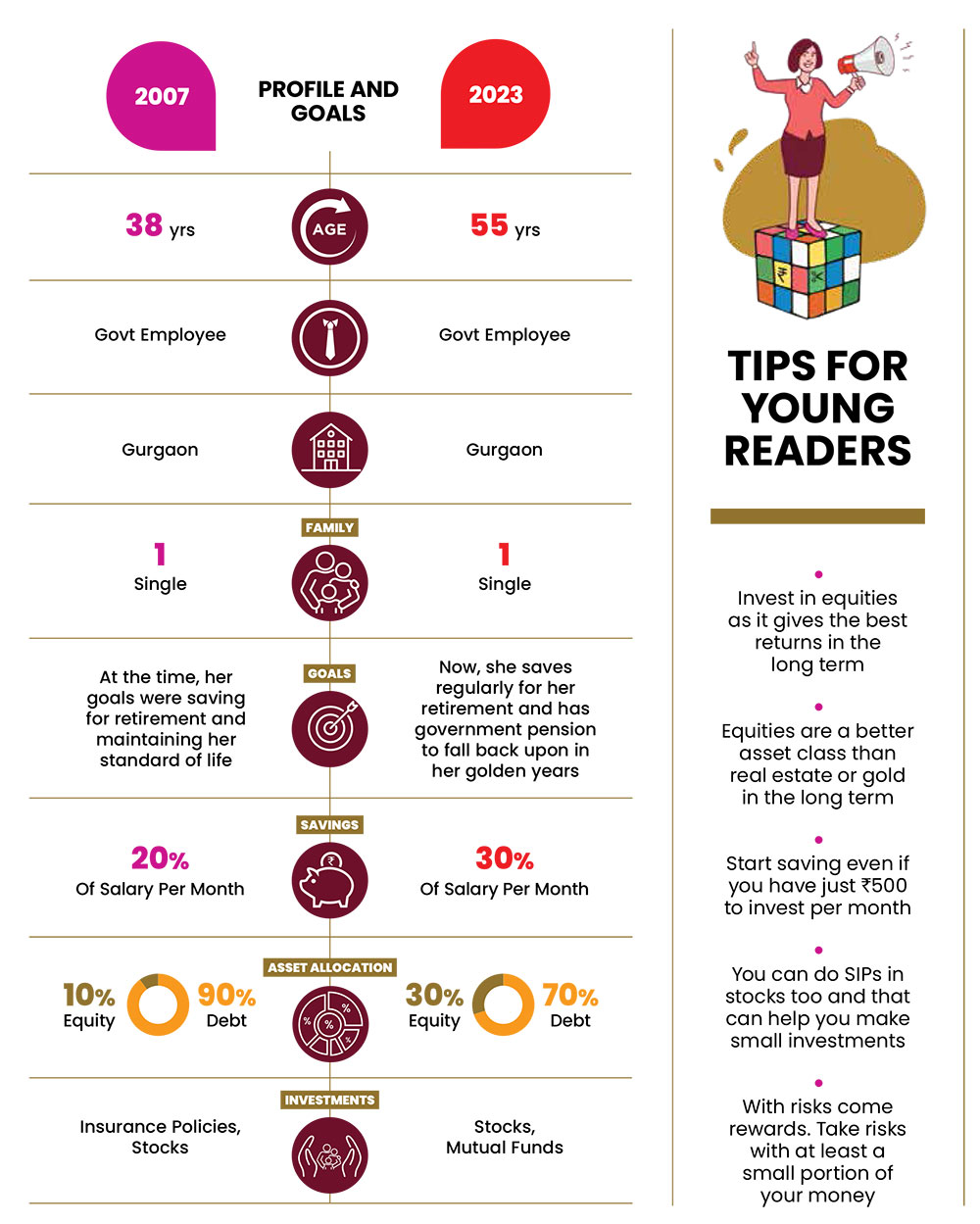

A little more than 15 years ago, Minoti Desai had a problem of plenty when it came to life insurance policies. She had several policies—a mix of endowment and unit-linked insurance plans (Ulips)—in her portfolio when she was featured in Outlook Money in September 2007. Over the years, she realised that even with so many policies, she was not on the path of making high returns. “I bought most of these policies in my 20s. At the time there weren’t enough options or awareness about other products,” says Minoti, who was a member of the Indian women’s cricket team and is now a government employee.

Over the years, she let some of her policies mature and surrendered a few; she has now stopped using insurance policies as investment products. Since she is single and her mother who lives in Indore is financially independent—she realised she does not need to buy any insurance for dependents, as she doesn’t have any.

She is now also aware how policies and investments are sold fraudulently and has come to her mother’s rescue a couple of times.

Now she invests only in stocks and mutual funds. “I realised that the returns from money-back and endowment policies are not enough to beat inflation, and changed my investing strategy. The kind of returns equities give in the long term is unparalleled,” she says.