There are various tax-saving options available in the market for those who are sticking to the old tax regime. But your best bets are the ones that find a place in your overall financial plan. We have strategies to help you choose the tax regime and the products that are right for you

Nothing is certain except death and taxes, but fortunately when it comes to the latter, there is a fair bit of planning that can be done to ease the burden.

If you are among those who have already done the calculations and decided to stay with the new tax regime, which was first proposed in 2020, you may not have much to worry about. You could simply continue with your financial plan. But if you are someone who has stayed in the new tax regime without giving it any thought—Union Minister of Finance Nirmala Sitharaman made it the default tax regime from FY2024—then you need to evaluate your options well.

If you are among those who find the old tax regime more beneficial because of the deductions and benefits it offers, you still need to plan carefully to ensure that the tax planning exercise fits into your overall investment portfolio. We give a list of the most efficient tax-saving instruments, and the rationale of investing in them.

The one that fits your needs will be the best choice for you.

Choose The Regime

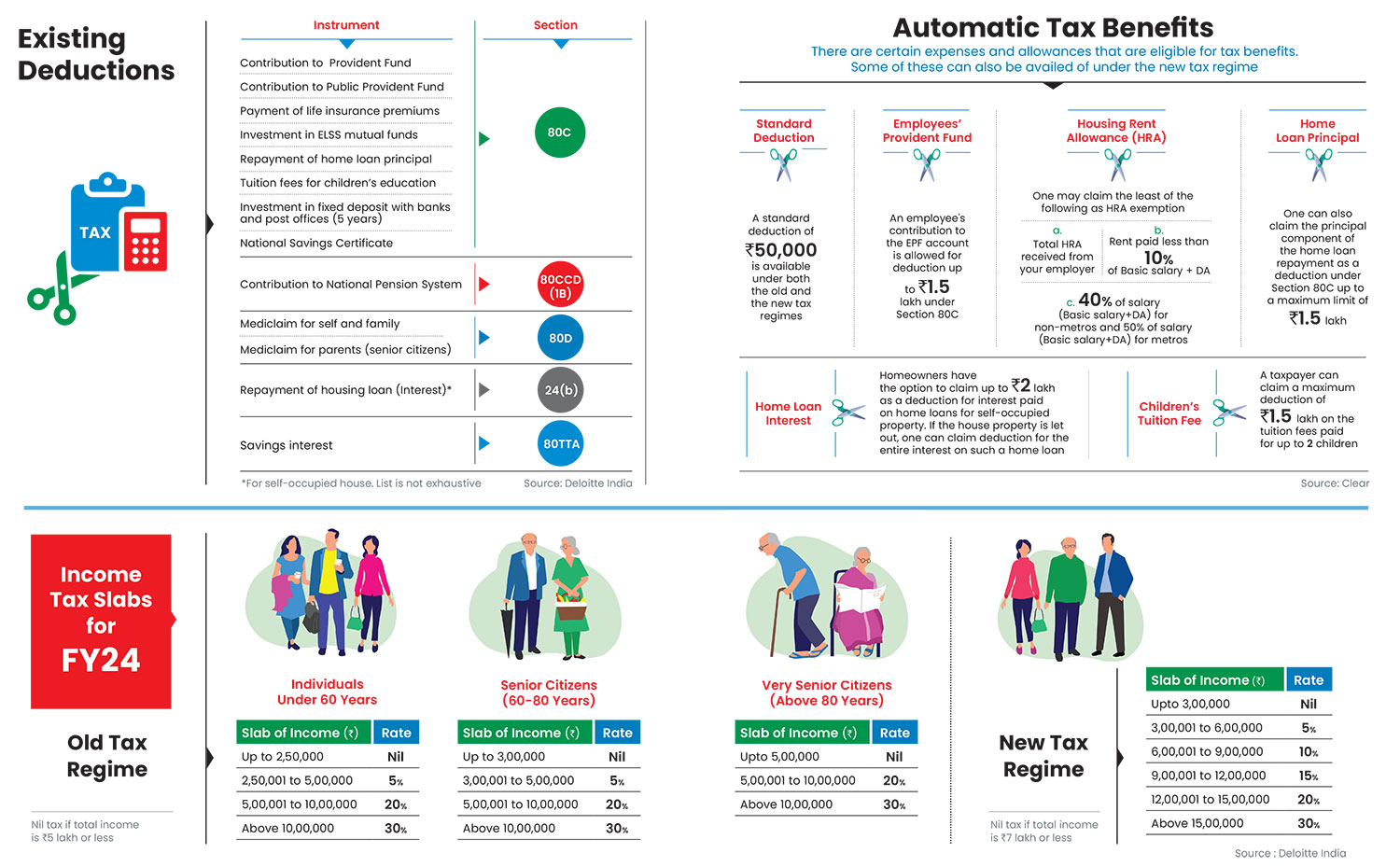

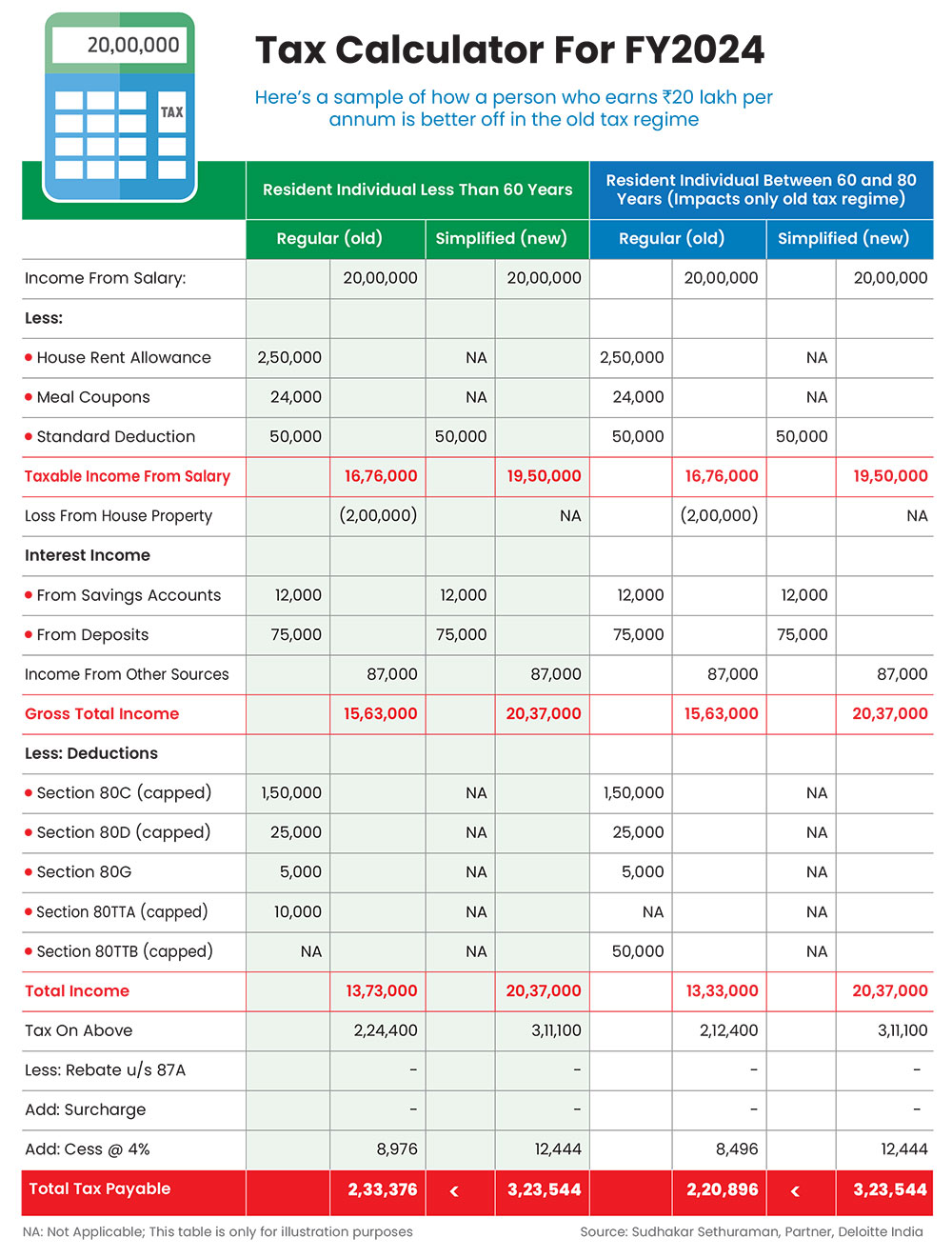

The first step to tax planning is deciding which tax regime is suitable for you if you haven’t already done so. You can only do this by comparing how much tax you are liable to pay under each of the tax regimes—new and old.

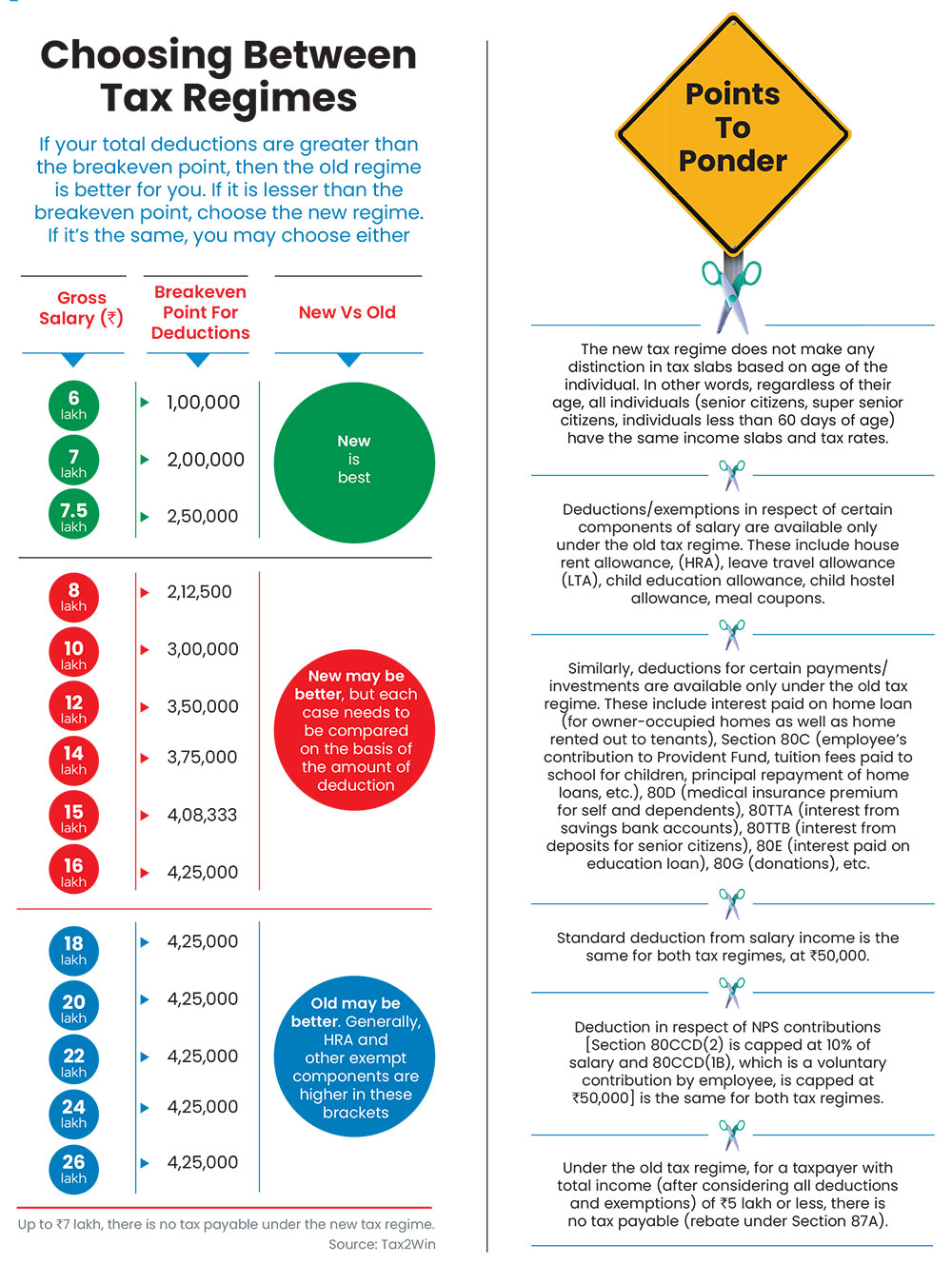

Despite the attractiveness of the new tax system after Budget 2023, the old regime remains beneficial for many. Says Abhishek Soni, CEO, Tax2Win, an income tax portal: “If your total eligible deductions and exemptions in the old regime are higher than the breakeven threshold of deductions, for your income level, then stick with the old regime. If the breakeven threshold is higher than your total eligible deductions and exemptions, the new regime may be more beneficial for you.” To figure out what works for you, see Choosing Between Tax Regimes.

You could also seek the help of the tax calculator provided by the income tax department (https://bitly.ws/3bmA3) to assess which works better for you. While making your calculations, you would need to consider two things—the deductions and exemptions you avail of and allowances, such as travel expenses and house rent allowance (HRA) that are part of your salary (see Automatic Tax Deductions).

The amount of HRA exemption is determined based on factors, such as the actual rent paid, HRA received, and the city of residence. The HRA deduction helps reduce the taxable income of an individual. The exemption is calculated as the minimum of three factors: actual HRA received, 50 per cent of the individual's salary if living in metro cities or 40 per cent for non-metro cities, and the actual rent paid minus 10 per cent of the salary.

Best Tax-Saving Options

Once you have decided to stay in the old tax regime, it’s time to choose the right avenues. But what’s right for you may not be right for another person. Therefore, understanding why you need a product and how it will fit into your portfolio is what can make the tax-saving choice right for you.

You may choose a tax-saving option for various purposes, such as creating wealth, your retirement, saving for your children, diversifying your portfolio, protecting your family against health and other uncertainties and others. Says Soni: “Many tax-saving instruments, such as equity-linked savings schemes (ELSS) or Public Provident Fund (PPF), have the potential to generate returns over time. This allows individuals to not only save taxes, but also accumulate wealth through investment growth.”

Remember that there are different deductions available under different Sections of the Income-tax Act, 1961 (see List Of Deductions For FY24).

When calculating your deductions, especially under Section 80C, don’t forget to include the Employees’ Provident Fund (EPF), the principal amount of the home loan you may have, and the tuition fees that you pay for your children. Once you take all this into account, you may realise that there’s little you need to invest in order to exhaust the 80C limit which is among the largest.

Also, if you have a home loan, the interest component will get you a separate deduction benefit of up to Rs 2 lakh under Section 24B. “While Section 80C benefits are available through various avenues, the deduction for interest payments uniquely benefits homebuyers,” adds Soni.

Do note that tax planning should be done in a way that it fits into your overall financial needs. Fortunately, there are enough instruments to help you find the one that fits your individual needs. Most importantly, always keep in mind that it’s never a good idea to invest only for the sake of saving taxes.

Equity-Linked Savings Scheme (ELSS)

Main Features: ELSS are mutual fund schemes that invest in equity-oriented instruments and come with a lock-in period of three years. You can open a systematic investment plan (SIP) in these funds.

However, remember that in this case, each instalment will come with a three-year lock-in. For instance, after three years, you will only be able to withdraw the first instalment at its current net asset value (NAV).

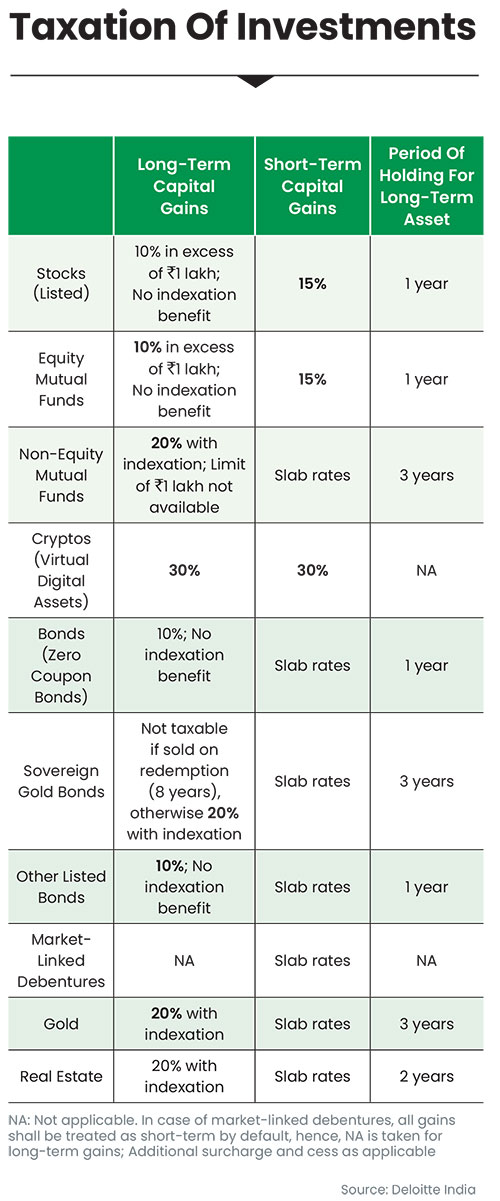

Tax Break: You can invest up to Rs 1.5 lakh in ELSS under Section 80C to claim deduction. At the time of withdrawal, the returns will be taxed as long-term capital gains (LTCG).

Rationale of Investing: Since ELSS funds invest in equity-oriented instruments, they have the potential to provide higher returns compared to traditional tax-saving instruments.

One notable advantage of ELSS is its relatively short lock-in period of three years, which offers greater liquidity than other tax savers. This aspect makes them appealing for investors seeking a balance between tax efficiency and accessibility to their funds.

ELSS can aid your wealth accumulation strategy. Because of their three-year lock-in, they help build the discipline to invest in equities for the long term.

Things To Keep In Mind: It’s crucial for investors to bear in mind the inherent risks associated with equity investments. The value of ELSS funds can fluctuate based on the prevailing market conditions, which makes them suitable for individuals with a higher risk tolerance and a long-term investment horizon.

“The return on ELSS funds vary drastically based on the type of fund and holding period. But one needs to consider the three-year average,” says Suneel Dasari, founder and CEO of EZTax.in.

In the last three years, ELSS funds have given a return of around 18.65 per cent on average.

Regular monitoring of the mutual fund's performance, understanding its investment objectives, and staying informed about market dynamics are imperative considerations for those opting for ELSS as part of their tax-saving and wealth strategy.

Public Provident Fund (PPF)

Main Features: A government-backed scheme, PPF comes with a 15-year lock-in that gives guaranteed returns. Post maturity, one has the option of extending the account in blocks of five years. The rate of return is notified by the government every quarter. At present, it gives a return of 7.1 per cent. The minimum and maximum investment allowed is Rs 500 and Rs 1.5 lakh per year, respectively. PPF allows partial withdrawal and also offers a loan facility.

Tax Break: PPF comes under the exempt-exempt-exempt (EEE) category. You can claim a deduction up to Rs 1.5 lakh annually under Section 80C. The interest earned is tax-free and so is the withdrawal.

Rationale of Investing: The lock-in of 15 years inculcates the habit of disciplined savings. PPF suits risk-averse investors who are seeking stable returns and tax advantages, but it can also be a robust element in your debt part of the portfolio. Its key benefits include capital protection, compounding of interest, and sovereign guarantee. Investors often use it for the purpose of saving for their children’s education and their retirement. All this makes it a compelling avenue for tax-saving and long-term wealth accumulation.

Things To Keep In Mind: Premature withdrawals are limited and may incur penalties. Besides, investing less than Rs 500 can lead to account deactivation, which may limit or annul some of the benefits it provides. Also keep in mind that the returns may not always be comparable with equities, as it’s primarily a debt product.

National Pension System (NPS)

Main Features: NPS is a government-backed voluntary investment scheme that is meant to help you save for retirement. For most government employees, NPS has replaced the old pension system and is mandatory, but any Indian citizen—resident, non-resident or Overseas Citizen of India—can invest in NPS. It needs to be opened by an individual and cannot be opened on behalf of others.

Tax Break: NPS is eligible for deduction up to Rs 1.5 lakh under Section 80C for non-government investors. An additional deduction of Rs 50,000 is available under Section 80CCD (1B) for investments made in the tier-I account.

Rationale of Investing: The key reason to invest in NPS is its role in long-term retirement planning. The disciplined contribution and potential market-linked returns help build a substantial corpus for retirement. NPS also offers investors the flexibility to choose investment options through its “Active” and “Auto” choice modes. In the “Active” mode, subscribers can allocate funds across asset classes, such as equity, corporate bonds, and government securities. The “Auto” mode dynamically manages the asset allocation based on the subscriber’s age, gradually shifting towards more conservative investments as retirement approaches.

Things To Keep In Mind: Investors should be mindful of the lock-in period until the age of 60, as there is limited liquidity before that.

Upon reaching the age of 60, NPS subscribers can withdraw up to 60 per cent of the corpus tax-free as lump sum, while the balance must be used for buying an annuity plan that provides a regular pension income. Recently, NPS has allowed the lump sum to be withdrawn in instalments if the subscriber so wishes.

It is crucial to regularly review and adjust the investment strategy in NPS based on one’s changing financial goals. Overall, NPS serves as an effective tax-saving tool with the added advantage of investing for a secure retirement corpus.

Sukanya Samriddhi Yojana (SSY)

Main Features: SSY is a government-backed scheme designed to encourage people to invest for daughters. The account can be opened in the name of a girl child till she attains the age of 10 years and is meant to help parents save for their education and wedding expenses. The minimum deposit is Rs 250 and the maximum Rs 1.5 lakh in a year. Only one account can be opened in the name of one girl child and a family can open a maximum of two accounts for two girl children, barring a few exceptions. The account can be transferred within India.

Tax Break: Contributions are eligible for deduction under Section 80C up to Rs 1.5 lakh annually. SSY also falls under the EEE category as the interest earned and withdrawal amount are tax-free too.

Rationale of Investing: There are few debt instruments that offer 8.2 per cent annual return. The rate is notified every quarter.

“SSY is designed for the girl child’s education and wedding and offers tax-free returns and relatively higher interest rates,” says Avinash Polepally, senior director, ClearTax.

It also comes with a sovereign guarantee, which makes it a risk-free instrument. Contributions need to be made only for 15 years, but the account continues to earn interest.

Things To Keep In Mind: Partial withdrawal from SSY—up to 50 per cent of the balance—is permissible for two reasons: wedding or higher education of the girl child. In the case of withdrawal for the child’s higher education, the account holder must be 18 years old, and she should have completed Class X.

Senior Citizen Savings Scheme (SCSS)

Main Features: SCSS is a government-backed scheme that gives guaranteed returns; the interest rate is notified by the government every quarter. The current rate is 8.2 per cent. The account is meant for senior citizens. Any individual above the age of 60 years or retired civilians in the age band of 55-60 years can open this account, subject to conditions. The rules for defence employees are slightly different. It can be opened jointly with spouse.

SCSS takes on-time deposits, between Rs 1,000 and Rs 30 lakh, in multiples of Rs 1,000. The scheme has a tenure of five years, and can be extended in multiple blocks of three years after maturity. The interest on the deposit is paid quarterly.

Tax Break: The principal amount invested in SCSS qualifies for a deduction of up to Rs 1.5 lakh under Section 80C. The interest accrued on the investment is not subject to tax deducted at source (TDS) up to Rs 50,000 in a financial year. It’s important to note that this exemption specifically applies to individuals aged 60 years or older.

Rationale Of Investing: One of the primary attractions of SCSS is the high rate of interest that is assured. Further, SCSS provides an added layer of security as it comes with sovereign guarantee. The government backing and assured returns minimise risks, offering capital protection crucial for financial security during retirement.

It is useful for seniors, as they can deposit a lump sum and get regular flow of income every quarter, which can help them meet their regular expenses. It has a flexible tenure as you can close the account after one year of opening or extend the account in a block of three years within one year of its maturity.

Things To Keep In Mind: The maximum investment limit is capped at Rs 30 lakh per account. Premature withdrawal attracts penalties. Also, SCSS does not offer any loan facility.

The interest is payable quarterly and not every month. Moreover, if you do not claim the interest at the end of every quarter, it will remain in the account, but will not earn any interest. If the interest amount exceeds Rs 50,000, it is fully taxable in the hands of the subscriber.

Term Insurance

Main Features: This is the simplest form of insurance that gives you adequate cover at a lower cost than other insurance policies. You don’t get any payout at the end of the insurance term as it just covers the mortality risk. Some term insurance

plans also come with riders, such as waiver of premium, disability cover and so on.

Tax Break: The premium paid towards term insurance is deductible up to Rs 1.5 lakh under Section 80C. Deduction is restricted to 20 per cent of the sum assured for term insurance policies issued on or before March 31, 2012, and 10 per cent in case of policies issued on or after April 1, 2012.

Rationale of Investing: Term insurance in the cheapest way to cover your life and protect your family. Think of it as a car insurance, which does not give any return, but pays up the claim when the situation so arises. It is a must-have for everyone who has dependents, including spouse, children, dependent parents or others. You can simply discontinue the policy once you feel your dependents can support themselves.

Things To Keep In Mind: Do keep in mind that term insurance is not meant as an investment, but is purely meant for protection. Check the claims settlement ratio of companies before choosing one. If you are considering to add a rider to your term insurance, look at the costs that get added to the premium before opting for one or more. Also, assess how useful these riders will be for you.

Unit-Linked Insurance Plans (Ulips)

Main Features: Ulips offer a unique combination of life insurance and investment opportunities. One of the main features is the dual benefit, where policyholders can enjoy life insurance coverage while the invested portion has the potential to grow with the market and give inflation beating returns. The investment choices cater to different risk appetites, letting you invest in equity, debt, and balanced funds.

For instance, as a low-risk investor, one has the option to allocate funds solely into debt-based investments or go for an optimal blend of equity and debt, based on the risk tolerance.

Tax Break: Premiums up to Rs 1.5 lakh are eligible for deduction under Section 80C. Further, the maturity proceeds are tax-free under Section 10(10D) if specific conditions are met. For policies issued on or after February 1, 2021, the combined annual premium, whether from a single policy or multiple policies, must not exceed Rs 2.5 lakh in any given year throughout the Ulip’s tenure to qualify for the Section 10(10D) exemption.

Rationale Behind Investing: Ulips are meant for long-term wealth creation, thanks to the market exposure, topped with some amount of life cover. It is also a flexible instrument that allows one to effortlessly switch between equity and debt investing options without any tax incidence.

Things To Keep In Mind: Potential investors should be mindful of the charges in Ulips, such as fund management fees, mortality charges, and surrender charges. These charges can eat into your overall returns.

Also, the life cover you get may not be commensurate with your needs and the premium, as compared to a term insurance plan that only covers mortality risks.

Since Ulips are market-linked, you should also be prepared for market fluctuations in returns. Look at the return illustrations carefully.

Health Insurance

Main Features: Health insurance policies, typically, cover the expenses of hospitalisation at specified hospitals for specified diseases. Some come with riders that provide additional coverage, while some provide cover for outpatient consultations that do not involve hospitalisation. Over the years, health insurance coverage has become wider and offers many options to customers.

Tax Break: Health insurance premiums are eligible for deduction under Section 80D up to Rs 25,000 for self, spouse and dependent children. An additional deduction of up to Rs 25,000 is available for parents aged below 60 years of age, and up to Rs 50,000 if they are senior citizens.

Says Polepally: “Individuals can claim a maximum deduction of up to Rs 75,000 including premium for self, spouse, dependent children and dependent parents above 60 years of age. If they are themselves senior citizens, they can claim a maximum deduction of Rs 1 lakh for premium for self, spouse, dependent children and dependent parents aged above 60 years of age.”

Rationale of Investing: This tax-saving provision provides a tangible financial benefit by reducing the taxable income. As healthcare costs rise, leveraging Section 80D is a prudent strategy for comprehensive health protection. An adequate health insurance will ensure your investment corpus doesn’t take a hit in case of a medical emergency.

Things To Keep In Mind: These plans usually come with certain terms and conditions and should, therefore, be reviewed carefully to assess the coverage. For instance, if you have a pre-existing disease, your policy may not cover it. Similarly, there may be sub-limits on the amount paid on the room rent that may affect your claim amount under the policy.