When Bengaluru-based registered investment advisor (RIA) Saurabh Bansal read about capital markets regulator Securities and Exchange Board of India’s (Sebi’s) intent to separate the advisory business from distribution in 2013, he decided to hold the advisory umbrella. He applied for the RIA licence.

“RIA regulations first came in 2013, which stipulated net worth requirement for body corporate (includes a private company, public company, one personal company, small company, limited liability partnerships, foreign company etc.) at Rs 5 lakh. By the time our application got approved, the net worth criterion was raised to Rs 25 lakh. The application fee was raised, too,” says Bansal. He reached out to the Sebi office in Bengaluru. “They informed that Sebi had done it across financial institutions, and RIAs couldn’t have been an exception,” he adds. Bansal was not in a position to arrange Rs 25 lakh at the time, and so, reapplied to seek a licence under proprietorship which he holds till date. A proprietorship or an individual licence holder can only onboard 150 clients, while there is no such cap on a corporate licence holder.

Migrating to a corporate licence scares him owing to the frequent changes in compliance. “It’s easier to drive on high gear when the road ahead is visible. Now, we are stuck in a traffic and trudging on first gear,” he says.

The Challenges

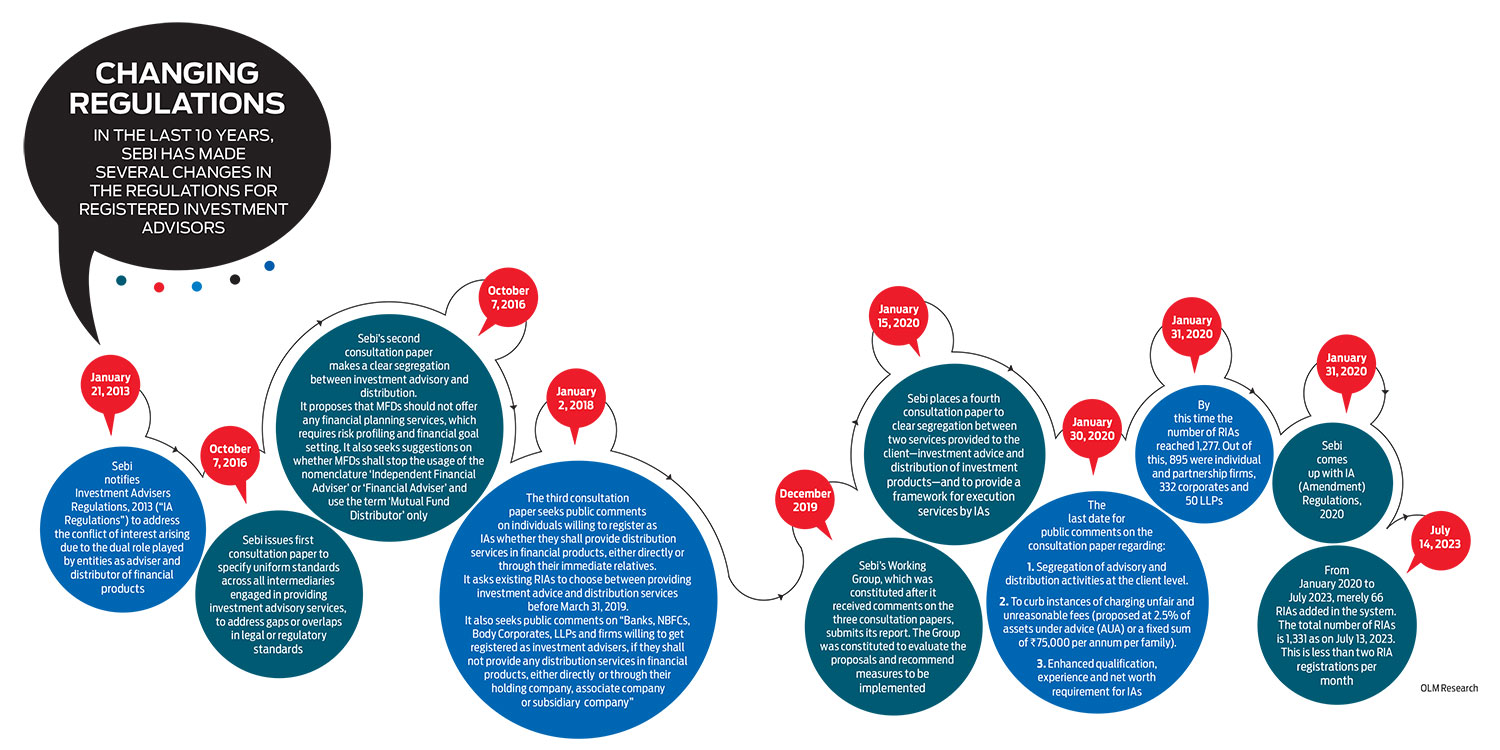

Over the last 10 years, Sebi has introduced several changes in the regulations for advisors. The first RIA regulations came in 2013. Sebi issued three consultation papers between 2016 and 2018 followed by a bunch of amendments in 2020. The years ahead greeted RIAs with more amendments, frameworks, and guidelines.

These changes have led to tighter entry barriers and draconian compliance burden, forcing some RIAs to surrender their licences. The number of advisors has inched up to just 1,331 as on July 13, 2023, even as a decade has gone by since the regulations first came in. This clearly shows less interest of finance professionals to opt for the RIA profession.

The Entry Challenge: The eligibility criterion for an aspiring RIA licence holder has become a challenge, given the new amended circular which came in force in 2020. Previously, any graduate with five years of experience could apply for the licence. Now one must have a graduate degree or post graduate diploma (minimum two years in duration) in finance, accountancy, business management, among others, along with work experience. Even people associated with investment advice (PAA), who usually constitute RIAs’ teams, must have a post-graduate degree in finance. Both RIAs and PAAs will have to sit for NISM exams after every three years, even if they have continuing professional education (CPE) points, which are not considered for renewing the RIA licence. CPE points accrue for professionals such as CFPs and CFAs, who need to get their certificates renewed every year.

Says Bansal: “It is understandable that Sebi wants to keep the bar high, but it should not be so high that the business becomes unsustainable. Hiring has become a major challenge because people having masters in finance will always have better opportunities elsewhere. We cannot offer them competitive salaries.”

Execution challenge: As RIAs work on a multi-asset model, the execution is also a challenge. Earlier, a lot of RIAs took the services of multi-asset platforms to consolidate their operations at one place. Notably, many RIAs took the services of iFAST India Holdings to execute financial plans on behalf of clients and collect fees, along with keeping track of audits and other compliance matters. In July 2022, the company’s Singapore-based parent firm, iFAST Corporation, shut its India operations after Sebi barred the usage of pool accounts for mutual fund transactions. Sebi’s regulation came in the wake of the Karvy episode in which the broker had misused investors’ funds. The RIA fraternity turned out to be a collateral damage.

“Advice cannot exist in isolation. iFast gave us an ecosystem to ensure advice rendered could be executed and fees could be collected seamlessly. Their exit disrupted our business. It was a very painful transition, as execution of different investments (MFs, stocks, global etc) existed only in separate silos outside iFast. Fee collection became another major challenge. I couldn’t sleep for many nights,” says Bansal.

Advertisement Approval: In April 2023, Sebi came out with the Advertisement Code for RIAs and Research Analysts (RAs). This code has added another challenge for RIAs. The code seems to suggest that the advice given to clients or the information on one’s website could be considered an ad for which approval from the regulator will be needed. “The advertising code is very loosely defined. Some clarifications did come, but it is still confusing,” says Keval Bhanushali, co-founder and CEO, 1 Finance, a Sebi-registered corporate RIA.

This regulation came in the wake of misuse of RIA services. Some Indore-based brokers took an RIA licence and started giving stock tips in the name of financial advice. The trouble is the regulations seem to have been framed keeping them in mind. There are three kinds of RIAs at present—the ones who provide comprehensive financial advice across asset classes, execution-only online platforms (EOPs) such as Kuvera, Groww, and those who are into stock advisory. The third category has mostly misused the licence.

Now, there is growing demand from RIAs to segregate the regulation for RIAs and RAs. “We seek separate licence and regulations for RIAs as they are different from RAs. The latter are solely into stock advisory and not holistic financial planning. We have done no harm to be on the wrong side of the law. The fledgling RIA community needs Sebi’s support to spread the financial advisory business,” says Bhanushali.

What Lies In The Future?

Vivek Rege, founder and CEO, V R Wealth Advisors, a Sebi-registered corporate RIA, says the regulator is aware of problems that RIAs are facing. “They know that the 150-client cap for individual RIAs, the net-worth requirement of Rs 50 lakh, the re-certification requirement, the fixed fee cap, the eligibility criteria, among others, have hindered the growth of the RIA profession. But a piecemeal approach to change an Act of Parliament won’t work. We need to wait for a holistic solution in due course,” says Rege.

Sebi has already introduced a framework for EOPs that says they can either obtain registration as an agent of asset management companies (AMCs) or an agent of an investor registered as a stock broker.

RIAs who are into comprehensive financial planning are patiently hoping for a better future.

letters@outlookmoney.com