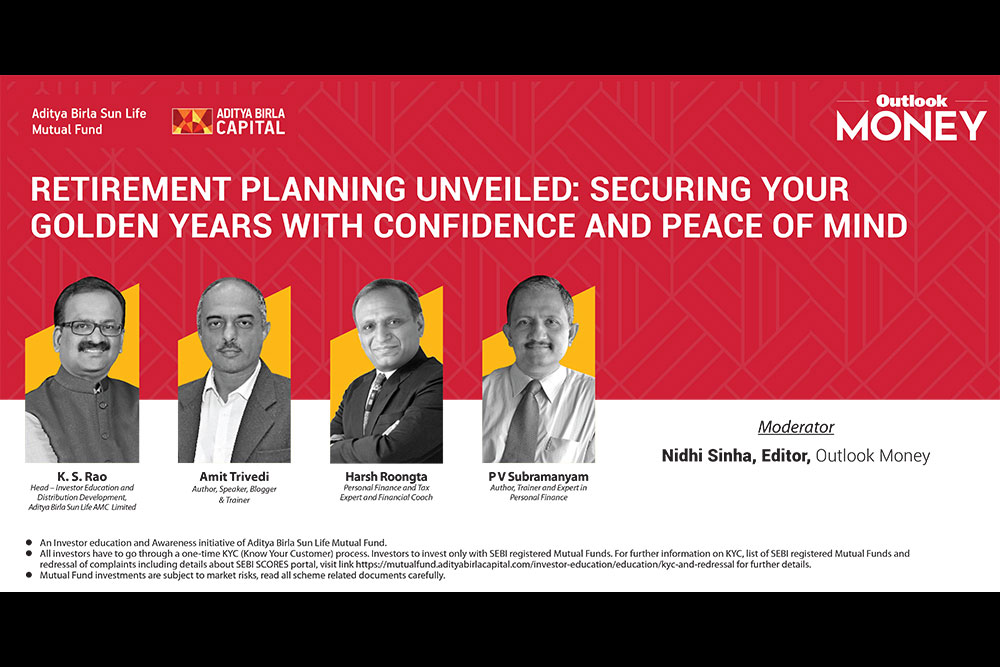

It is estimated that the number of retired people is going to steadily increase over the years and, therefore, it is important for people to start investing early for their retirement. A recent panel discussion by Outlook Money in association with Aditya Birla Sun Life Mutual Fund focused on this key issue. The topic was: “Retirement Planning: How To Secure Your Golden Years?”. The guests included K.S. Rao, head of investor education and distribution development at Aditya Birla Sun Life AMC; Amit Trivedi, author, speaker, blogger, and trainer; P.V. Subramanyam, chartered account, author and trainer; and Harsh Roongta, a personal finance and tax expert. The discussion was moderated by Nidhi Sinha, editor, Outlook Money. Here are some edited excerpts from the discussion.

What are the basic things to keep in mind when planning for retirement?

Rao: Five aspects are vital to keep in mind: How much money does one need? How long should it last? How should it end up? How much return to target? How much risk to take?

For the fourth aspect, it is vital to consider inflation. It’s not an easy task, but if these aspects are adequately addressed, one would have a sound retirement plan. But sometimes, instead of planning early, people realise it late. If that happens, they can increase their contributions to provident funds or mutual fund systematic investment plans (SIPs). They must also consider minimising expenses or going for gainful engagement. So, early planning reduces the risks significantly and allows them a lifestyle of their choice, or else, a lifestyle of their corpus’s choice.

How does one decide whether they are saving enough?

Trivedi: It depends on several factors, like how much money the person can comfortably part with for retirement, the age at retirement, and longevity, the most difficult to predict. The individual must also consider how much money will be needed in the first year of retirement and if there are any other financial goals that one might have to fund during retirement. One might also want to travel or do charity work. So, the corpus fund will depend on the goals. The best thing to do is to write down the goals and assign an amount for each purpose. Then, it is also essential to consider the expected inflation during the retirement years. But all these actions should happen in the pre-retirement age to build a sound corpus fund.

What role can a financial advisor play in planning?

Roongta: Unfortunately, most people never prioritise their goals. Retirement often is the last priority. But early retirement planning is vital for every milestone in life, for instance, a child’s education, marriage, etc. If the advisor does that “trade-off”, explaining where the money is being spent, the client can make a much more rational decision. Moreover, people, mostly the young generation, look at absolute amounts, say, Rs 1 crore, but that significant sum may appear minuscule at retirement. So planning is vital because it gives a sense of moving in the right direction and confidence to overcome setbacks.

What strategies will work if the individual hasn’t saved sufficiently and realises it late?

Subramanyam: There is no excuse for not saving for old age. Of course, one can do training or take up counselling jobs. But this will work only up to a certain age, and they will have to depend on their children. It will be far worse if there are no children. Alternatively, if they own a house in a city, they can sell it and move to a cheap neighbourhood or village where they can sustain themselves from the property sale proceeds.