Industry Came Of Age During Covid Pandemic

Insurance companies must keep customers at the centre of their product designs and utilise new technology to meet their evolving expectations, said industry experts at a panel discussion, “New-Age Disruptors”, at the 3rd edition of the Outlook Money Insurance Summit.

The experts in the panel were Kamlesh Rao, MD and CEO, Aditya Birla Sunlife Insurance; Mahesh Kumar Sharma, MD and CEO, SBI Life Insurance; N.S. Kannan, CEO, ICICI Prudential Life Insurance; and Vibha Padalkar, MD and CEO, HDFC Life Insurance. Nidhi Sinha, editor, Outlook Money , moderated the session.

Padalkar said technology should be integrated into every aspect of the business, from product design to customer journey to risk management. She highlighted the use of virtual avatars and artificial intelligence (AI) for underwriting and customer queries.

“The ultimate goal is to make insurance accessible and seamless for customers, while also preventing unwanted behaviour and ensuring that honest customers are not disadvantaged. From virtual avatars to AI and machine learning (ML)-driven customer service, we are using the latest tech to provide seamless experiences,” said Padalkar.

Kannan said the digital technology ecosystem has evolved so much that customers expect the same level of service and ease of use in all categories, including insurance. Kannan suggested two key things: constant internal disruption of traditional practices and external collaboration to address these.

“Customer expectations have changed hugely. So, there are huge expectations on how we want to behave in terms of product design, and sales,” said Kannan.

Sharma highlighted that while there have been many product innovations in the insurance industry, traditional regulations have often limited creativity and innovation. However, new regulations indicate a shift towards a more principle-based approach that encourages creativity and customisation, which is a positive for the industry.

“It is a step in the direction of customising products, making products more suited to individuals and pitching these to them,” added Sharma.

Rao said the the life insurance industry came of age in terms of processing and handling claims during the Covid pandemic. The industry grew at 10-15 per cent year-on-year in the last two years, he said.

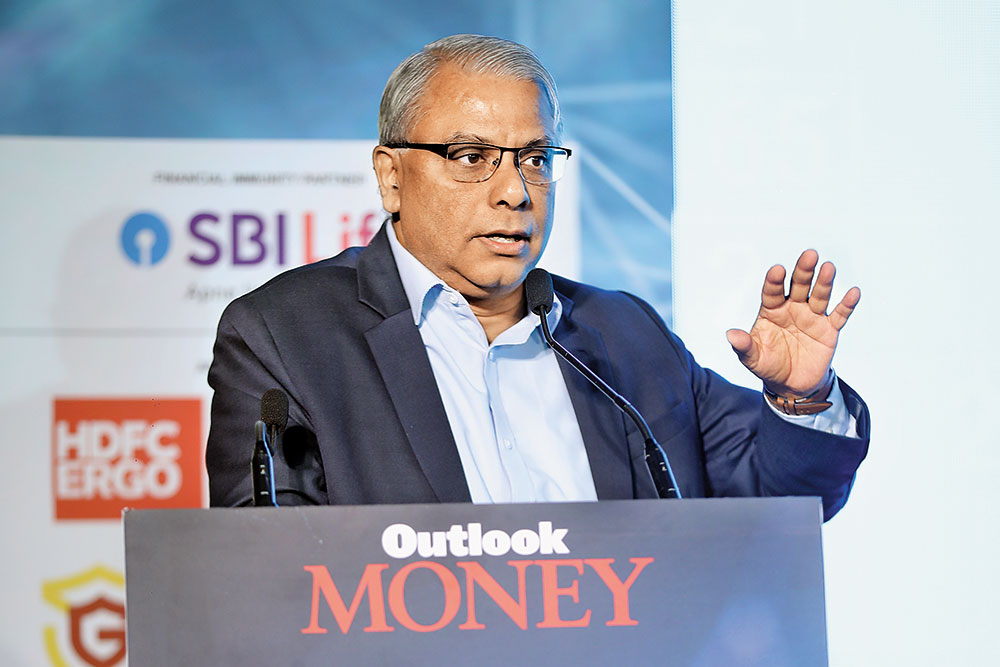

Arijit Basu, Non-Executive Director, Prudential Plc

India Lagging In Digital Adoption

Technology has been the main agent of change in the life insurance industry, revolutionising the way we do business, but we must also focus on making life simpler for our internal and distribution workforce, Arijit Basu, non-executive director at Prudential Plc, said at the Outlook Money Insurance Summit.

He said digital adoption in India is still lagging behind other countries.

“China has an adoption rate of 80-90 per cent, Brazil has 55-60 per cent, while India is only at 20-30 per cent. Even though India has 800 million mobile phones, it still lags behind in digital adoption. For instance, only 5 per cent of the population uses debit or credit cards, and only 1 per cent uses mobile or Internet transactions,” he said in his speech.

He said there was a significant gap between the current coverage and the actual needs of the country. “In the insurance industry, the state-owned Life Insurance Corporation (LIC) of India is still the dominant player, accounting for more than 50 per cent of the market share in terms of premiums. Private players have not been able to match that outreach. While there has been proactive regulatory intervention in the industry, there is still a significant gap,” he said.

He added that “the upcoming insurance amendment in Parliament is expected to open up new opportunities, but addressing the issue of governance and coverage in top metros and tier II and tier three III will be crucial.”

Shubhra Goel, Managing Director and Insurance Lead, Accenture

Metaverse Has Huge Potential In Insurance

The role of Web 3.0 and metaverse would be crucial for the insurance industry, Shubhra Goel, managing director and insurance lead, Accenture, said in her presentation on “Web 3.0 & Metaverse: Broadening Boundaries”.

Goel spoke about the evolution of the Internet and how it is moving beyond ‘browsing’ to ‘participating and inhabiting’ in a shared experience through metaverse.

Metaverse is gaining traction globally, with expected revenue likely to grow from $180 billion in 2021 to $800 billion in 2024, she cited data to highlight the point. Companies across industries are experimenting in the metaverse—from gaming, travel and tourism, fashion, automobiles, to learning and healthcare.

She said such growth also meant there are risks involved, such as of accidental loss due to network issues, service outages; financial fraud through illegal fundraising or other illicit activities with cryptocurrency; hacking to steal virtual assets; IP theft; physical and mental harm through online harassment, trolling; and breach of privacy.

She said metaverse has huge potential in insurance—from payments to customer and employee experiences, product design, supply chain, relationship management, verifications, virtual support, settlement and claims, and security and transparency. Insurance on the blockchain has an $8 trillion market opportunity, she said.

(Left) K.V. Dipu, Senior President, Bajaj Allianz General Insurance, and Kundan Kishore, Deputy Editor, Outlook Money

Need To Sync Data With Apt Scenarios

Areas with high customer friction provide ample opportunities for innovation. An example of this would be the ride-sharing apps that solved the problem of booking taxis, said K.V. Dipu, senior president, Bajaj Allianz General Insurance, in his talk at the Outlook Money Insurance Summit.

He said that when it came to deploying AI, he always looked for areas of friction in use-case scenarios. An example of this would be during the Covid pandemic when they deployed AI in health insurance to ensure uninterrupted servicing in the form of digital examinations through telemedicine.

He also emphasised on the importance of understanding data and applying it to the right use case scenario to ensure rapid scaling up by way of developing and creating innovative and specialised products that cater to customer needs.

These could include user-based plans, bite-sized products, sub-products, for a select sets of customers.

Additionally, there could also be models of products where customers can pick and choose what they want, thus giving them complete flexibility and control over their choice, he said.

He added that as we move towards digital interactions, cyber insurance will be the new frontier.

Left to Right: Ritesh Kumar, MD and CEO, HDFC Ergo General Insurance Mayank Bathwal, MD and CEO, Aditya Birla Health Insurance Bhargav Dasgupta, MD and CEO, ICICI Lombard General Insurance, and Nidhi Sinha, Editor, Outlook Money

Innovation Underway, But A Lot Still Needs To Be Done

The general insurance industry has undertaken many innovations in the past few years to enhance customer experience, but customers are asking for more, said experts at a panel discussion, “Reinventing Experiences”, at the Outlook Money Insurance Summit.

The experts in the panel were Bhargav Dasgupta, MD and CEO, ICICI Lombard General Insurance; Mayank Bathwal, MD and CEO, Aditya Birla Health Insurance; and Ritesh Kumar, MD and CEO, HDFC Ergo General Insurance. The session was moderated by Nidhi Sinha, editor, Outlook Money.

Dasgupta discussed how the industry is focused on improving customer experience in various sectors, including motor, health, and commercial insurance. He gave examples of how they have transformed the claims process using techniques such as virtual claim services, AI/ML engines, and IoT devices.

“Our aim is to not only be a partner for policy and risk transfer, but also to be a partner in risk management and mitigation through the use of analytics and other tools,” he said.

Their focus is on providing a seamless and efficient experience for their customers, he said.

Bathwal said that during the Covid pandemic, there was a significant increase in the demand for health insurance due to heightened awareness of the possibility of a health event affecting anyone. He emphasised the need for the industry to leverage this increased awareness to ensure that health insurance continues to be seen as a relevant product even post-Covid.

“The impact of Covid on consumer behaviour is clear. Priorities have shifted towards travel and leisure, while essential decisions like health insurance are being postponed. As we navigate this new reality, opportunities arise to re-evaluate our products and services,” said Bathwal.

Kumar said the recent developments will lead to higher penetration, and some early successes are already evident. There is a national goal to achieve insurance for all by 2047, India’s 100th year of Independence, and there are three key pillars to achieve this, he said. One of them is awareness, which requires reaching even the smallest sections of society through advertising.

He also highlighted the issue of fraud in the industry, adding that effective measures can be taken to minimise it.

R. Arunachalam, President, Institute Of Actuaries Of India

Industry Not Geared To Tackle Climate Issues

Climate change can cause irreversible ecological damage and disrupt the economy and lead to food insecurity, R. Arunachalam, president, Institute of Actuaries of India, said in his talk on “Risk Management Amid Climate Change”.

These can also have a negative impact on people’s health and mortality. The main risk people face as a result of climate change are loss of lives, livelihood and habitat, and disruption of critical infrastructure.

Health-related risks include heat-related mortality, and vector- and water-borne diseases.

The insurance industry can step in to offer risk management by bifurcating between unavoidable and avoidable risks and by encouraging prevention and preparedness.

This would, of course require, governance and policy changes along with increased assistance and collaboration from various stakeholders, he said. Other key stakeholders in this process can be the civil society, the private sector, institutions, intergovernmental organisations, local authorities, and citizens themselves.

He said the insurance industry as a whole will require granular and forward-looking measurement methodologies to identify the gaps in data and risk classification methods. It’s a challenge to translate climate risk into robustly quantifiable financial risks. Though there are some models that are being applied in some areas in this regard, a lot stilll needs to be done, he added.

Prakash Viswanathan, Founder and CEO, Gradatim

Tech Can Help Scale Up Processes

Technology is emerging as the new player, and leveraging it efficiently is the key to deriving the right results, said Prakash Viswanathan, founder and CEO, Gradatim in his talk on “Leveraging Tech”.

He said the insurance industry has shown resilience in a rapidly changing post-corona world. The industry embraced digitalisation, AI and analytics, mobility, and innovation in distribution. “Most insurers have stable operations and have managed to expand their processes and customer journeys,” he said.

Now, the industry would need to create a future-proof foundation that is flexible and scalable and one that speed-releases insurance products. This can be done on the back of modular technology that is secure and flexible, he said.

Some of the simple things that the industry needs to scale up is end-to-end automation, cloud, modular platform, and data ubiquity. “Investing at scale is the single-most important factor that will reduce your cost of operations,” he said.

Another factor that can help scale up is expanding the size of the role you plan to play in the customer’s life. That can happen by investing more in the development of digital and analytics, and a strong infrastructure backbone. Technology can be leveraged to scale pricing, he added.