Insurance has been part of the financial lexicon for years now. What has changed to some extent, though, is how it perceives insurance.

Most of us saw our parents using life insurance policies as the only investment and savings tool, other than fixed deposits (FD), to fund education, weddings and other needs of the family. Then we bought or were made to buy our own set of similar insurance policies once we entered the workforce.

The first big change in how we perceived insurance—still largely as an investment, though—was when unit-linked insurance plans (Ulips) came in the mid-2000s. They promised market-linked returns, and the exuberance at the time, coupled with investors’ trust in older insurance institutions, gave a leg up to these. But soon enough, people realised that these products were heavily front-loaded and agents were promising unreal returns. The 2008 crisis brought home the fact that markets were not always friendly and could erode both money as well as trust. People started going back to traditional policies.

But as markets recovered and mutual funds became a new and viable investing option for people, term insurance—the simplest and cheapest form of insurance that is meant for pure protection with no investment component—started gaining attention.

The 2000s was also the decade when aspirational India started buying more cars, and auto insurance became part of common parlance. Familiarity with health insurance for most was through the good-old schemes available to government employees, but it came on its own when Covid hit in 2020.

Over the past few years, as Covid hammered down the need for protection, both health and life insurance got a new lease of life. Coupled with the need for protection was digital innovations—again Covid forced the industry to dust off its processes and embrace digitalisation with renewed vigour. Then came a series of process changes—from digital know your customer (KYC) and online policy issuances to video-based inspections of damaged vehicles and bite-sized policies for small and immediate needs.

The Way Forward

Need-based insurance is the way forward as the investing landscape matures and people have way more options. The other experiments in the making are based on the concepts of artificial intelligence and metaverse. It promises to open a wide range of possibilities and disrupt the way customers’ needs are predicted, and experiences are enhanced, the way products are designed and supply chains are maximised. Convenience and customisation in terms of payments and services will become the buzzwords.

Then and Now

Minoti Desai

Photo: Nilotpal Baruah; Vikram Sharma

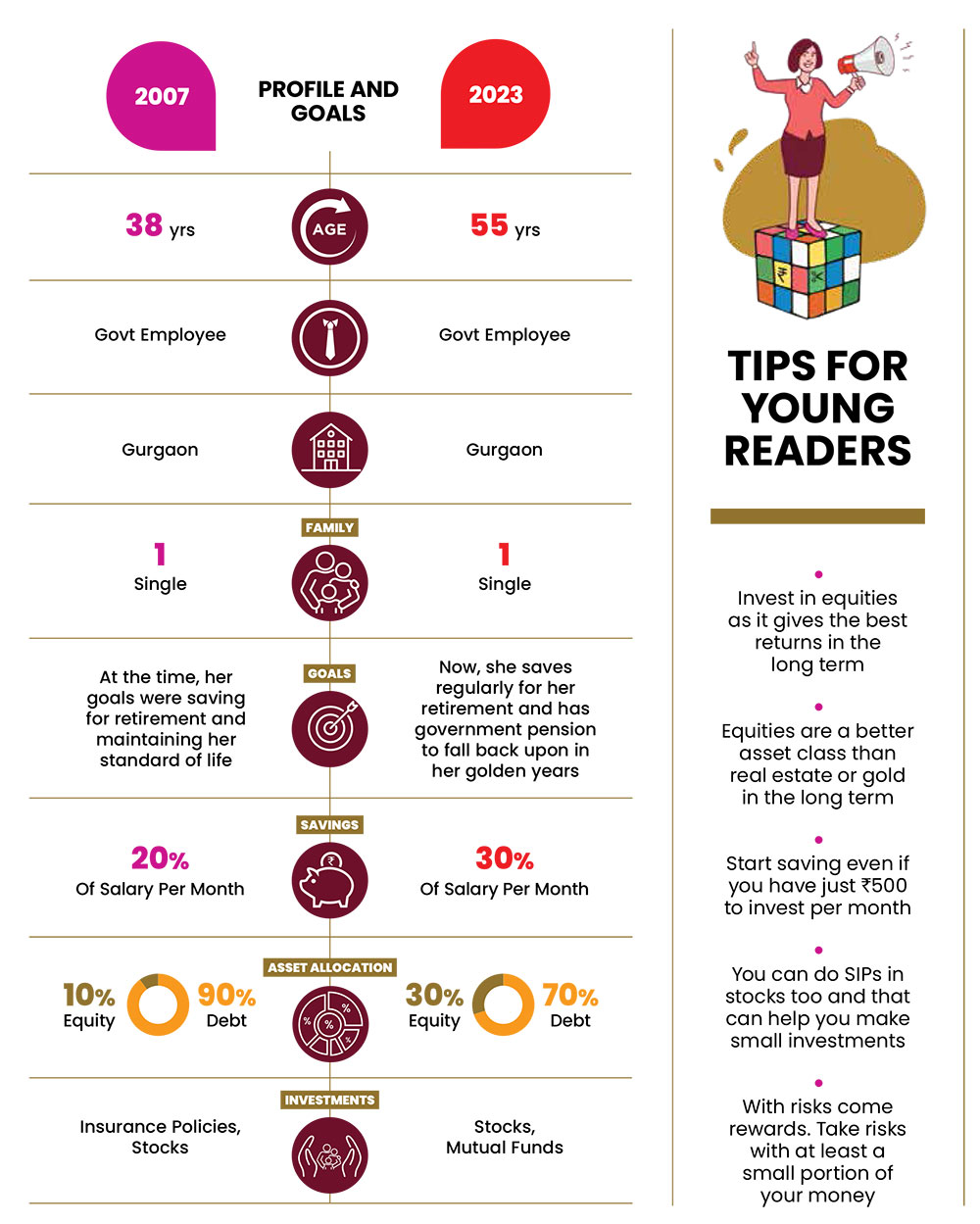

A little more than 15 years ago, Minoti Desai had a problem of plenty when it came to life insurance policies. She had several policies—a mix of endowment and unit-linked insurance plans (Ulips)—in her portfolio when she was featured in Outlook Money in September 2007. Over the years, she realised that even with so many policies, she was not on the path of making high returns. “I bought most of these policies in my 20s. At the time there weren’t enough options or awareness about other products,” says Minoti, who was a member of the Indian women’s cricket team and is now a government employee.

Over the years, she let some of her policies mature and surrendered a few; she has now stopped using insurance policies as investment products. Since she is single and her mother who lives in Indore is financially independent—she realised she does not need to buy any insurance for dependents, as she doesn’t have any.

She is now also aware how policies and investments are sold fraudulently and has come to her mother’s rescue a couple of times.

Now she invests only in stocks and mutual funds. “I realised that the returns from money-back and endowment policies are not enough to beat inflation, and changed my investing strategy. The kind of returns equities give in the long term is unparalleled,” she says.