As the financial year draws to a close, everyone is in a rush to meet their tax receipt deadlines. If you are planning to invest in a tax-saving mutual fund, such as equity-linked savings scheme (ELSS), then exercise caution. The reason being that you will have to stay invested for three years due to the mandatory lock-in even if the fund underperforms. That’s why, it becomes crucial to choose a fund, which has a good track record and has the potential to deliver better returns in the future.

One such fund worth exploring is the Kotak ELSS Tax Saver Fund. It has proven its mettle in the past and its fund management team has the potential to deliver good returns in the future, too. The fund has also weathered many market cycles to emerge as a seasoned performer in the tax-saving category.

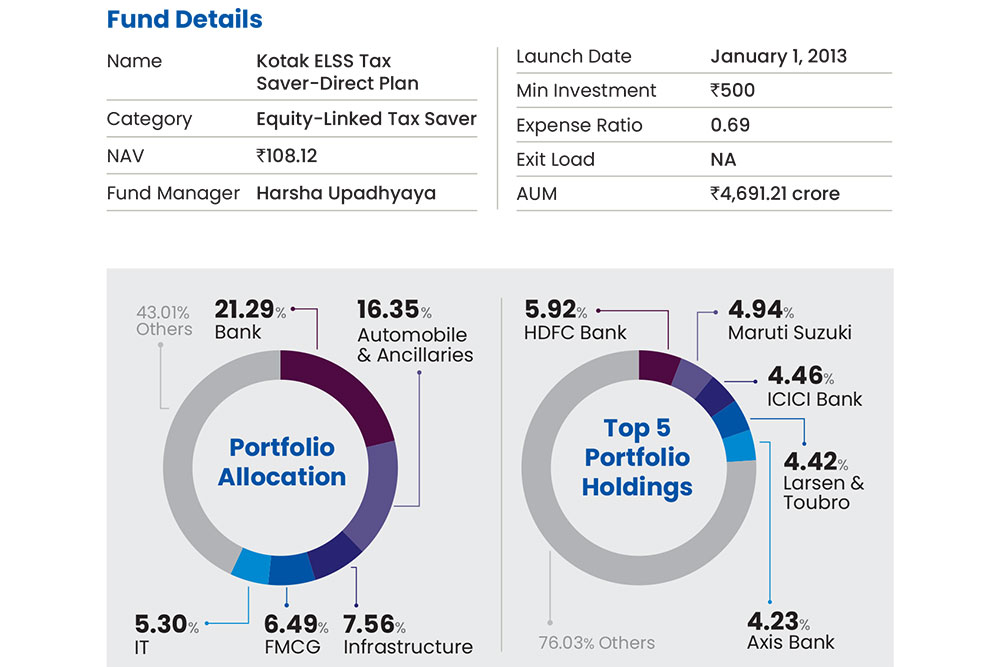

Portfolio

The fund has a mandate to invest across sectors and market caps. Though it prefers to stick with large-caps, it takes fair exposure in mid- and small-cap stocks, if the opportunity arises. Historically, the fund has maintained a minimum 60 per cent exposure in large-caps. At present, it has invested around 66 per cent in large-caps, and 20.36 per cent and 10.42 per cent in mid- and small-caps, respectively. The fund also prefers to stick with high growth stocks in the long term rather than venture into momentum stocks. While picking stocks, fund manager Harsha Upadhyaya, who has been at the helm since 2015, looks to invest in businesses that are scalable in nature and display high capital efficiency. The scheme also prefers to remain diversified. As of December 2023, the fund has invested in 59 stocks across 26 sectors.

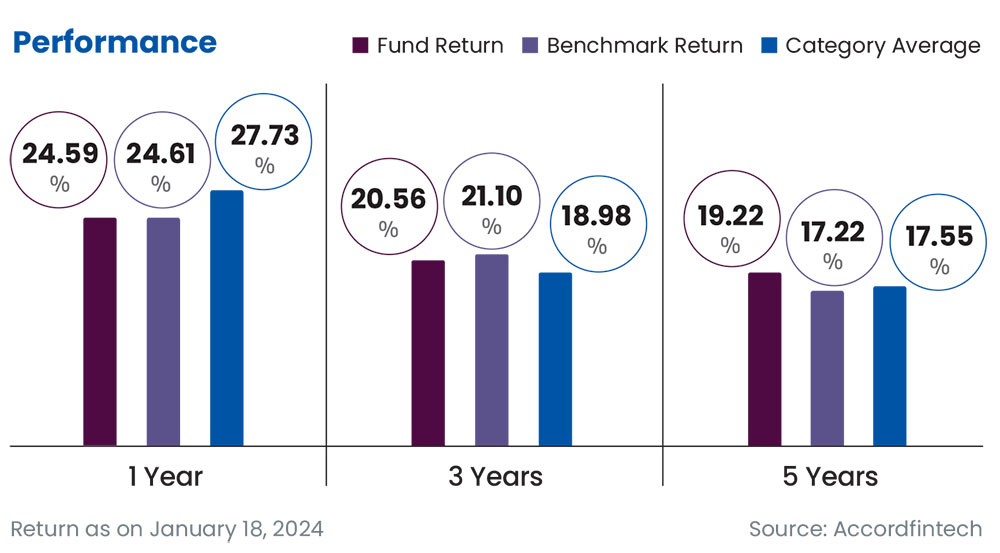

Performance

The fund has consistently beaten its benchmark Nifty500 across periods barring a few years, but it has a mixed record when compared to its peers. It has outperformed the category over three- and five-year periods, but lags in terms of one-year returns.

OLM Take

It is suitable for investors who are not willing to take higher exposure in the mid-cap segment, and prefer decent returns in the long run.

kundan@outlookindia.com