The challenge for most conservative investors is to strike a balance between risk and return. If you want to take lower risks, you need to compromise on your returns and vice-versa. If you, too, are caught up in such a dilemma, Kotak Debt Hybrid Fund could offer a solution. It allows you to have your cake and eat it too. It invests in highly-rated debt for safety, along with a good chunk in equity to boost returns. Kotak Debt Hybrid is among the 10 oldest debt hybrid funds in the country.

Portfolio

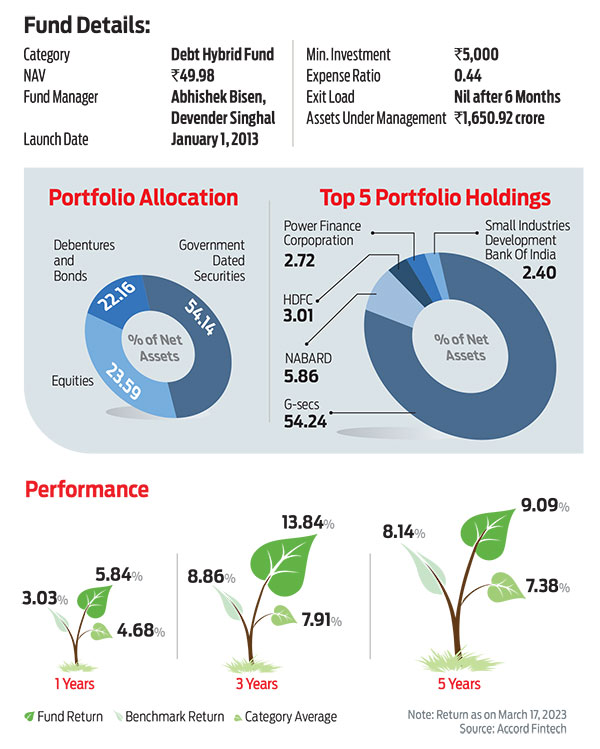

The fund follows a conservative approach towards investing, be it in equity or debt. In case of equity investment, the fund managers prefer to stick with large-caps, and to an extent, scout for quality mid-caps in the portfolio. The fund managers prefer to play safe, and therefore, do not go overboard on mid- and small-cap stocks to maximise return. The fund usually invests in the range of 20-25 per cent in equity instruments, and the rest in debt instruments. This equity component in the portfolio enables it to deliver excess returns in addition to the fixed-income returns.

For building the debt portfolio, the fund manager prefers to invest in a mix of high credit debt instruments across issuers and money market instruments at the shorter end of the yield curve. The fund manager believes that 3-6 years segment is the sweet spot from curve positioning.

At present, the average maturity period of debt papers in the portfolio is 5.79 years. Lower duration in the portfolio helps the fund contain downside in a better way in a changing interest rate scenario.

Performance

Over the years, the fund has delivered a decent set of returns. On a 10-year basis, the fund has delivered 10.51 per cent compared to the category average return of 9.23 per cent. Even in the short term, it has not disappointed investors. In the last three years, the fund has delivered 13.84 per cent against the category average return of 7.91 per cent. The fund has beaten its benchmark and its category average consistently, over one-, three- and five-year periods.

OLM Take

Kotak Debt Hybrid Fund is suitable for conservative investors who intend to generate inflation-beating returns. Given that the fund has better dividend distribution track record, investors looking for regular income can also opt for its dividend option.

kundan@outlookindia.com