Outlook Money’s India’s Best Funds 2024 issue aims to empower you with valuable insights and analysis, to help you make informed decisions on the funds you already own or the ones you plan to invest in

India’s vibrant democracy is currently immersed in the festival of elections. By the time you would be reading this, the results for the Lok Sabha elections will probably be out. In some ways, the process of elections and investments are not so different.

Just like it is crucial to choose who you vote for by considering the value it can add to the economy, policies and the social fabric of India, it is also important to choose the right mutual fund (MF) that can add value to your investment portfolio across market cycles.

Elections give an opportunity to you to consider the past performance of a party or government and assess their potential for delivering better outcomes in the future. Of course, out of these, performance tops the list as that differentiates winners from losers. Performance is also a crucial metric, among others, to assess an MF.

The popularity of MFs has grown by leaps and bounds—the total assets under management (AUM) of the industry has gone up 37.29 per cent, from Rs 41.53 trillion in April 2023 to Rs 57.01 trillion in April 2024. Till a few years ago, the MF industry was dominated by institutional investors, but now individual investors command 60.5 per cent of the AUM. Interestingly, the share of equity-oriented schemes is 58.1 per cent of the AUM, and 88 per cent of it is coming from individual investors, showing their preference for the category.

But investors will do well only if they choose right by assessing how their fund is doing. Our Best Funds list, powered by Morningstar India ratings, will give you an idea about the best performing funds. It ranks the funds according to their three-year performance ending financial year 2024 (see How We Did It). As the market is cruising at its all-time high levels, the recent returns from most funds will look good, but not all of these may be suitable for you or deliver similar results over the long term. That’s why we have chosen to base it on three-year performance.

Do note that this is not an investment advisory; this exercise is only meant to help you better understand how the schemes you may have invested in or are planning to invest in are faring. The analysis along with the ratings will help you make informed decisions.

The Way Forward

The election results usually have a direct bearing on the market, and thereby your MF investments, at least in the short term. For instance, a fractured mandate leads to weak market sentiments, while a strong mandate acts like a booster.

This was visible during the first few phases of the election: lower turnout made the markets jittery and improved turnout added to its confidence.

In fact, after the fifth phase of elections, the Indian equity market saw a revival. Both broad market indices, BSE Sensex and NSE Nifty, touched fresh new highs of 75,636 and 23,026 points, respectively, on May 24, 2024. On the same day, India achieved another milestone with its market capitalisation crossing $5 trillion. “India’s aggregate market cap crossing $5 trillion is driven primarily by continuing strong economic growth and robust corporate performance trend. India is now the world’s fourth-largest country in terms of aggregate market cap. This signifies the breadth and the depth of Indian listed equity space and its long-term potential,” says Harsha Upadhyaya, chief investment office of equity, Kotak Mutual Fund.

There are various factors that contribute to lifting the market mood, including anticipation of the current government’s continuation, declining inflation, and a stable macroeconomic environment. The Reserve Bank of India’s (RBI’s) announcement of a record dividend has added to the positive sentiment. Besides, various research reports suggest that the highest-ever surplus transfer is estimated to reduce the fiscal deficit by 30-40 basis points from the budgeted level of 5.1 per cent of the GDP for FY25, as set in the interim budget.

If you want further details on which funds can give you a hand in the long-term, look at our OLM 50 list in this issue (page 46), which are chosen on a variety of criteria.

Given India’s status as an emerging market with robust macroeconomic conditions coupled with high growth potential, mutual funds are poised to deliver better returns in the future. If you have not invested yet, it is time to board the flight now. Consider the Best Funds issue as your boarding pass.

***

Morningstar Rating Methodology

Outlook Money’s rating partner Morningstar India helped us rate mutual fund schemes with an investment track record of more than three years. The cut-off date for this exercise was March 31, 2024.

The ratings are based on the funds’ risk-adjusted returns. Morningstar uses three steps to calculate Morningstar Risk-Adjusted Return (MRAR). The calculations are done on a monthly basis first and then the results are annualised. Here’s the three-step process.

Total Return: This is the first step in which the monthly total returns for the funds are calculated.

Morningstar Return: At the second step, it calculates or collects monthly total returns for the appropriate risk-free rate. It then adjusts returns for the risk-free rate to get the Morningstar Return.

MRAR: The third step in the selection process is about adjusting the Morningstar Return for risk to get MRAR. Morningstar Risk is then calculated as the difference between Morningstar Return and MRAR. On the basis of these scores, Morningstar India then assigns the star ratings. Morningstar ranks all mutual funds in a category using MRAR, and the funds with the highest scores get the most stars.

***

Equity

The equity market is in a bull run, and so are most equity mutual funds. However, there is a huge divergence in returns within the category.

In the flexi-cap category, there is a huge difference between the best and the worst performers. The best fund in the category gave a return of 63 per cent, while the worst fund show merely 18 per cent, a gap of around 45 percentage points.

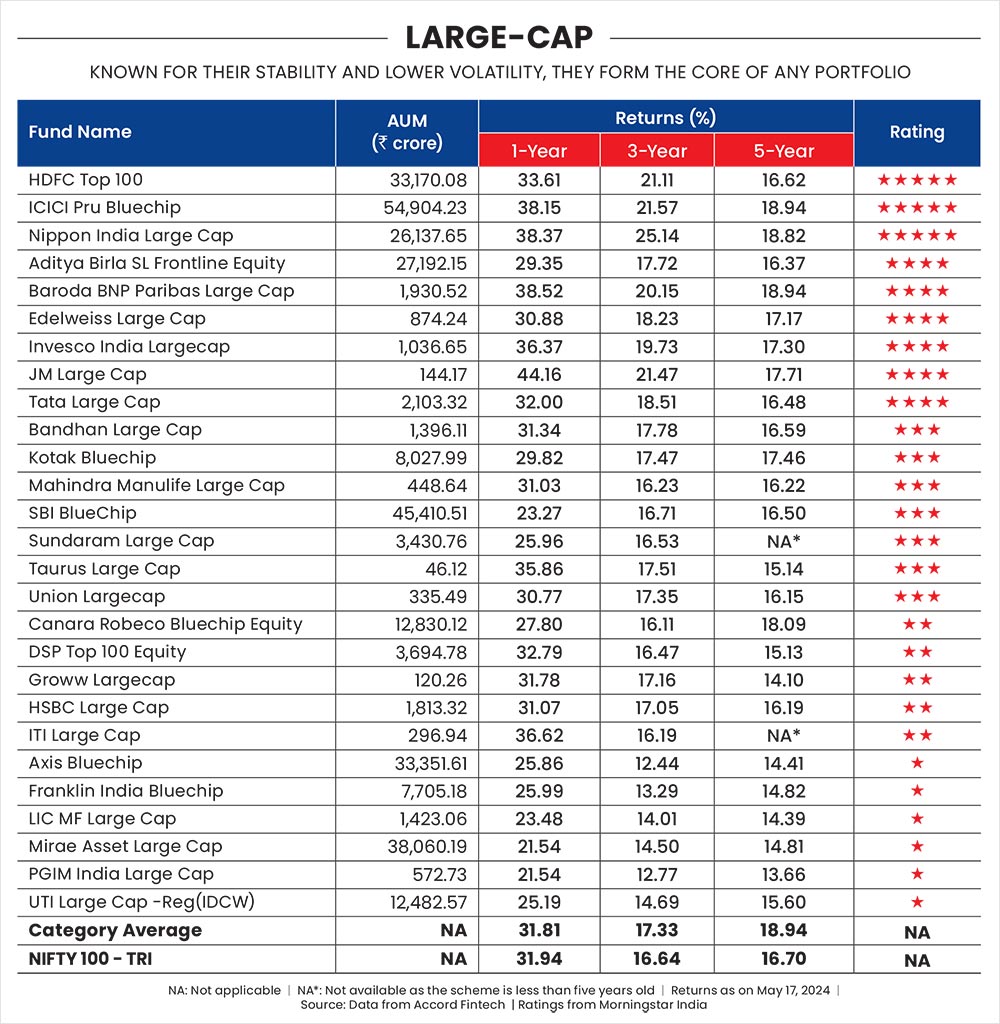

Among large-caps, out of the 31 schemes, 27 qualified for our analysis, and only 10 could beat the benchmark index Nifty 100-TRI. The fund managers who caught the market pulse well in advance and increased exposure to the auto, fast moving consumer goods (FMCG), infrastructure, and financial services, especially banks, scored well.

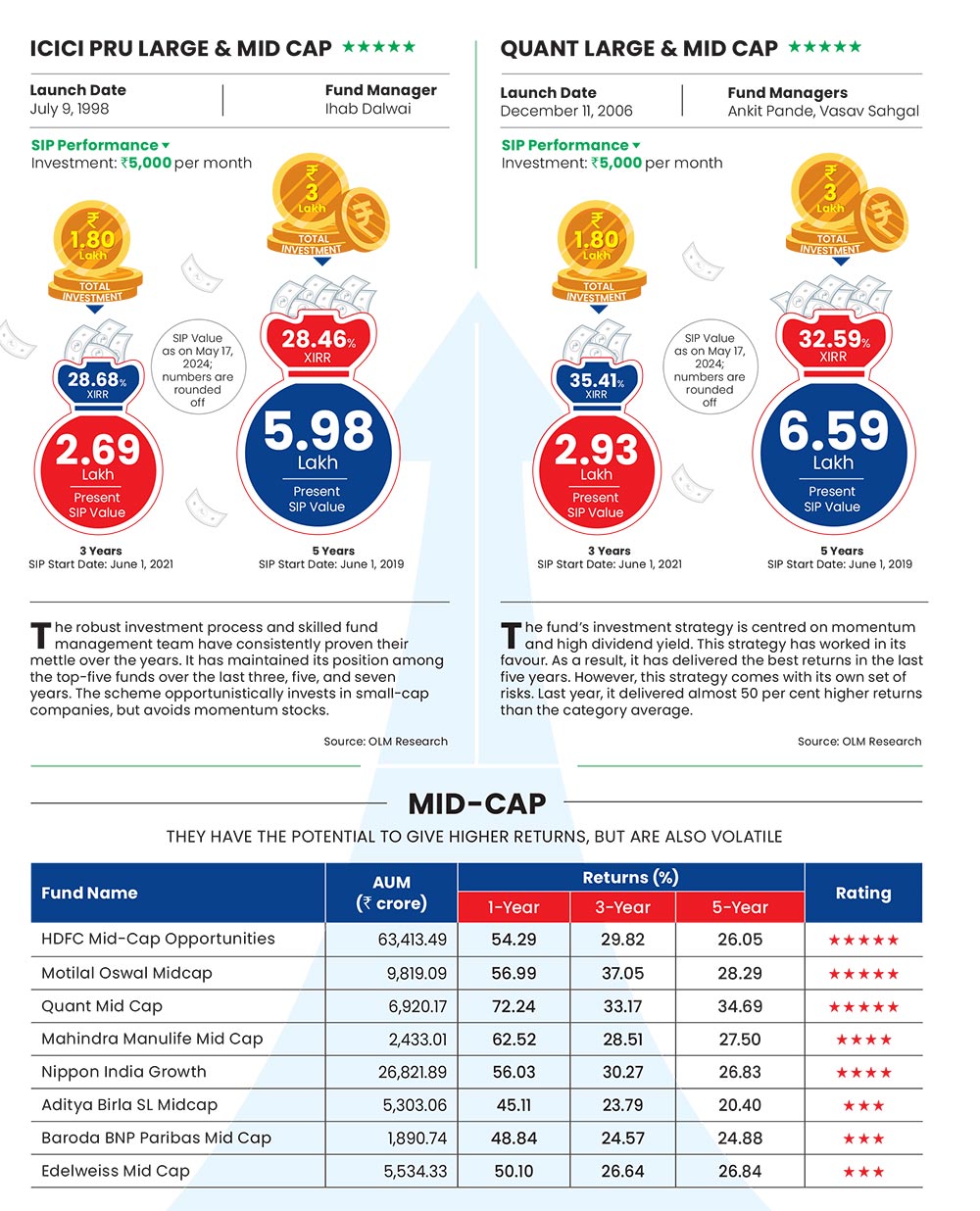

In the mid-cap space, the returns were impressive at 45-50 per cent. However, only four of the 28 schemes managed to beat the Nifty 150-TRI index.

Similarly, in the small-caps, merely three schemes beat the S&P BSE 250 Small Cap-TRI index.

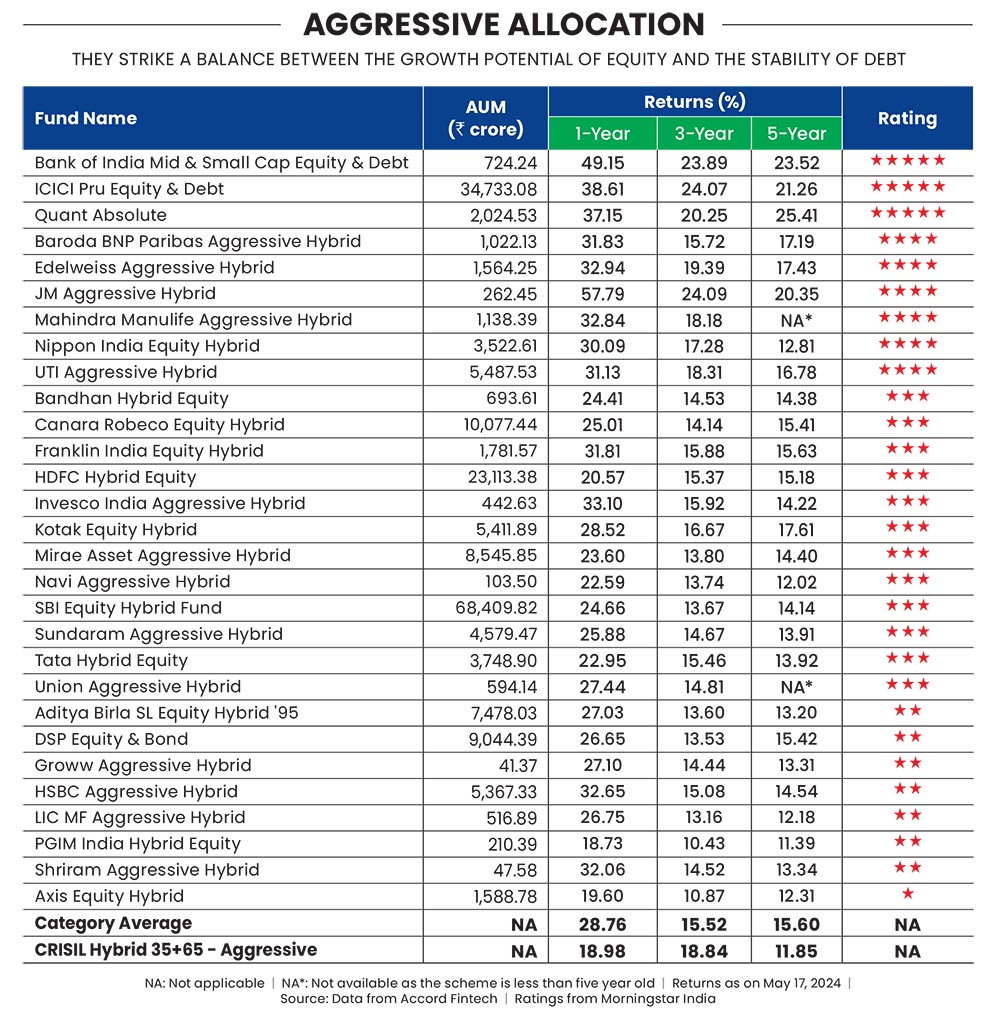

Hybrid

There are many categories in the hybrid category, but we have taken only two. Also, with the promise of dynamic asset allocation in volatile markets, balanced advantage funds (BAFs) have shot to fame recently. The rising AUM is the evidence of its popularity among investors. The majority of equity-oriented hybrid funds, managed to beat the Crisil Hybrid 35+65 – Aggressive index. As some of the funds in this category are mandated to take higher exposure in equity, they have delivered higher returns compared to peers. Typically, in a rising market, the equity factor gives a boost to returns, so the funds with higher equity allocation managed to deliver better returns. Funds with higher mid- and small-cap exposure secured the top positions in the category. For instance, Bank of India Mid & Small Cap Equity & Debt, which invests up to 85 per cent in equity, delivered 50 per cent returns against 24 per cent by the category.

Debt

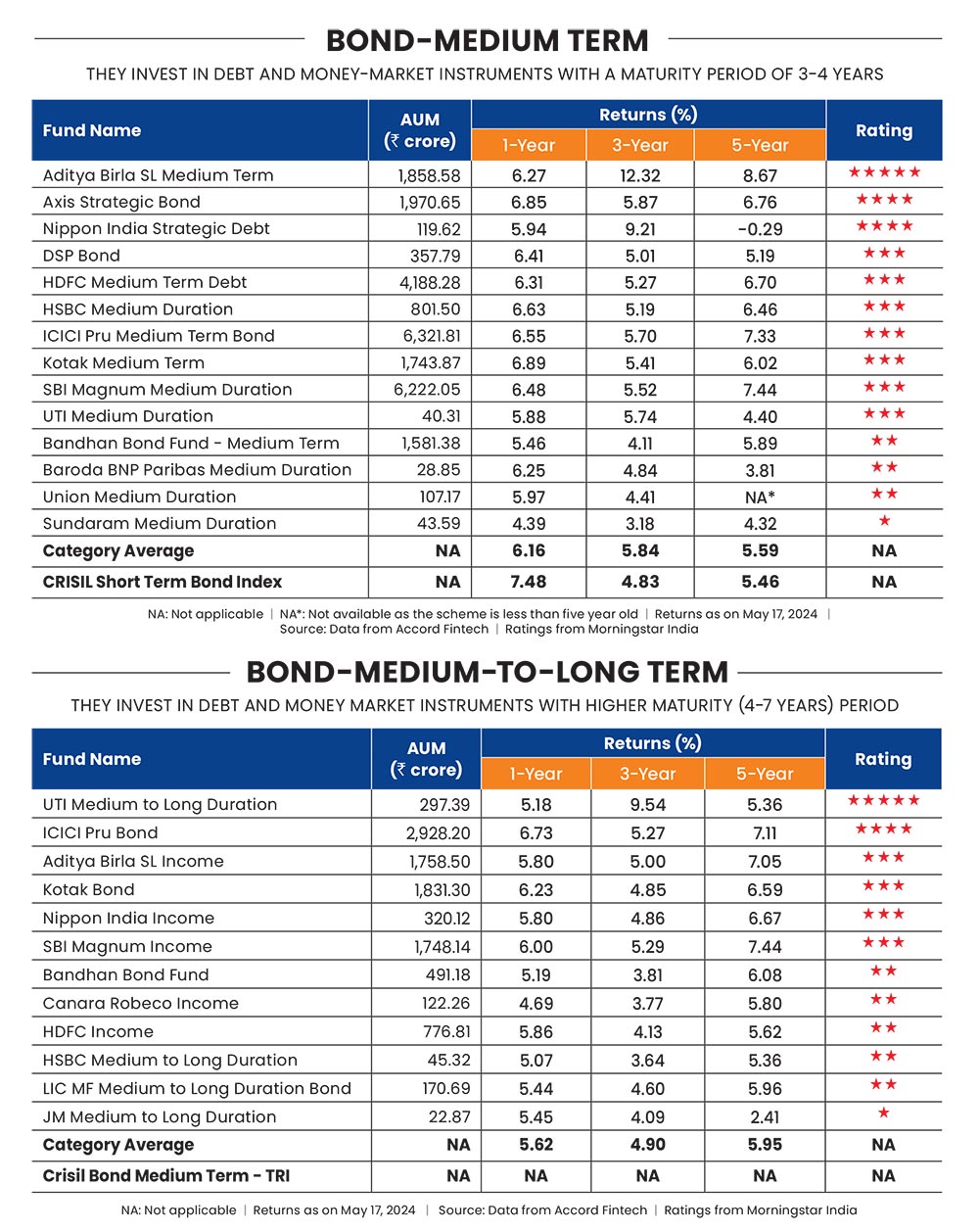

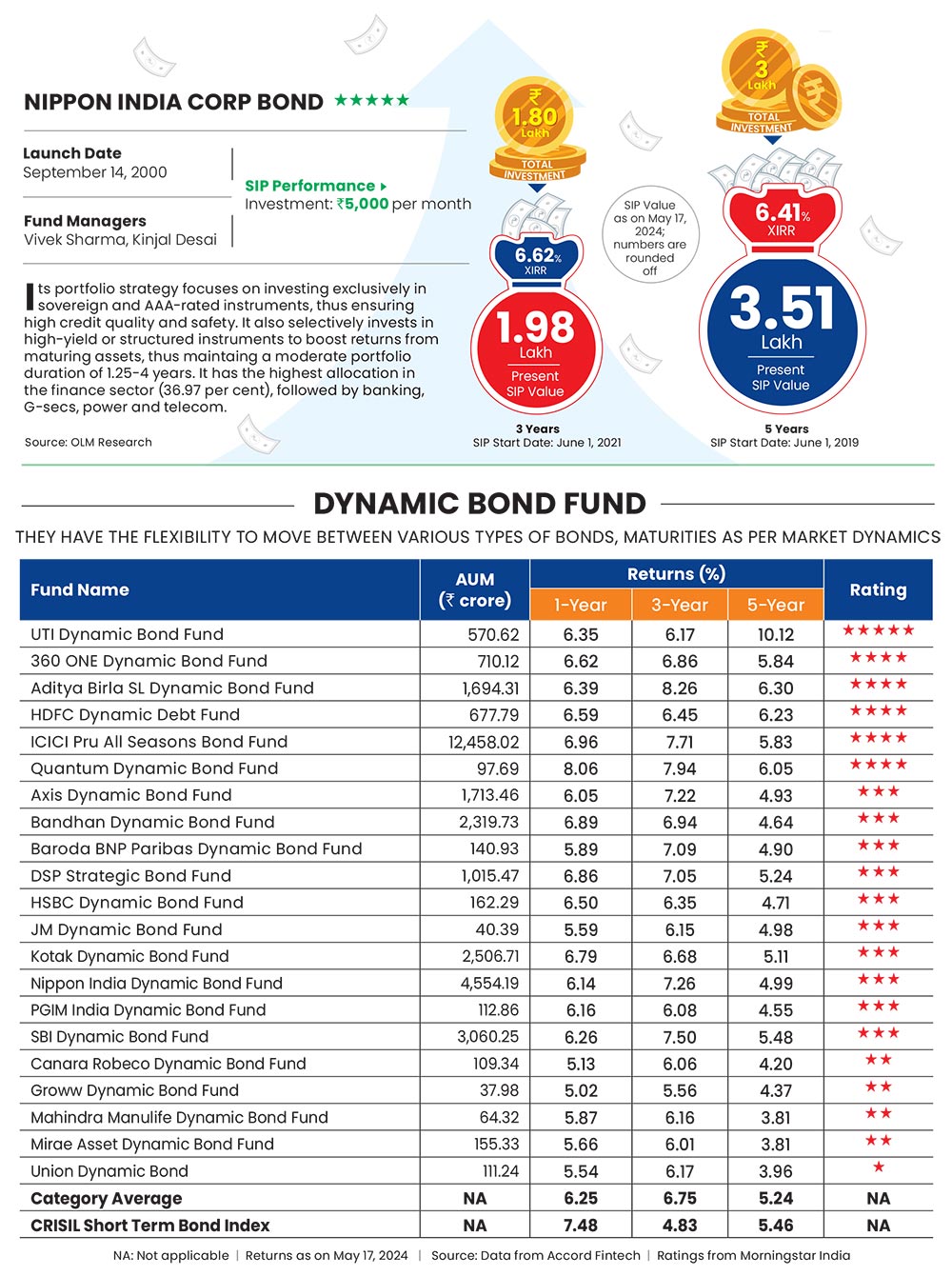

After a rollercoaster ride of the last few years, debt fund managers are anticipating an interest rate cut by RBI which can help improve returns. Many factors are hinting at a potential downward trajectory for Indian bond yields, offering a buying opportunity for bond fund investors. The anticipated shift in the US Federal Reserve’s policy is a factor that can influence Indian bonds positively. However, uncertainty is still looming over the timing of the rate cut.

On the domestic front, rate hikes seem to have peaked, signaling an imminent rate-cutting cycle as inflation seems to be cooling down. According to experts, domestically, the demand-supply dynamics in the bond market are looking more favourable with robust tax collections, the government’s fiscal consolidation plan and India’s inclusion in the global bond index. The best strategy is to invest in a mix of short-and medium-term debt funds in this market scenario.