When it comes to financial planning, investors often overlook inflation. In reality, even the best-planned financial goals can go awry just because inflation is not factored in at the planning stage. So, how does inflation impact our financial lives?

What is inflation?

The general understanding is that the continuous rise in the price of commodities, goods and services is called inflation. But actually, it is the other way around. Inflation is not just the price increase of commodities but also the declining value of a currency and, by extension, the declining purchasing power. So, a thing that could be purchased for Rs.100 last year will cost more this year due to inflation. There are several factors that cause inflation, but one of the primary ones is when the government prints new currency and puts it into the economy by spending on infrastructure, rising salaries, etc. The value of the existing currency falls. So, inflation is basically the fall in purchasing power of the currency and not the rise in the prices of commodities.

How inflation affects your financial life?

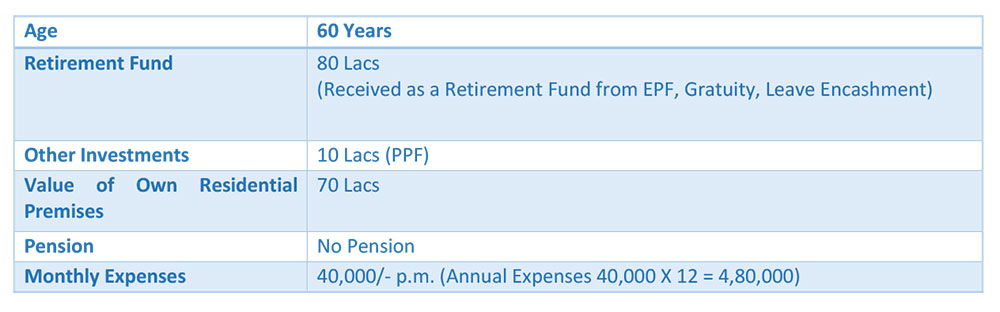

Inflation has a severe impact on our long-term goals like retirement, the education cost of our children, etc. Let us consider some real-life cases. In 2015, a client approached me for his financial planning. He had just retired from a senior management position at a large company. Following are his details.

Throughout his working years, he had saved in PPF and EPF, apart from some life insurance policies. When we met, he was of the view that Rs. 80 lakh corpus will be sufficient to survive. He had planned to park the whole sum in an FD at 8% interest rate. The interest he would receive will be around Rs. 6.4 lakh.

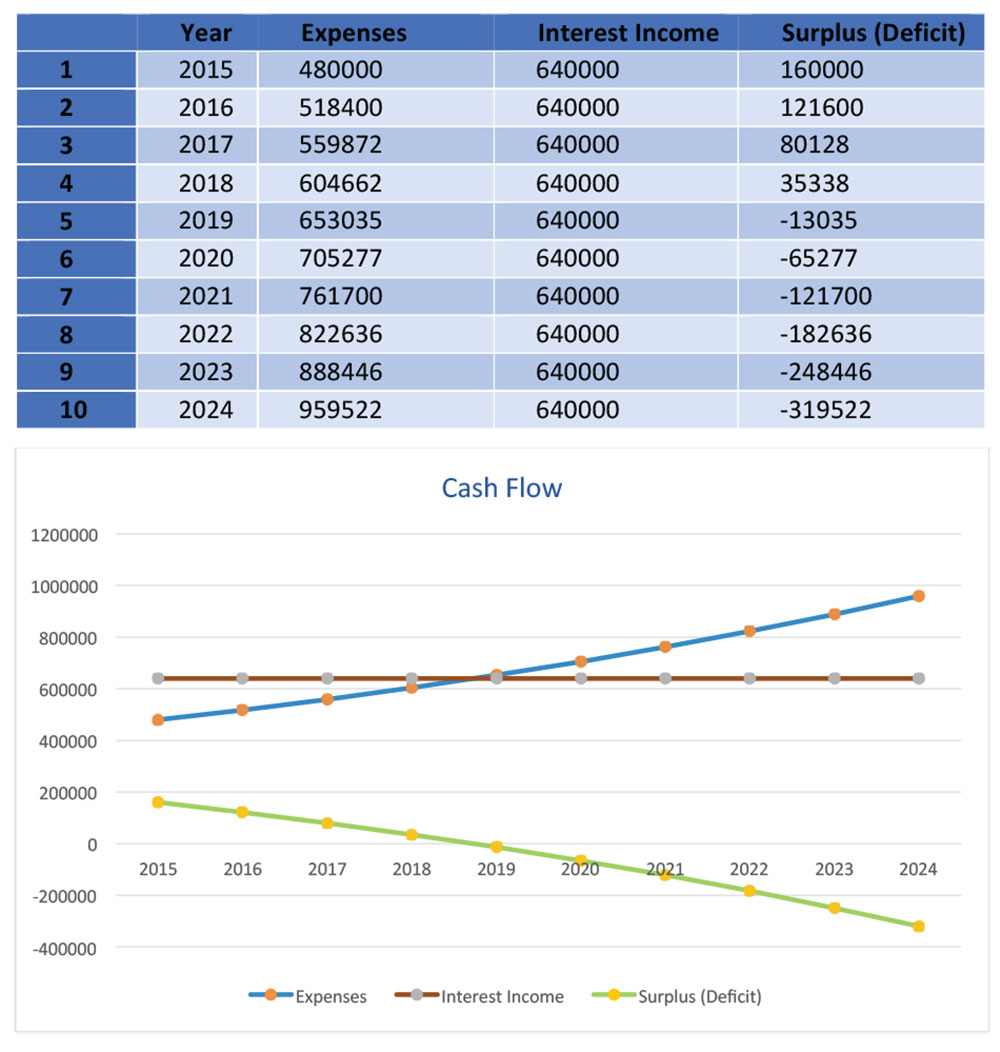

With his monthly expenses at Rs. 40,000, annually he would require Rs. 4.8 lakh, which can be taken care of from the FD interest received and still he will have an excess of Rs 1.6 lakhs (6.4-4.8 lakhs). In this case, if we assume an 8% per annum inflation, let us see how his annual cost of living pans out over the next decade. For this, we have assumed zero taxes and an 8% interest rate.

The PPF corpus of Rs 10 lakhs is kept away for meeting any medical emergencies and hence not considered for these calculations.

The table above shows that in the fifth year (2019) of his retired life, his cost of living would be more than the interest income. This is despite making zero changes to his lifestyle. From 2019 onwards, just to maintain his lifestyle, he will have to withdraw from his investment capital of Rs. 80 lakhs.

The mistake he made was not factoring in the impact of inflation on his cost of living. This shows that inflation can be our biggest enemy in the way of meeting our long-term goals. Most often, people either consider the same level of expenses for future years or miss out on calculating the future value of today’s expenses by factoring in inflation. Missing out on this single step can be a cause of undoing when it comes to meeting long-term financial goals like retirement, meeting a child’s marriage and education expenses, etc.

The irony is that the impact of inflation on short-term goals is negligible, and thus does not capture the imagination of the masses. If a goal is only a year away, inflation will not affect much; however, for long-term goals, inflation is the greatest risk.

Disclaimer

The views are personal and are not part of the Outlook Money editorial Feature.

Prakash Hariram Lohana, Managing Director, Ascent Financial Solutions Private Limited