Prateek Sahni (name changed) is a 23-year-old who started his career with an MNC about two years ago. He earns about Rs 1 lakh per month. Prateek’s main passions are buying gadgets, partying and travelling. Saving is not on the list of priorities. Prateek’s parents, while happy with their son’s progress, have been trying to convince him to invest. But, as happens often, their advice is falling on deaf ears. Prateek says, “What’s the point of saving now? I will save later.” His parents convinced him to have a meeting with me and this is how it went.

Me: Hi, Prateek! Your parents wanted me to speak to you about investing.

Prateek: Yes, but I think I want to do that after 2-3 years; not now.

Me: No problem. But can you answer one question? You earn about Rs 1 lakh a month. So, how much money are you going to make in your earning life?

Prateek: Well, I haven’t really thought about this but I expect there will be a 5 per cent increment every year and I plan to work till 55 years of age.

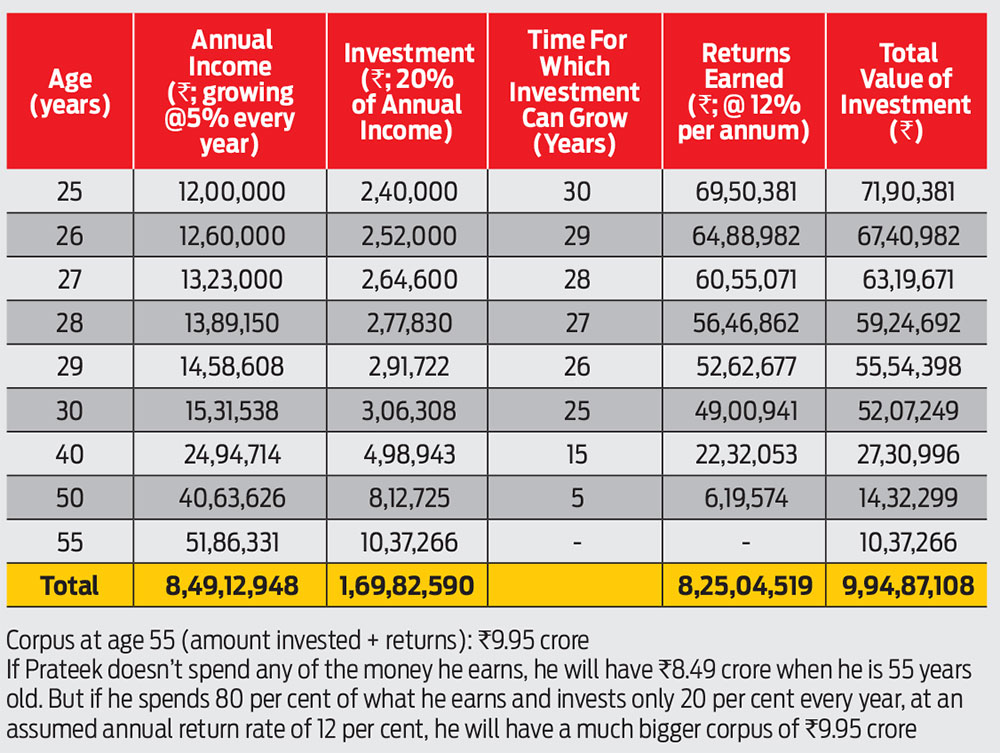

Me: Wonderful! That means you will make Rs 8.49 crore in your working life of some 30 years. How much time would you put in?

Prateek: I work 8-10 hours, daily.

Me: So, that means you will work about 65,000 hours and make roughly Rs 8 crore. What if you could earn more without working for it? Here’s how:

Me: It’s easy! You need to save and invest smartly just 20 per cent of your monthly income. By working till 55 years, you expect to make about Rs 8.5 crore. But if you invest just 20 per cent, you can make almost Rs 9.95 crore.

Prateek: Wow! That’s eye-opening. I can easily do 20 per cent; I’ll still have 80 per cent to spend. Prateek has started making his money work for him. Have you?

The author is a CFP and Founder, Trustedarms Wealth