After an initial downturn, the pandemic gave an unexpected push to the real estate sector last year. Changing lifestyle needs increased the demand for bigger houses and Covid-related uncertainty made investors seek comfort in homes they owned even if it meant moving away from the humdrum of bigger cities or city centres. With the changing nature of homebuyer demand, developers repurposed the supply with better designs and more amenities. The all-time low loan rates and affordable prices of homes were further incentives for buyers.

The landscape, however, may be changing now, with geopolitical conditions and rising inflation expected to push up real estate prices and interest rates already on an upward curve. In this changing scenario, what should buyers do? Here’s an analysis of what pepped up the real estate sector in the past and which direction it’s expected to go.

The Rise of Positive Sentiment

Before the pandemic brought in a big shift in the way they lived and worked, Ahmedabad-based Sanjay and Priya Kapoor, who are in their late 30s and did not want to reveal their identities, used to stay in a rented one-bedroom apartment in Goregaon East, Mumbai. The long working hours meant that the couple hardly spent any time at home, except on the weekends. That changed when the pandemic struck and the couple started working from their small home. During that period, Priya decided to pursue her passion for music seriously and took a smaller role in her company to accommodate that.

Eventually, she felt the need to have a separate room to practise her chords but bigger houses in Mumbai didn’t fit into their budget. “Mumbai was becoming too expensive and suffocating for us, with a small apartment. I needed more space for my music practice,” says Priya. The couple then decided to move to a bigger house in Ahmedabad now that they had the flexibility of working

from anywhere.

Many others in India took similar decisions. For this reason and others, the investor sentiment turned positive in 2021, according to the Knight Frank-FICCI-NAREDCO Real Estate Sentiment Index. The score went up from 63 to 65 in the fourth quarter of 2021 (October-December 2021) from the previous quarter and to 68 in the first quarter of this year. A score above 50 indicates “optimism”, while a score below 50 indicates “pessimism”.

Another buyer trend to emerge was that even the Gen Z and younger millennials joined the home buying bandwagon. “According to recent reports, the average age of home loan borrowers has fallen to 25-28 years, thanks to income stability from a very young age and the low rate of interest (then). This was a major factor that kept the real estate demand afloat,” says Raoul Kapoor, co-CEO, Andromeda Loans, a loan distribution company.

Home loan disbursement by banks and housing finance companies breached the pre-Covid level. “For example, the State Bank of India (SBI) registered a growth of home loan by 20 per cent in FY2020. Interestingly, 40 per cent of the disbursement was in Tier I cities and it was broad-based. The average ticket size is about Rs 34 lakh, which matches the pricing of the affordable segment,” says Subhankar Mitra, managing director, advisory services, Colliers India, a real estate consultancy firm, citing internal data.

As the pandemic subsides, pent up demand is rising to the surface.

At the same time, developers who withheld supply earlier, considering stagnant and declining demand, loosened the supply. “With the situation improving, the supply influx has increased with developers coming up with new launches and also delivering ready properties,” says Ritesh Mehta, senior director and head-west, residential services and developer initiatives, India, Jones Lang LaSalle (JLL), a real estate firm.

Led by Bengaluru and Mumbai Metropolitan Region, the residential apartment market in India recorded sales of nearly 52,000 units in the January-March 2022 quarter, up 11 per cent on a sequential basis. Sales for the quarter also surpassed the average quarterly sales for the pre-Covid 2018-19 period by a significant 148 per cent, according to JLL’s residential market update for Q1 2022.

Will The Positivity Continue?

With the investor sentiment high and the economy slowly but steadily getting back on track, the demand is still growing, especially in tier-II and tier-III cities, say experts.

The increased rate of project completions, supportive government policies, and rising employment opportunities suggest that the number of infrastructure projects coming up for delivery will be higher, thus catering to the increased demand. “As per Budget 2022, the government has added Rs 48,000 crore as stimulus under the PM Awas Yojana and PM Gati Shakti scheme, which has encouraged first-time and middle-income groups to buy budget homes,” adds Kapoor.

The investment sentiment score for the future, which gauges the stakeholders’ expectations for the next six months, remains in the optimistic zone, though it came down from 72 in Q3 2021 to 60 in Q4 2021 only to rise higher to soared to 75 in Q1 2022.

“Post pandemic, the market sentiment has majorly been inclined towards owning a house rather than renting. This mindset is supported by companies switching to a hybrid model, enabling people to work from home or remote locations,” says Mehta.

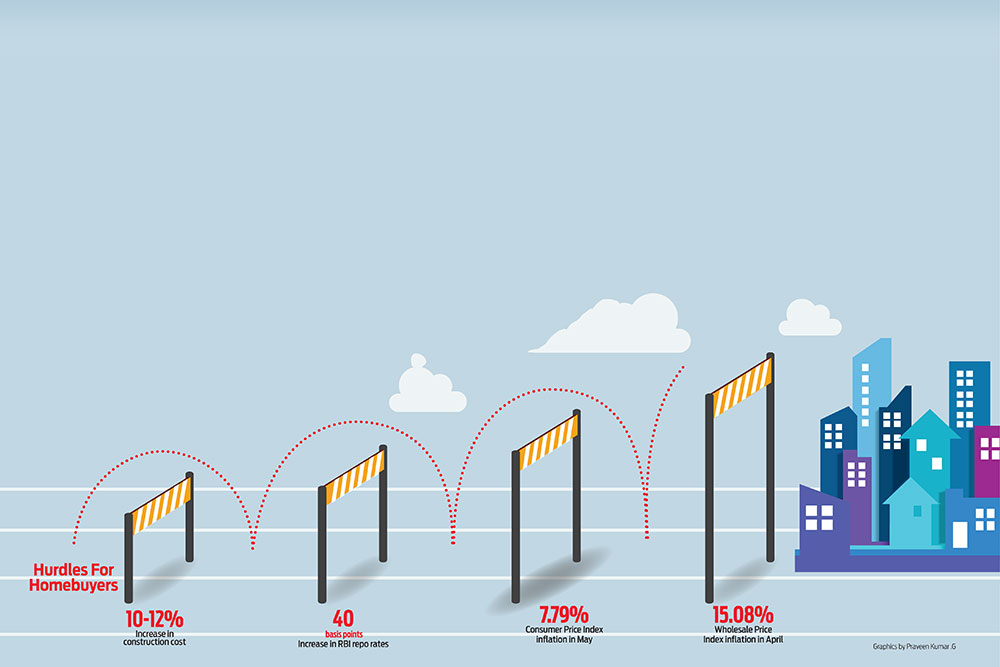

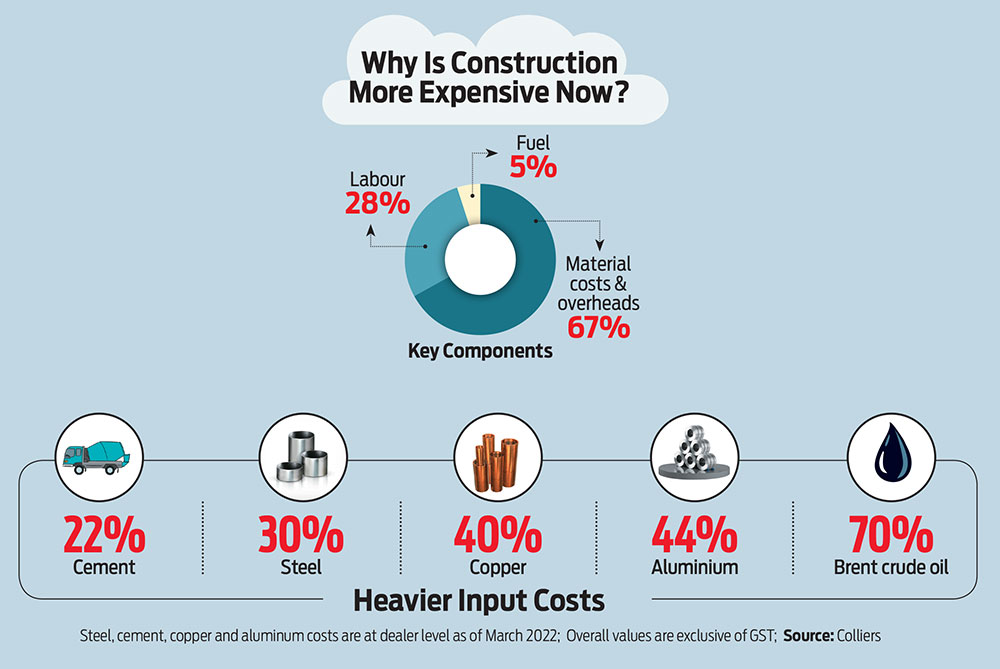

However, recent adverse geopolitical conditions, which have affected the global supply chain, may put a spanner in real estate demand as prices in the sector are expected to rise further. Rising prices of oil and commodities, falling currency rates and higher input costs are squeezing margins. Higher input costs have pushed up developers’ average cost of construction by 10-12 per cent over the last one year, according to a Colliers report. The cost of key materials such as cement and steel, which form about two-thirds of the total cost of construction, has risen over 20 per cent yearly as of March 2022. Developers are under pressure and are reviewing their pricing strategy.

“The real estate sector has witnessed the impact of inflation in steel and cement prices and also in the cost of labour. As a result, prices have started to increase. In April, developers from NCR announced a 10 per cent hike in price; this is happening elsewhere too. There is fear that the cost might go up further unless stability returns on the geopolitical front,” says Mitra.

Adding to the pressure is the recent hike in interest rates by the Reserve Bank of India (RBI), which may render another blow to demand. While the central bank has already raised interest rates once, in a surprise move early-May, more rate hikes are expected. This is in line with global banks’ action. The US Federal Reserve has raised interest rates sharply and has indicated that it would continue to do so. “RBI has hiked the repo rate by 40 basis points to deal with the changing macroeconomic conditions and higher inflation,” says Mitra, adding that the move may rob the real estate sector of some of the enthusiasm that was seen over the last year.

Various lenders have already followed suit by increasing their home loan interest rates. SBI, for instance, has hiked its marginal cost of funds-based lending rate (MCLR) by 10 basis points across tenures. HDFC has increased its retail prime lending rate (RPLR) on housing loans by 30 basis points. LIC Housing Finance has done so with 20-40 basis points. With each passing day, more lenders are raising rates.

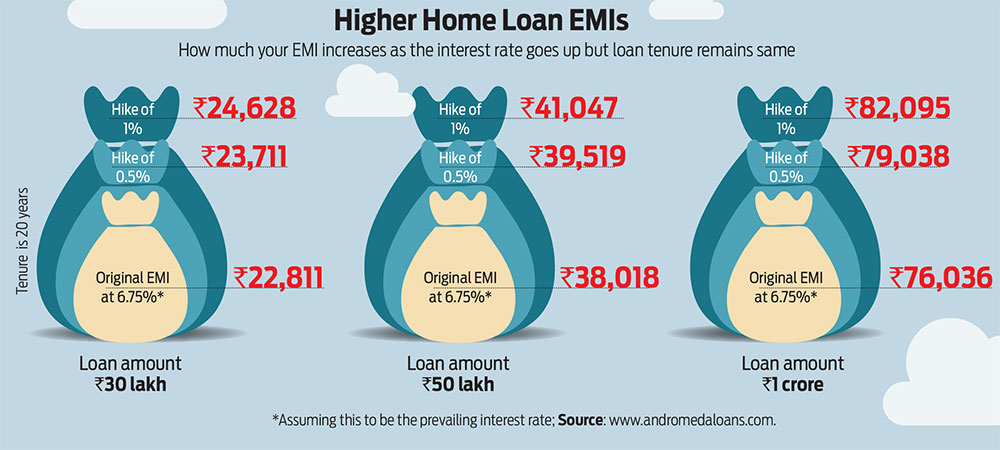

Roughly, an increase of 50 basis points (or 0.5 per cent) increases the EMI by about 4 per cent if the tenure remains the same.

What Should You Do?

Some experts continue to be optimistic about home buyer sentiment remaining positive. “Many millennials have become convinced home buyers. While low interest rates and property prices were the icing on the cake, the real incentive was the desire for the certainty of home ownership amidst many uncertainties. Nothing has changed about that,” says Anuj Puri, chairman, Anarock group, a real estate services company.

Real estate prices have increased but are still affordable.

According to the Knight Frank Affordability Index 2021, Indian property markets are at their decadal best in terms of affordability. With an affordability ratio of 20 per cent, Ahmedabad was the most affordable in the index, followed by Pune and Chennai at 24 per cent and 25 per cent, respectively, in 2021. Only Mumbai recorded higher than threshold affordability ratio at 53 per cent, but it has improved since 2011.

“Property prices have remained stable for a long time. The property market is well regulated at this moment which is encouraging for young buyers. They now have more options of products across various markets,” says Mitra.

This situation may not remain the same for long. With increasing material cost, rising inflation and recovering interest rates, property prices are expected to climb eventually.

The present affordability faces a threat from inflation since prices of under-construction projects are likely to increase as developers factor in the increased costs over the construction life cycle. Developers may also try to offset the impact by rescheduling various stages of construction activities so that the impact of inflation gets spread out, says Mitra. “As a result, the completion of under-construction projects may take longer than estimated,” he adds.

Even though the Real Estate Regulatory Authority (Rera) has created some regulatory guard rails, it does not guarantee timely delivery of projects (see The Role Of Rera). “The onus of verifying the antecedents and overall viability of a developer and his project still rests with the buyers. On the positive side, a lot of the fresh supply is by credible developers. Buyers would do well to stick to such players when it comes to investing in under-construction homes,” says Puri.

Moreover, interest rates have started rising and may not remain as attractive as they were in the past couple of years. Increasing rates mean that buyers need to assess their future cash flows as EMIs will increase. For example, the EMI for a loan amount of Rs 30 lakh would now increase by Rs 700-900 depending on the base rates.

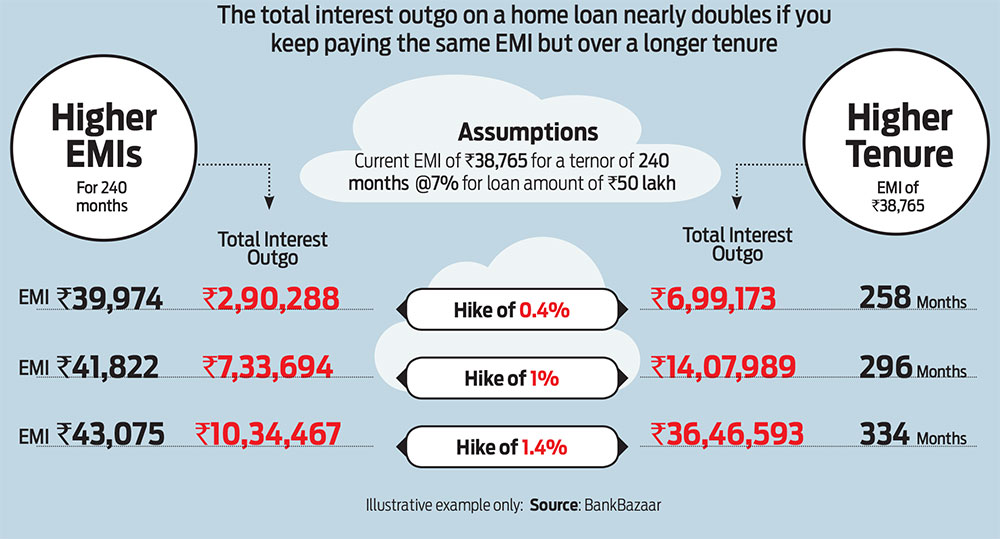

If you are looking to buy a house for end use, you may get an affordable deal at present but be ready to pay higher EMIs or repay for a longer tenure compared to what’s available in the market at present.

***

The Role of Rera

Ever since the Real Estate Regulatory Authorities (Rera) were formed in various states, developers have made a beeline to register their projects under Rera. Around 82,240 real estate projects and 63,439 agents have registered, according to the Ministry of Housing and Urban Affairs’ data as on May 21, 2022.

The authority has inspired some amount of confidence among buyers. “Rera has created assurance for home buyers, particularly those who are investing for the first time. States like Maharashtra have introduced innovative reconciliation forums for speedy redressal of grievances,” says Subhankar Mitra, managing director, advisory services, Colliers India.

While the total number of complaints filed is not known, 91,286 complaints have been disposed by Rera across the country, according to the ministry data.

Official figures suggest that more than 75,000 projects are registered under Rera, with states like Maharashtra, Gujarat, and Karnataka having the highest number. “This number could have been much higher, but due to stringent norms, around 80,000 projects were not registered due to various shortcomings,” says Raoul Kapoor, co-CEO, Andromeda Loans.

However, implementation is a major drawback, especially in terms of timely completion and penalties for delays or inferior quality. This is preventing buyer confidence from becoming stronger. “Unlike Maharashtra, most of the states have not brought data into public domain in a transparent way. Some states are less efficient than others in terms of addressing complaints and taking action,” says Mitra.

Though Rera assures timely completion, there are a few loopholes in the procedure. For instance, builders can apply for extension of timelines. “Additionally, natural pandemics like Covid are not covered under Rera compliances,” says Ritesh Mehta, senior director, Jones Lang LaSalle.

So, while increasing cost of construction, more expensive home loans and inflation could weigh down home buyer sentiment, these factors are cyclical in nature and can change. Lack of policy and legal support to buyers, however, is a longer-term play.

meghna@outlookindia.com