Company Name Harsha Engineers

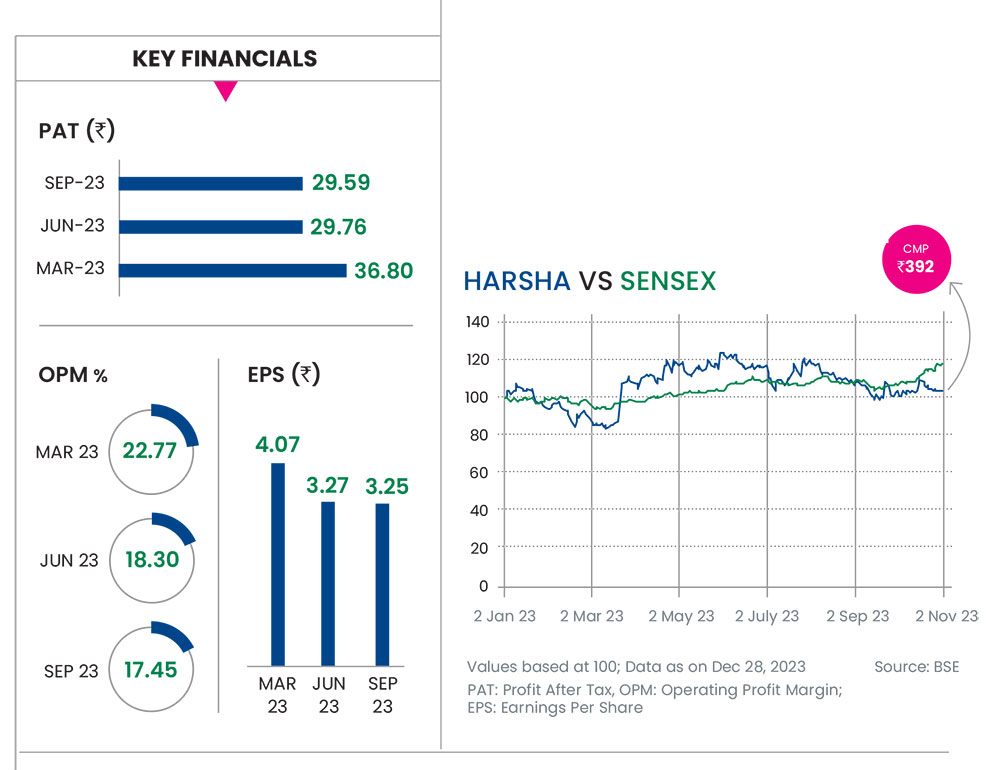

Current Market Price 392

Calendar Year Return 2.03%

***

Harsha Engineers is the largest manufacturer of ball bearing cases in India, supplying to each of the top six global manufactures of bearings.

Investing Rationale

Market Leader: Harsha has four manufacturing facilities with warehouses located close to clients, and two subsidiaries in China and Romania, supplying products to over 25 countries across five continents. They have a 6.5 per cent market share in the global organised bearing cages segment and derive 65 per cent of their revenue from overseas.

Expertise: Harsha has the expertise to design and develop advance tooling inhouse which enables them to manufacture precision products, right from the design to the manufacturing stage.

The advent of electric vehicles (EVs) will increase the demand for specialised bearings and Harsha is focused on developing products for this new market, which is expected to grow at 30 per cent in the next eight years.

The solar expert packing credit (EPC) business, which was set up a decade ago, is also expected to contribute well from FY25. The China and Romania operations are expected to turn around soon.

Healthy Growth: The global bearings market is expected to grow at 6.4 per cent compounded annual growth rate (CAGR) over the next five years, while the domestic market is expected to grow at 8.3 per cent. However, Harsha has been growing at a faster pace (15 per cent CAGR since the last three years) and is expected to continue to do so in the future. Gross margins have been high at 48 per cent.

Another trigger would be the green field project for bushings, large-size steel bearing cages, and stamping components which should start production in FY25. Bushings are key components used in the manufacture of the wind power gear box and the wind market in Europe is expected to revive well in 2024. The company came out with an initial public offering (IPO) a year ago at Rs 330. The stock saw a high of Rs 494 in June 2023 and soon corrected itself. I am expecting a target price of Rs 525 for the share.

Recommended by: Ambareesh Baliga, Market Analyst