What’s Taxable For NRIs In India?

- Salary or income received in India

- Rental income from house located in India

- Income from business set up or controlled in India

- Capital gains income from capital assets such as house property, shares and securities, gold, etc.

- Interest received in savings account and fixed deposits in India

***

Chirag Batra, 26, works as a software engineer in London and is a non-resident Indian (NRI) since 2018. “I have invested in fixed deposits and some other savings (instruments) in India. My earnings in London are not taxable in India. But I pay taxes on the earnings I get from the investments in India,” says Batra.

Batra is one of the many NRIs who work or stay abroad but have investments in India. Many are under the wrong impression or are not clear about whether their income or investments in India are taxable here or not. If you are an NRI and confused about whether or not to pay taxes in India, read on to get more clarity.

Are You An NRI For Tax Purposes?

Not all NRIs may be considered so under the income-tax laws. Section 6 of the Income-tax Act, 1961 first defines who a resident is. A person who is not a resident, can then be considered an NRI. The distinction is based on the number of days a person stayed in India. There are two ways this is calculated.

First criteria: If the individual was in India for a period of 182 days or more during the previous year; or

Second criteria: If the individual was in India for a period of 60 days or more during the previous year and 365 days or more during four years immediately preceding the previous year.

However, if an Indian citizen or a person of Indian origin visits India during the year, the period of 60 days as mentioned shall be substituted with 182 days. “Even if the person is earning abroad but has stayed in India for 182 days at a stretch, then any sort of earnings become taxable, as the person would be considered a citizen of India,” says Nitin Mohan Kashyap, a practising chartered accountant and director, Coopers Tax Consulting.

Whether a person will be classified as an NRI or not will depend on the number of days he or she has stayed in India and the quantum of income earned, explains Ruchika Bhagat, managing director of Neeraj Bhagat and Co., a chartered accountancy firm. “Till FY 2019-20, NRIs would include individuals of Indian origin who visited India for less than 182 days in a particular financial year. However, in Budget 2020, NRIs whose Indian income is more than Rs 15 lakh, the residency period was reduced to 120 days,” adds Bhagat. This means that from FY 2020-21 onwards, if your Indian income is more than Rs 15 lakh and you visited India for less than 120 days, you will be considered an NRI for tax purposes. The residential status needs to be determined individually for every financial year.

During the Covid-related lockdowns, the Central Board of Direct Taxes (CBDT) issued a notice stating that for an NRI who has not been able to leave India on or before March 31, 2020, the period of stay in India from March 22, 2020 to March 31, 2020 shall not be taken into account to calculate the 182 days or more period of stay during FY2020.

Do You Have Taxable Income?

Income earned abroad is not taxable in India, but other income (salary or income received in India or from a business in India) may be taxable for NRIs. Apart from these, rental income from houses located in India, interest received in a saving account and fixed deposits held in Indian banks, capital gains income from capital assets such as house property, shares and securities, gold, etc. “If someone fails to pay the tax, then he/she can do it later, but it needs to be done in the same year. Failing to pay the tax will mean getting notices from the income tax department,” adds Kashyap.

Once you have established your NRI status and figured out which of your incomes and/or investments are taxable in India, find out the relevant tax slab so that you know your tax rate.

Based on the income slab, NRIs may choose between the old and new tax regimes. “For those whose earnings in India fall under the high-income tax bracket, it may be better to not go for the new tax regime,” adds Kashyap. But there is a limitation here. A resident individual whose total income does not exceed Rs 5 lakh is entitled to a tax rebate of 100 per cent of income tax or an amount of Rs 12,500, whichever is less. “This tax rebate is not available to an NRI,” says Kashyap.

The tax rates for NRIs and residents are the same but there are differences based on age. “The basic exemption limit is Rs 2.5 lakh, irrespective of age (for resident senior citizens above 60 to 80 years, the exemption limit is Rs 3 lakh, and Rs 5 lakh for super senior citizens above 80 years under the old tax regime). In surcharge and health and education cess rates, there is no difference between NRIs and resident individuals,” says Kashyap.

Can You Invest For Tax-Saving?

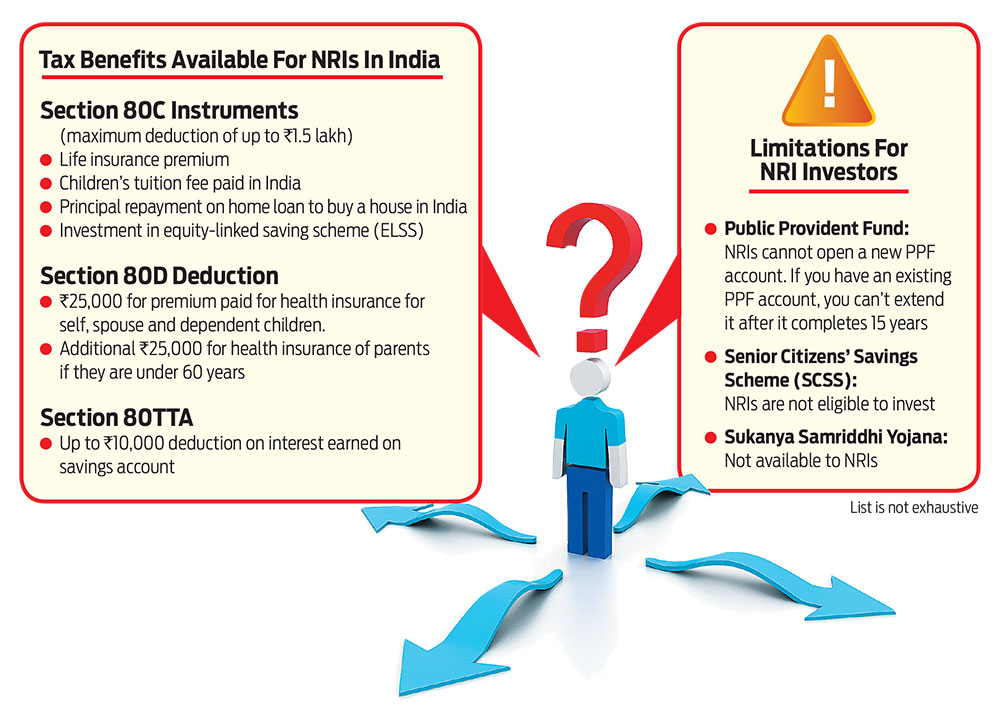

NRIs can get tax deductions on certain products, many of which come under Section 80C of the Income-tax Act, but there are others too (read Tax Benefits Available For NRIs In India).

There are some avenues where the rules differ for residents and NRIs. For example, Public Provident Fund (PPF). “An NRI cannot open a new PPF account. But existing investors, after becoming an NRI, can continue to invest in PPF till maturity and avail deduction under Section 80C. The facility to extend a PPF account after completion of 15 years is not available to NRIs,” says Arijit Sen, a financial planner associated with Merrymind, a financial planning firm.

Choice of investments should be based on suitability rather than just the tax benefits available. This applies to all investors, be it a resident or an NRI. “Choose investments based on your risk profile and asset allocation. Depending on this, one can decide on a product/scheme that gives best returns after taxes. Ease of ownership and liquidation should also be a guiding point,” says Sachin Parekh, a financial planner and founder of financial planning firm SNPFP.

“If the income from India does not affect your overall finances too much, then you should just look at lowering the tax payable,” says Parekh.

National Pension System (NPS) is an example of a product in which an NRI investor has to weigh the scale for suitability and taxability. “There may be more competent pension products available in the NRI’s country of residence,” says Sen. If as an NRI you still wish to invest in NPS, you can do so and avail yearly deduction up to Rs 50,000 under Section 80CCD(1B).

Education loan is an example of a product that is high on usability and tax benefits. An NRI can take an education loan for self, spouse or children or for any individual for whom the NRI is the local guardian. Along with this, “there is no limit on the amount that can be claimed as deduction (Section 80E). The deduction can be claimed for a maximum of eight years or till the interest is paid,” adds Kashyap. However, compare the interest rates in the home country before taking an education loan in India.

Things To Keep In Mind

Most investments and financial products are open to NRIs as they are to resident Indians. But one of the differences is that tax is deducted at source (TDS) for NRIs. “No payment can be made to an NRI without deducting this. If TDS is not deducted, the person making the payment is liable to bear penalties on the tax that had to be deducted,” says Bhagat. This is mandated under Section 195, which provides for deduction of tax on payments such as interest or any other sum chargeable to tax.

For example, “if an NRI sells a house property and earns long-term capital gains, the buyer shall deduct TDS at 20 per cent,” says Sen. However, in tandem, a tax benefit is allowed. “The NRI can claim capital gains exemption from sale of house property by investing in another house property (Section 54) or by investing in capital gain bonds (Section 54EC) if necessary conditions are met,” adds Sen. One does not have to invest the entire sale receipt; only the amount of capital gains needs to be invested to avail tax exemption.

NRI investors can also make use of the Double Taxation Avoidance Agreement (DTAA) benefits. Check if there is DTAA between the country where you work and India. Depending on the nature of income, an NRI can claim relief under DTAA.

Apart from these, there are investments that are tax-exempt, but whose details have to be mentioned in the tax return. These include interest earned on deposits in Non-Resident (External) (NRE) rupee account and Foreign Currency Non-Resident (FCNR) account.

Overall, if you are choosing financial products as an NRI, weigh the usability first, and then consider the taxability. Also remember that taxable as well as tax-exempt incomes have to be mentioned in the tax return. So, do remember to file tax returns and to include all relevant details.

pushpita@outlookindia.com