The festive season in India is not just about spending money on goodies and indulging your wants, but also about making investments. And when it comes to making investments during this time, gold is still on top of the list for most.

Over the years, gold buying has taken several different forms. First, many Indians have switched to non-physical gold and prefer to invest in instruments, such as Sovereign Gold Bonds (SGBs), and gold mutual funds and exchange-traded funds (ETFs). Second, gold in physical form remains a popular choice. For instance, it is considered auspicious to buy metal on the festival of Dhanteras. Similarly, gold jewellery is an intrinsic part of Indian weddings, and many Hindu families organise weddings in November. Third, with the age-old tradition of accumulating gold in India, many families pass on jewellery to the next generation, but the newer generation, typically, prefers to exchange the old ones with new ones by investing a little extra.

Since physical gold is still the popular choice during the festive season, let’s understand what exchanging gold jewellery entails and whether it makes sense to buy new jewellery instead.

The Process Of Exchanging

People exchange gold for different reasons—it could be about wanting to wear new designs, or because of wear and tear of old jewellery, or simply because of lack of adequate budget to buy new jewellery. In the process, people typically end up spending more money, which constitutes their incremental auspicious spending.

However, the process of exchanging gold jewellery may not always be smooth given lack of standardisation in the market.

If you plan to exchange your gold jewellery from the same jeweller from where you purchased it, then they usually give you the full value of the gold according to its purity and the prevailing market price, while you have to make an payment towards additional gold (if any), making charges and taxes on the new jewellery (see Cost Of Exchanging Jewellery).

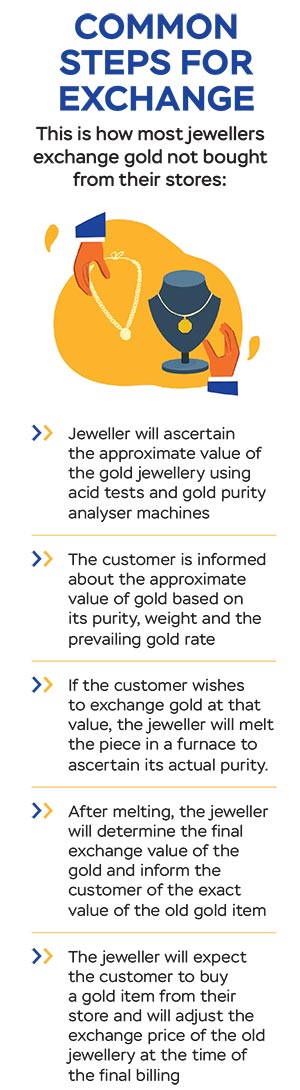

If you plan to exchange the gold from a different jeweller and not from where it was originally purchased, then you may have to undergo a different process, and it is important to understand all the details very carefully. Every jewellery may have a different set of terms and conditions though there are some commonalities (see Common Steps For Exchange). Also, most jewellers prefer to melt the old gold item to ascertain the purity and expect that you would buy another item from them in exchange.

Says Hareesh V., head of commodities at Geojit Financial Services, “The jeweller uses a digital or mechanical scale to measure the weight of the gold item. Knowing the weight is essential, because it is used in conjunction with purity to calculate the value of the gold. In India, gold is typically measured in terms of purity, with the most common purities being 24 karats (99.9 per cent purity), 22 karats (91.6 per cent purity), and 18 karats (75 per cent purity). Some jewellers may perform a scratch and acid test to confirm the purity of the gold.”

Reena and ronak Patel, Both 41, with children at their residence in Vadodara

The couple say the exchange process is more streamlined than it was before. In 2014, a jeweller offered them Rs 37,500 for an old gold chain. Recently, after tests, another jeweller offered them Rs 1.12 lakh

***

The most reliable way to determine the purity of gold in India is by looking for the hallmark certification on the jewellery or the gold items. “The Bureau of Indian Standards (BIS) provides hallmarking services to certify the purity of gold. Hallmarked gold is trusted for its purity,” says Hareesh.

Reena and Ronak Patel, both 41, a couple based in Vadodara, feels the exchange process is more streamlined now than it was 5-10 years ago. Says Ronak, who runs a construction business, “I remember the first time we approached a local jeweller to exchange a broken gold chain, way back in 2014. The 20-gram gold chain was gifted by my grandfather, so we didn’t know from which jeweller it was originally purchased. The local jeweller looked at the chain and by naked eye observation, he determined that the chain had 18K purity. He offered an exchange price of Rs 37,500 for my chain, based on the prevailing buying rate of Rs 25,000 per 10 grams for 24K purity gold. The gold price at that time was around Rs 26,500 per 10 grams.” They didn’t go ahead with the exchange then.

Recently, when they went to exchange the same chain, the jeweller put it in a gold analyser machine and told them the metal had 22K purity. “He asked us if we wanted to go ahead with the process of melting to know the exact value. After our consent, they melted the chain, and the purity was 22.1K. The market rate of gold on that day was Rs 60,500 per 10 grams, but the jeweller’s rate was a little higher at Rs 61,000 per 10 grams as their buying and selling rate was the same. We got Rs 1.12 lakh for that chain in exchange value,” says Ronak. He and Reena, who runs a bakery business, bought another gold item in exchange and the price of the old chain was adjusted in the billing.

Should You Buy New Gold Jewellery?

Should You Buy New Gold Jewellery?

Gold is an asset, which can add value to one’s investment portfolio. So, what should those who do not want to get rid of an old piece and can afford to buy new gold do?

Remember that investing in physical gold, especially jewellery, comes with the added cost of making charges, taxes and issues related to purity. Most of the jewellers from whom one purchases jewellery may offer 100 per cent exchange value, but they don’t return the 100 per cent value of gold in cash. If the customer asks for cash by returning the gold jewellery, they may deduct a certain percentage from the value of gold. This usually ranges from 3-5 per cent.

Says Dilshad Billimoria, board member, Association of Registered Investment Advisors (ARIA), and a Sebi-registered investment advisor: “Jewellery has sentimental and emotional value and is normally passed down generations, especially old jewellery designs. However, due to high making charges of 5-25 per cent, the cost of exchange is high. Besides, jewellery entails storage and locker charges, too.”

She adds: “Physical gold and jewellery are personal assets that don’t add to the value of net worth of an investor. Investing in gold bars or gold coins is a bit better than investing in jewellery.”

Also, when you buy jewellery as an investment, you will need to stay loyal to the same jeweller for exchanging it with new jewellery. Even buying coins and bars from banks can be a problem when you want to liquidate it. “Coins and bars once sold by banks are never bought back. Hence, customers are compelled to sell it outside and they usually deduct a huge amount in the name of wastage and melting charges. At the same time, if customers wish to liquidate their gold at the same jeweller from whom they bought, they usually deduct less charges,” says Hareesh.

Availability of more avenues has also taken away some of the sheen from investing in new gold jewellery. Neha (42) and Anand Jain (47), a couple based in Thane, Mumbai, who run a clothing and garment manufacturing business for the last three decades, exchange jewellery for ornamental needs. But for investments, they have switched to assets, such as mutual fund schemes and others. “Earlier, adding gold jewellery also allowed us an opportunity to diversify our investment portfolio. The gold rate from the year 2000 to 2010 was mostly below Rs 15,000 per 10 grams, but in the last 10-15 years, the price has more than quadrupled, so now there is no point in buying gold jewellery for investment purpose,” says Anand. The couple now prefers exchanging old gold jewellery for new if there is a requirement for a specific ornament.

Neha, 42; Anand Jain, 47 at their residence in Thane

The couple who run a clothing and garment business, previously bought gold jewellery to diversify their investments when gold cost Rs 15,000 per 10 gram. But now they do not buy jewellery for investment. Instead, they prefer exchanging old jewellery as and when needed

***

What Should You Do?

Experts believe that gold can be a good hedge against inflation, and investing in it can add the required diversification to one’s investment portfolio. But from an investment perspective, there are better options available in the market such as gold ETFs, SGBs, gold mutual funds, etc.

Says Billimoria, “Historically, gold prices have grown by 5-11 per cent depending on the state of the economy. In rising inflation, gold is a hedge, and from the point of asset allocation and diversification, gold is a good investment, but not in the form of bars or jewellery.” However, she says other asset classes, like fixed income, Public Provident Fund (PPF), and corporate fixed deposits offer the same asset allocation and diversification with better returns and liquidity.

In short, exchanging old gold can take care of your need for auspicious gold buying in physical form but you will have to stick to the same jeweller. You can use the rest to invest either in non-physical gold or look at other avenues. Keeping your investment and jewellery needs apart will help you decide.

The author is an Independent Financial Journalist