Retail investors these days are aware about most financial instruments—from insurance to mutual funds and now cryptocurrencies—with more and more companies pushing advertisements everywhere. Apart from being on billboards, television and newspapers, the advertisements flash on the boundaries of sports arenas, interrupt mobile games and pop up on every other app, from food ordering to booking.

The advertisement market is growing in size. GroupM, a US-based media investment company, forecasts the total ad spends across media in India to cross `1 lakh crore in 2022, with digital set to overtake TV as the largest advertising medium.

Most ads do what they are meant to—highlight the benefits of a product to attract buyers. “Advertisements not only affect the consumer psychology but also boost consumer confidence as people are shown gaining positive results, thus, pushing the demand further,” says Aditya Sharma, advocate on record, Supreme Court of India.

However, whether the ads familiarise retail investors with the nuances and risks of various products is a matter of debate.

The Advertising Standards Council of India (ASCI), a self-regulatory industry body, issues guidelines for various financial instruments from time to time, but these are not legally binding. Some financial regulators, including the Securities and Exchange Board of India (Sebi) and the Insurance Regulatory and Development Authority of India (Irdai), are doing their bit by upholding ASCI guidelines.

When Ads Mislead

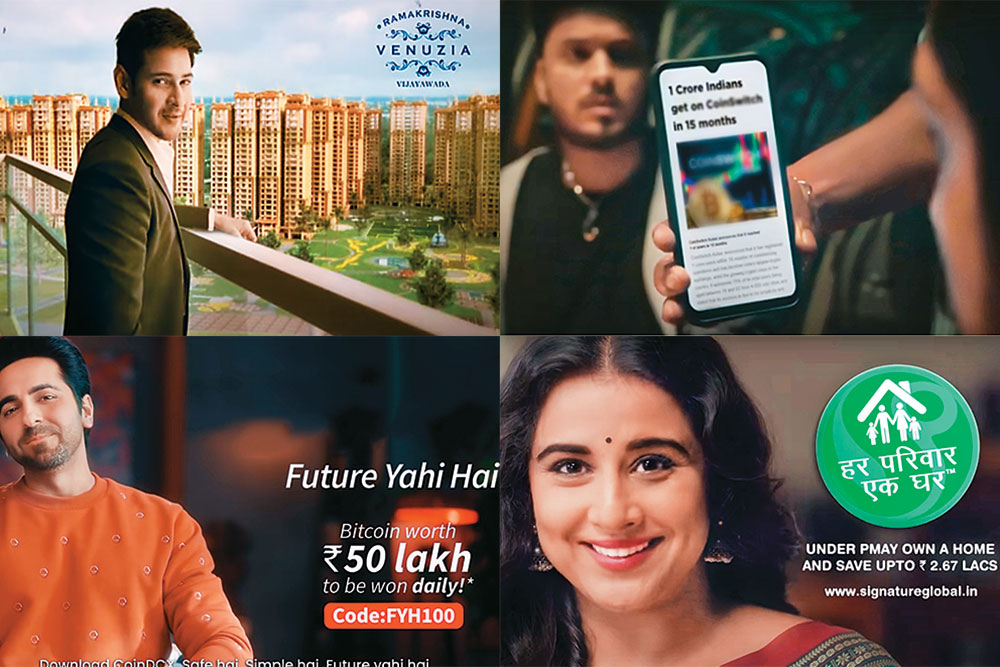

Making an emotional appeal to consumers is a common strategy applied across industries, especially insurance. Using the lure of celebrities is another tactic. While ads by real estate companies had a heavy presence of celebrities such as M.S. Dhoni, Mahesh Babu, Vidya Balan, Deepika Padukone, Shah Rukh Khan and many others, more recently, crypto exchanges have been using celebrities such as actors Ranveer Singh, Amitabh Bachchan, Salman Khan, Ayushmann Khurrana and Alok Nath and cricketers Yuvraj Singh and Sreesanth.

But many ads across products could be called ‘misleading’. For instance, one ad from a crypto exchange stated that the returns are four-times higher than what a fixed deposit gives. The ad was pulled out after some time. “Any specific claim has to be communicated very clearly and without any attempt at misleading the unaware consumer. Hiding important things in the fine print doesn’t help the consumer. So, it (ads) merits better monitoring and analysis,” says ASCI chairman Subhash Kamath.

There have been frequent complaints against misleading ads. Even Prime Minister Narendra Modi made a case against “misleading ads” in the context of cryptocurrencies last year.

“People have not quite understood the risks involved. To that extent, they are vulnerable, especially as celebrities, who enjoy a huge amount of trust and credibility from their fans, are involved,” adds Kamath.

ASCI lists out criteria for ads in any sector; for financial products, these are mostly about disclaimers. “For consumer protection, we will ensure that the ads shown to consumers do not mislead them. However, there could be other ways in which consumers could fall prey to fraud or get cheated, which is more in the nature of product delivery,” says Manisha Kapoor, Secretary-General, ASCI.

Pointing Out The Risks

Delhi-based design engineer Sourabh Sethi, 28, got convinced he should invest in cryptocurrencies after the Indian Premier League (IPL) series last year. The series was sponsored by some crypto exchanges and their ads frequently flashed during the series. Sethi caught on to the crypto buzz, but the ads didn’t give him any information about the other side of the ‘coin’—the associated risks.

“I started by investing `500 in Bitcoin and I was enjoying the thrill and the community around it. Soon, I ended up owning dog and cat coins, one of which became worthless after the Squid token rug pull,” says Sethi, who is now more informed about the risks. A rug pull happens when the developers of a cryptocurrency shut a project after amassing a sizeable amount of investors’ money.

As per ASCI guidelines, crypto ads are now supposed to carry disclaimers regarding the risky nature of the asset class similar to ads of mutual funds. Sebi rules mandate that the disclaimers in mutual funds’ ads need to be read and shown at a slower pace than earlier. “They read out the disclaimer very, very fast which you can’t even understand. The disclaimer should be prominent and at the same tone or speed as the rest of the advertisement. You can’t rush through a disclaimer, it loses the purpose of the disclaimer,” Union Minister Piyush Goyal recently said while addressing a National Stock Exchange event.

Real estate ads have to be based on the facts as revealed to Real Estate Regulatory Authority (Rera) and have the developer’s Rera registration number, among other details.

Crypto Disclaimers

In February 2022, ASCI introduced a set of 12 guidelines for the advertisement and promotion of virtual digital assets and services including cryptos and non-fungible assets. These are to be applicable on all ads released or published on or after April 1, 2022.

“These regulations/guidelines have a lot of persuasive value. Ads from crypto exchanges and other organisations will fully abide by them. (However,) the growth of crypto businesses is driven by numerous factors other than ads. So, ad guidelines will not impact the industry materially,” says S.C. Garg, former finance secretary of India.

Crypto exchanges agree that ASCI’s guidelines will be helpful as cryptocurrencies are complex and highly volatile. “The guidelines will go a long way in ensuring a high degree of maturity and responsibility among all stakeholders,” says Avinash Shekhar, CEO of ZebPay, a crypto exchange.

Some of the guidelines are that in print, the disclaimer has to be at least one-fifth of the advertising space. In video ads, the voiceover has to be at a normal speaking pace. On social media, the disclaimer is to be placed upfront at the beginning of the post. In formats with limits on characters, like Twitter, a shortened version has to be carried.

What Should You Do?

Ads are designed to attract people. But when it comes to investing, it’s better to take the road less travelled.

“Read and search (before investing) about the particular insurance, crypto or mutual fund product and also about the agency through which the investment is being made, to avoid frauds,” says Sharma.

Aryaman Vir, founder and CEO, MYRE Capital, a real estate firm, says one can’t rely solely on ads. “Misrepresentations (by real estate entities) have been penalised retroactively by courts and competent authorities in case of dispute between an investor and developer. It is highly recommended that you review the detailed terms and conditions before investing.”

Ensure you collect all details about the investment, including the name of the entity, copy of agreement-contract, and details of agents and stock operators. Check if they are registered with any exchanges and/or come under a regulatory authority, and if they have been involved in any dispute recently and what was the outcome, says Sharma.

Don’t be shy of asking questions—about the genuineness of the product, the returns it will offer, cost, risks and anything else you want clarity on. Try and get the promises in writing.

harsh@outlookindia.com