The financial year 2023-24 has already set sail, and before you embark on this new journey, it’s time to make sure everything is in order. A good starting point would be to assess your tax life.

If you think it’s too early to start thinking about it, you are mistaken. It won’t be long before your HR department sends you a reminder to declare your intended tax-saving investments and expenses during the year. From FY24, the new tax regime would be the default one. Since it does not allow any deductions or exemptions (except the standard deduction of Rs 50,000, which Budget 2023-24 proposed to introduce), the HR department may simply skip asking for declarations.

Whether the HR department reminds you or not would depend on its policy, but if you want to stay in the old tax regime—if that suits you—you better remind the accounts department in April.

Here’s why. If you choose the old tax regime, you would be doing so because it will help you save more. If you don’t make the declarations on time, your employer will deduct tax as per the calculation under the new tax regime, which may reduce your take-home salary.

Weigh Your Options

To be able to make that choice and inform your employer well in time, you will need to calculate your tax payable under both regimes and weigh which one is more beneficial.

While there is enough material available to help you make the calculation, including a tax calculator provided by the income tax department (https://bit.ly/3Tv5Olx), you would need to ask yourself two key questions to be able to run the calculations. One, the amount of deductions you can avail of and the allowances in your income on which you can claim exemptions.

How Much Deduction Can You Avail Of? The amount of deduction you can avail of could depend on many factors, such as whether you have a home loan or make the requisite investments.

“Most employees already have EPF (Employees’ Provident Fund), PPF (Public Provident Fund), insurance premium, school fees for children, home loan EMI, etc., which are considered for tax reduction (under the old regime). Everyone should do a cost-benefit analysis and decide which regime is better for them in this financial year and decide. For those who have an ongoing home loan, the old regime can be better,” says Melvin Joseph, Sebi-registered investment adviser and managing partner, Finvin Financial Planners.

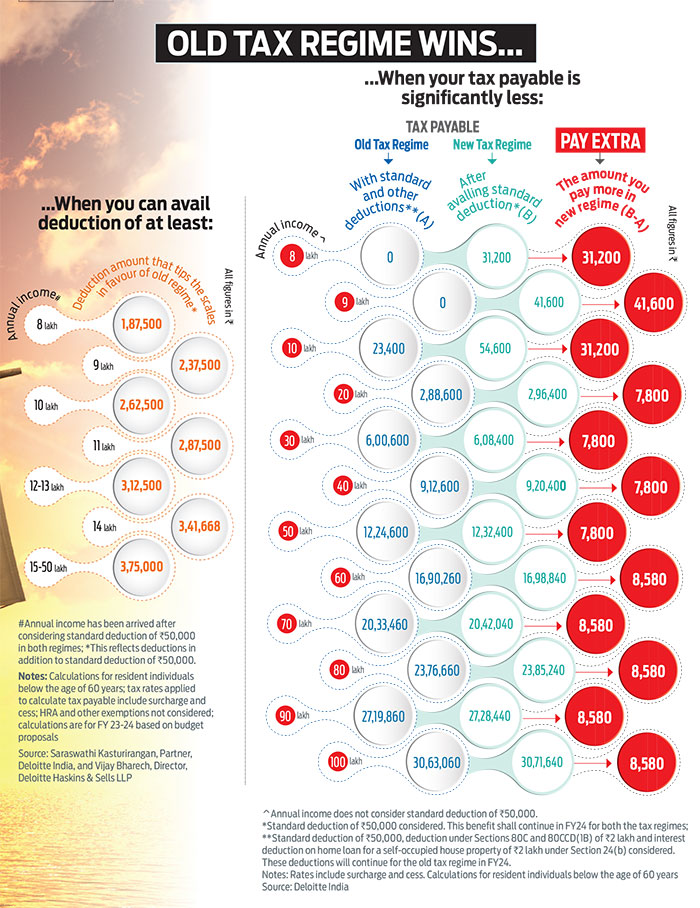

We have some numbers to help you decide the deductions you can avail of under the old tax regime. According to the calculations provided by Deloitte India, availing of deductions can benefit even those earning an annual income of Rs 8 lakh (after reducing it using the standard deduction of Rs 50,000), but only if these deductions total to at least Rs 1,87,500 (see Old Tax Regime Wins: When You Can Avail Deduction Of At Least).

The limit of minimum deductions that an individual needs to avail to weigh the scales in favour of the old regime keeps increasing at every income level but becomes stagnant at Rs 3,75,000 from Rs 15 lakh to Rs 50 lakh.

We considered annual incomes (after reducing them using the standard deduction of Rs 50,000) of Rs 8 lakh to Rs 15 lakh and then increased the income level by Rs 5 lakh each up to Rs 50 lakh to cover a wide set of readers. The Budget proposed to increase the rebate limit from Rs 5 lakh to Rs 7 lakh under the new regime, making annual income up to Rs 7 lakh tax-free, so we didn’t consider incomes lower than Rs 8 lakh.

“Under the new regime, from FY24, individuals with salary income up to Rs 7.5 lakh will not pay any taxes. This is because of the introduction of the standard deduction of Rs 50,000 for the new regime, and a tax rebate to resident individuals with taxable income up to Rs 7 lakh under the new tax regime. For others, the old regime could help if they have sufficient deductions and exemptions to claim,” says Saraswathi Kasturirangan, partner, Deloitte India.

Once you learn how much deduction you can avail of, you can use the income tax calculator to compute the exact benefits in the old regime.

What’s The Amount Of Allowances You Get? For the calculations, Deloitte considered only certain deductions as exemptions vary widely between individuals. But if you factor in exemptions on reimbursements against submission of original bills for fuel, travel, house rent allowance (HRA), etc., your annual income will reduce further.

The calculator on the income tax website can help you input those and make a comparison accordingly. Note that allowances against certain reimbursements may be allowed under both the old and new regimes.

Kuldip Kumar, personal tax expert and former national leader, global mobility practice, PwC India, explains: “Where the employee uses his own car for official and personal purposes, the taxable value is taken at actual expenses reimbursed to the employee as reduced by Rs 1,800 per month where the cubic capacity of the car does not exceed 1.6 litres and Rs 2,400 per month where it exceeds 1.6 litres. So, Rs 900 per month is deducted, and the driver’s cost is reimbursed. However, when an employee claims higher use of a car for official purposes, a higher deduction is allowed subject to maintenance of specified documentation. This applies in both old and new regimes.”

So, when using the calculator, reduce such allowances when entering the gross salary. For example, if you have an annual income of Rs 15 lakh, and have Rs 2 lakh of allowances on, say, fuel expenses, enter the gross salary as Rs 13 lakh. Enter other allowances, such as HRA and applicable deductions, in the required fields that follow.

Allowances can reduce the tax payable significantly under the old regime. In the above example, if your HRA is, say, Rs 3 lakh per annum and you maximise your deductions to Rs 3.75 lakh (other than the standard deduction of Rs 50,000), the total income reduces to Rs 5.75 lakh under the old regime as compared with Rs 12.5 lakh under the new regime, according to the tax calculator on the income tax website. Consequently, the total tax liability under the old regime will be around Rs 28,000 against about Rs 1 lakh under the new regime.

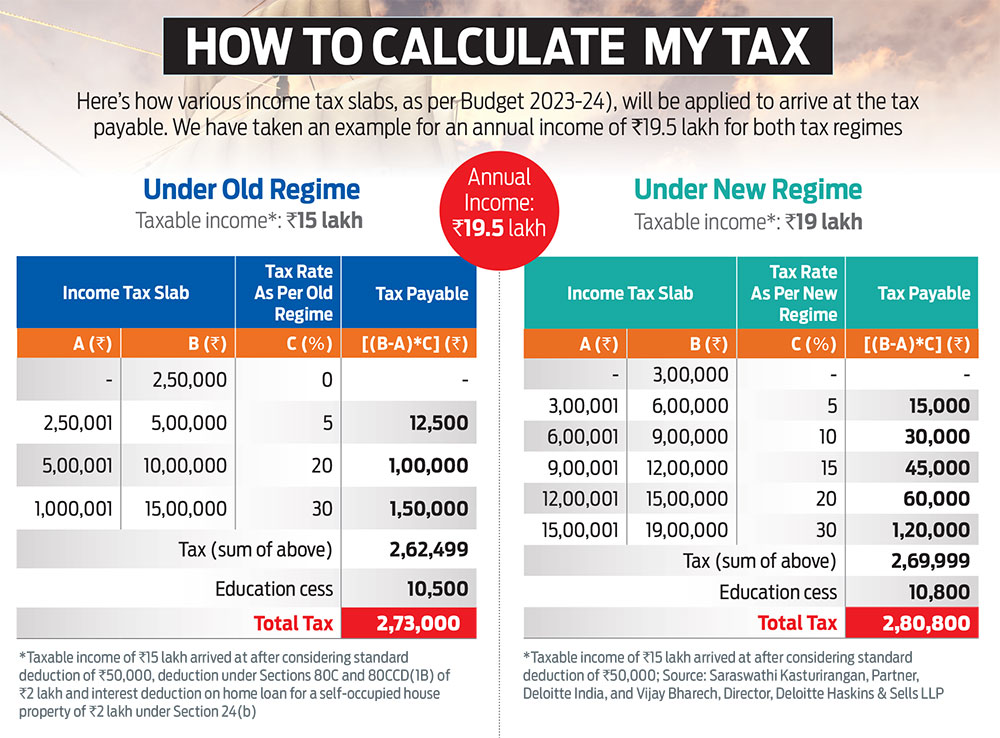

You can also do your own calculation by applying various income tax slabs under both regimes and comparing (see How To Calculate My Tax).

What Should You Do?

Old or new tax regime, there would be taxes to pay throughout the year if you are in the higher salary brackets. Having an idea of how much tax you will need to pay will ensure you can divvy it up instead of paying large instalments at the end of the year.

While your employer may do its calculations and start cutting your taxes if you make proper declarations, income other than that from the employer, such as house rent or income from investments, will have to be dealt with by you.

“Everyone should carefully plan for this in April 2023 itself and decide which regime is better for them for FY24. Without committing to any new investments, ongoing investments and home loan EMI itself will make the old regime better for some investors. Others can opt for the new regime if it is better for them,” says Joseph.

The numbers show that the old tax regime will still be beneficial for most people, provided they invest in tax-saving instruments and avail of allowances above a certain limit.

But if you are in the lower tax bracket or do not have enough money to invest in tax-saving instruments or relevant expenses that can help you save tax, you can stay with the new tax regime.

“For employees who have a salary of more than Rs 8 lakh, the new regime will be beneficial in case they are well-capitalised and do not wish to take a house loan, or wish to invest as per their choice or do not wish to do a lot of paperwork for tax purposes,” says Vivek Jalan, partner, Tax Connect Advisory, a multi-disciplinary tax consultancy firm.

In such cases, you may not have to do anything except intimate the HR or accounts department if it asks you to.

If you opt for the new tax regime, you will not need to invest to save taxes. “Tax planning was a motivating factor to kickstart the investment journey for the middle class. Traditionally, most middle-class employees start their first investment with ELSS funds, life insurance policy and PPF with an immediate benefit of tax savings under Section 80C. From there, they moved to the world of investments in mutual funds etc.,” says Joseph.

Since there is no such motivation anymore, be conscious of the change and start investing towards your goals. And that is something that every citizen may have to learn going forward when the switch to the new tax regime is complete.

nidhi@outlookindia.com