The government seems to have put its weight behind equities in the tug of war—being played out in the minds of investors, especially the Gen-Z and the younger millennial generations—between the two riskiest assets, equities and cryptos. The Union Budget 2022 introduced a steep tax rate of 30 per cent on virtual digital assets, including cryptocurrencies and non-fungible tokens (NFTs), while giving a slight relief on long-term capital gains (LTCG) tax levied on unlisted equities; for listed securities, the LTCG tax rate is 10 per cent, subject to conditions.

While the gap in the tax rates is significant, the scales are already tipped in favour of equities when compared with cryptocurrencies. Taxation just adds another hurdle for cryptocurrencies.

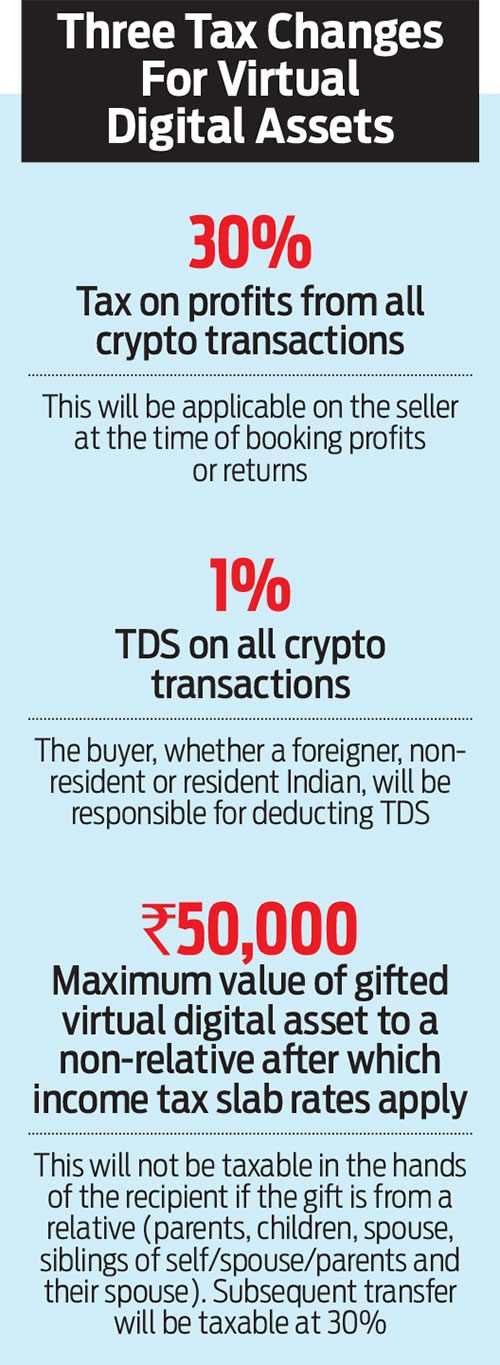

“Virtual digital assets will be taxed at 30 per cent. Only the cost of acquisition can be reduced while computing the gain. Further, no other expenditure can be claimed as a deduction. Also, no set-off of any loss is permitted against these gains,” says Sudhakar Sethuraman, partner, Deloitte India.

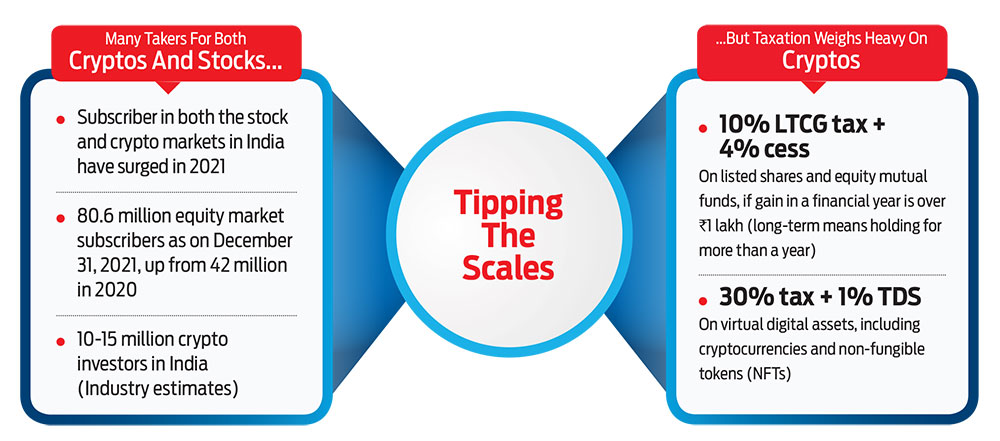

Both the stock and crypto markets in India saw a surge in the number of subscribers in 2021. The number of equity market subscribers were up from 42 million in 2020 to 80.6 million as on December 31, 2021. India ranks second in crypto adoption globally, according to Chainalysis Report 2021. Also, it is estimated that there are about 10-15 million crypto investors in India. Most of these investors are from the younger generations. According to the 2021 user data collected by Paxful, one of the world’s leading peer-to-peer crypto marketplaces, 32.21 per cent of crypto traders are reportedly 18-24 years old, while another 32.76 per cent are in the 25-34 age group.

Equities In Leading Position

Less risk: The quantum of risk in equities and cryptocurrencies is not comparable—but investors who are lured by quick gains and the buzz around cryptocurrencies don’t necessarily keep that in mind. Cryptocurrencies remain unregulated and are riskier than equities, which are traded in a regulated environment. Moreover, the costs for investing in cryptocurrencies are often ignored (read Peeling Off Cost Layers Of Crypto Investing, on pg 36). The cost of investing in equities is minimal.

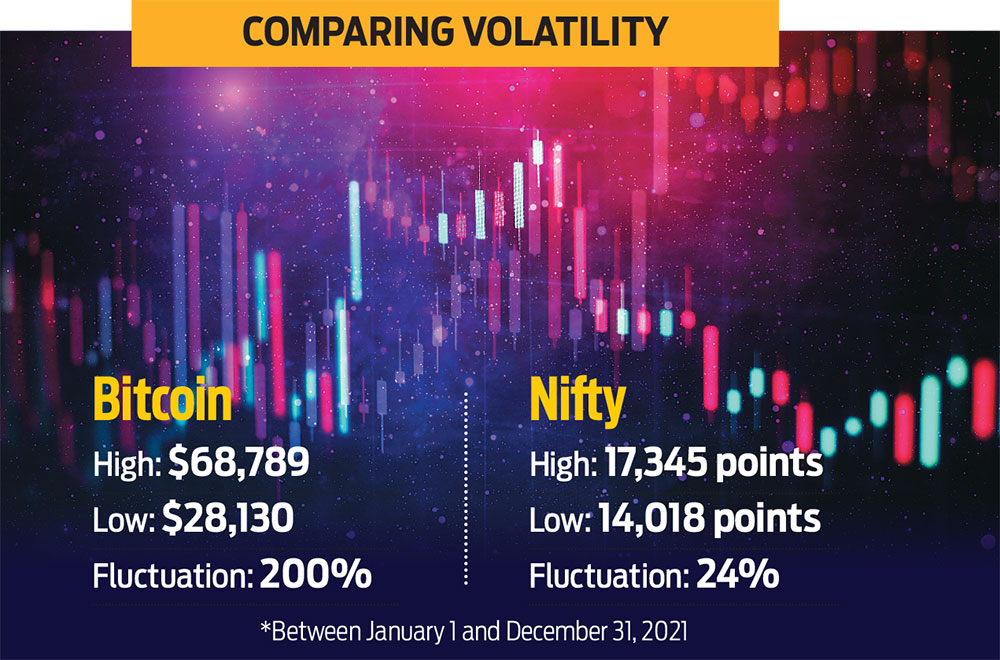

Less volatility: Volatility is another aspect that puts equities at an advantage. Historical data suggest that crypto is more volatile than equity. Between January 1 and December 31, 2021, Bitcoin, the world’s oldest cryptocurrency, touched a high and low of $68,789 and $28,130, respectively. This is, technically, a fluctuation of over 200 per cent in prices on the higher side. In contrast, the broader stock market index Nifty moved in the range of 14,018 on the lower side to 17,345 on the higher side over the same period. This shows about 24 per cent fluctuation in the value of Nifty.

Here’s another data point that shows how volatile cryptos are. On September 29, 2021, the price of Bitcoin was $41,041. This went up to $67,553 on November 9, 2021, a rise of over 65 per cent in less than two months. It then fell to $47,128 on December 31, 2021, a fall of 30.23 per cent.

Less tax: The Budget has offered tax relief to investors in capital assets (other than listed shares and equity mutual funds or MFs) by capping the surcharge levied on LTCG at 15 per cent. According to an EY report, the highest LTCG tax rate will reduce from 28.5 per cent to 23.92 per cent. The Finance Act 2019 had enhanced the surcharge for all sets of investors–individuals, Hindu Undivided Families (HUF), Associations of Persons (AOPs) and Body of Individuals (BOIs)–to 25 per cent and 37 per cent where income exceeds Rs 2 crore and Rs 5 crore, respectively.

Listed shares and equity MFs attract LTCG tax at 10 per cent and 4 per cent cess, respectively, provided the gain in a financial year is above Rs 1 lakh and the equities are held for more than a year. In other words, gains below Rs 1 lakh are tax-free if the holding period is more than a year.

According to experts, the difference in taxation makes equities more attractive. “On the tax front, the simplification on LTCG tax would be a key feature. Also, taxation on virtual digital assets will make equity more attractive, especially to the millennials,” says Anoop Bhaskar, head-equity, IDFC Asset Management Company.

Highly regulated structure: Regulatory framework gives equity investing an added advantage. Every entity, be it a stock broker or an MF or any other market participant, has to be approved by the market watchdog, the Securities and Exchange Board of India (Sebi). This structure helps avoid the risk of dishonest activity at all levels. Cryptocurrencies, however, are completely unregulated.

The Crypto Party Over?

Some seem to think so. According to former finance secretary S.C. Garg, “There was nothing on the crypto Bill in the Budget but taxation (on cryptos) at 30 per cent (came in). The party seems to be over for crypto assets and exchanges.”

The Budget not just levied a 30 per cent tax on profits from all crypto transactions, but also announced a 1 per cent tax deducted at source (TDS) on them. Besides, gifting of virtual digital assets worth more than Rs 50,000 to a non-relative will attract tax at the slab rates.

“While the proposed taxation can be a dampener, a bigger negative would be the continuing downtrend in crypto trading. For an asset class with an active trading history of less than a couple years, ‘Buy on Dips’ could still be an untested trading strategy,” says Bhaskar.

Some feel it may be tough only for those in the lower income tax slabs. That’s a cause for concern, given the high proportion of young investors in the total crypto investor pie. “Small investors and those who would ordinarily not need to pay tax, will now be required to pay 30 per cent. This will discourage them. It could be onerous for those in the lower tax slabs. So that doesn’t ring right,” says Ajeet Khurana, a crypto advisor

and investor.

The distrust factor: The Budget announcements clearly outline the suspicion that the government has regarding cryptos issued by any stakeholder other than the government, and the need for tracking transactions in the space.

Finance Minister Nirmala Sitharaman, in the press conference on Budget day, said, “A currency is a currency only when it’s issued by a central bank. Everything outside are assets created by individuals, and in transacting those assets, the profits will be taxed.” The Budget also announced that the Reserve Bank of India will launch a digital currency in the financial year 2022-23. “(The aim is) tracking every trail of money… every transaction will have a TDS in the crypto world… Distinctions (between government-issued currency and other virtual assets) are very clear,” she added.

Experts Outlook Money spoke with agree that the main intention of the finance minister behind introducing 1 per cent TDS was to track crypto transactions so that the government won’t have to depend on crypto exchanges to collect data of each transaction and

the volume.

“Through TDS, the government can keep track of the crypto transactions, and collect the data, which might also help them in making crypto-related regulations in future,” says Avinash Shekhar, CEO of ZebPay, a crypto exchange.

Amit Jindal, partner, Felix Advisory, Project Management Group-Apiary (Blockchain Centre of Excellence), Software Technology Park of India (Government of India), explains further. “The TDS provision will enable the government to regulate and monitor the transfer of VDAs (virtual digital assets) to collect revenue. Rate of 1 per cent on transfer of VDAs is in line with the TDS applicable on transfer of immovable property,” he says.

TDS will be applicable under Section 194S of the Income-tax Act, 1961. It will be applicable on all transactions after July 1, 2022. The other two taxes–30 per cent tax and income slab rates on virtual asset gifts of over Rs 50,000–will be applicable from April 1, 2022.

Future of Cryptos

While the taxation rate of 30 per cent is steep, this may be the first step towards crypto regulation.

“The tax provisions for VDAs in India is just a temporary first step, which will lead to rationalisation eventually… At the same time, several people who were holding back from investing owing to (lack of) regulatory clarity, might feel that they have a green signal. On the whole, I think this will lead to increased volumes,” says Khurana.

But will taxation push VDAs into the legal domain? Purushottam Anand, advocate and founder of Crypto Legal, clarified that India’s Income-tax Act is ambivalent about the means of acquiring income. “Incomes derived from legal as well as illegal activities are liable to be taxed. This means that the legality or illegality of a transaction is irrelevant while computing the taxable income of a person,” he said. For instance, most forms of gambling and lottery are illegal in India, but the gains from those are subject to tax.

All in all, the Budget has raised many questions about the future of cryptos in India.

kundan@outlookindia.com