If you think that the insurance policy you bought doesn’t quite align with your goals, you may surrender it. But that comes at a cost. Here’s why you should do the calculations

One of the biggest challenges that investors in insurance policies face is the lack of liquidity. Though they are allowed to surrender their policy at any time, the charges to do so are so high that most prefer to remain locked into it. Such situations are not uncommon because a lot of policies are pushed to young people by their elders, or, mis-sold with the promise of higher market-linked or guaranteed returns.

So, when the Insurance Regulatory and Development Authority of India (Irdai) issued a proposal in December 2023, reducing surrender charges—which meant an increase in the surrender value (SV)—the move was welcomed and considered a step in the right direction. Irdai proposed a guaranteed surrender value (GSV) and asked insurers to refund premiums exceeding a certain threshold to policyholders.

But the hopes of receiving a higher SV were dashed when Irdai seemingly gave in to industry pressure and came up with the final surrender norms in March 2023, which are broadly in line with the existing ones.

Since nothing has really changed now and Irdai’s final move is not to the advantage of policyholders, the onus is once again on investors themselves to do their due diligence in the face of mis-selling and understand complex policies on their own.

But Mahavir Chopra, founder, Beshak.org, an insurance platform, doesn’t think that increasing the SV is a solution to mis-selling. “It will be like treating the symptom, not the disease. If the focus is to encourage need-based purchase of insurance and reduce mis-selling, increasing SV won’t solve the problem. In fact, it can be used to mis-sell further. A higher SV will also reduce returns for serious customers. The real solution is to enforce clear communication of benefits and limitations in a plan with customers before they buy, and to enforce persistency-linked commission and revenue structures.”

The regulator, on its part, said that insurers must improve disclosures and transparency and ensure the customer gets correct information regarding the policy’s terms and conditions, including those related to surrender.

The fact that customers need to be aware and be conscious about what they are getting into has been highlighted often. In an interview with Outlook Money in January 2024, Anup Bagchi, managing director and chief executive officer of ICICI Prudential Life Insurance, said, “Customers need to have clarity about the kind of protection they are looking for. In fact, there are hardly any complaints when people are buying for protection. Even in the case of annuities, there are no complaints because buyers know that they are paying a lump sum, and will get back some money every month, or the nominee will get the money if they were to pass away. Similarly, for guaranteed products, they know they are paying for, say, five years and will get an x amount at the end.”

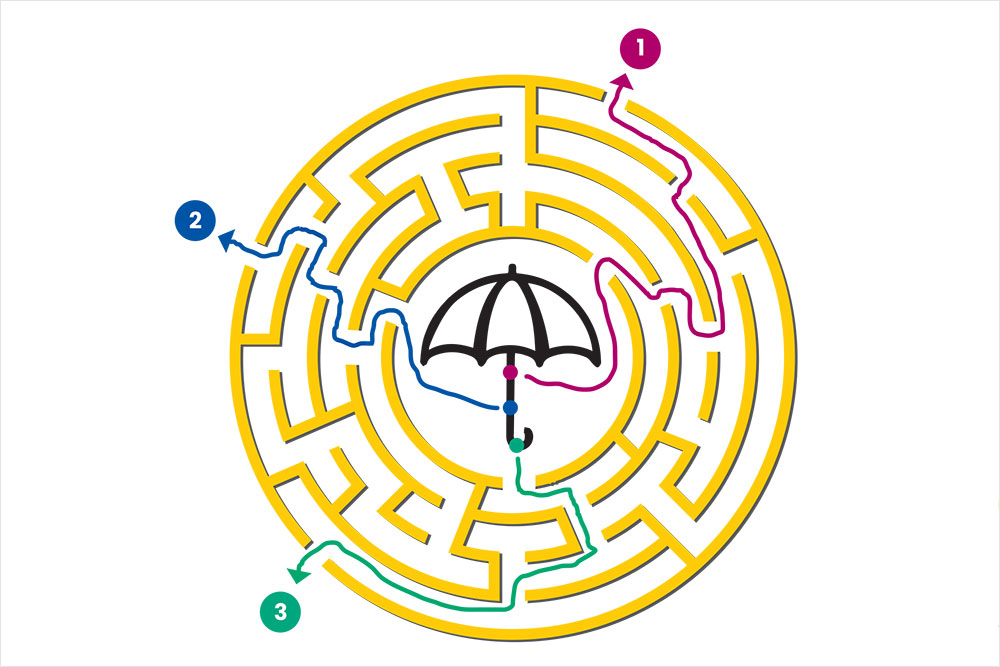

So, if you are among those who were planning to surrender your policy, here are three things you must absolutely check so that you are able to make an informed decision.

Check The Surrender Terms

Different types of policies may have different terms and conditions for surrender. SV will also differ from policy to policy depending on the structure of the policy, and the surrender terms.

For instance, most endowment policies require a minimum of two years of premium payment to be eligible for surrender. “Usually, the amount received in these is very low,” says Kiran Telang, Mumbai-based Securities and Exchange Board of India-registred investment advisor (Sebi-RIA).

If you have a unit-linked insurance plan (Ulip), the surrender rules will depend on when the policies were bought, as there have been several changes over the years, says Telang. “The best solution is to read the terms and conditions in the policy document. At present, if policies are surrendered before five years (considering that’s the lock-in), the funds are shifted to a discontinued policy fund and the payment is made to the investor after the completion of five years of the policy,” she says.

Check The Surrender Value

There are two types of surrender value that insurers, typically, offer—GSV and special surrender value (SSV). “GSV is known upfront at the time of policy purchase. SSV is a higher amount that may be paid out in case of surrender. SSV takes into account the accrued bonuses and, hence is usually higher than GSV. Since bonuses accrue over a period of time, the difference between GSV and SSV is very little in the initial years, but increases with time,” says Telang.

But all that doesn’t change the fact that the cost of surrender is high in India (see High Cost Of Surrender).

Compare Returns

The returns from endowment policies are, typically, in the range of 5-6 per cent. Depending on the type of the policy, it may or may not be mentioned in the policy document. So, to calculate the returns, one should look at the inflow and outflow of funds and then do an extended internal rate of return (XIRR) calculation. Now, look at the returns of the final SV you are getting. You can seek the help of an advisor to do this.

In most cases, it may make sense to compare returns from the investment of future premiums and the lump sum SV, if you are surrendering just because you think you are caught in the wrong product. The cost-benefit analysis needs to be done keeping in mind the years you have spent in the policy (see Compare Your Returns).

It’s Not Just About Cost

Consider other factors too when surrendering a policy. “Whether one should drop from a policy or continue depends on whether it was bought consciously and aligns with the policyholder’s financial goals. One should get the policy reviewed for its features and limitations and then decide,” says Chopra.

In certain situations, it may make sense to continue with the policy. “When there is a need to cover the risk of death and there is no other policy that already exists, or can be bought, it makes sense to stay with the policy,” says Telang.

So assess your situation, take stock of how long you have already spent in the policy, and check the terms and conditions before deciding.

With inputs from Meghna Maiti