The stock markets have been gaining ground since the updated OLM Elite was featured in April. The gains are visible in all the funds, which should instil confidence among investors. However, the ups and the downs of stock market movements should not hamper your long-term investment aspirations too much, as the real test of achieving your financial goals is to stay through the course of the investment plan.

For those of you who are joining in late, the OLM Elite is a perennial work in progress to ensure investors have an updated and relevant list of funds to pick from. The Elite list is a collection of mutual fund schemes that have been arrived at based on five types of investors: Beginner, Safe Player, UltraCool, Adventurer and Fixed Guns. Each investor stereotype addresses a core investment need without being constrained by the number of funds to meet those needs. For starters, these five categories have handpicked funds for each investor type to choose from.

The idea of such a nomenclature is to ensure that, just like whether it is an 8-year-old or an 80-year-old, the chances of them effortlessly using an Apple product like the iPhone is very high—whatever be the type of investor you are, you should be able to select mutual funds to invest in. The OLM Elite has emerged based on reader queries that are typically intended to know the best mutual fund to invest in. There is no simple answer to that. There is no single mutual fund that can achieve all the financial goals one has.

It’s been two years since we started this feature and so far the ins and outs from the fund list have been negligible, which holds to our conviction of selecting funds that are tested over time and have the necessary traits to face the challenges of time. To be relevant with changing times, there is scope to increase the investor types as well as the funds within each of these categories. The current list is an investment aid and does not constitute advice or a personalised recommendation to invest.

Keeping it simple

To sift through more than 2,000 mutual funds to select a fund to invest in and to make investing in mutual funds as easy as navigating an iPhone or iPad, we set about understanding investor concerns. The focus on making fund selection simple was to provide the investors with an experience of fund selection which is similar to using an Apple product, where you rarely need a manual to start operating the device. For that matter, the Elite list solves every investor’s problem by categorising funds into groups that are reflective of an investor’s state of mind when it comes to investing. It is a mix of the risk they can take and the investment time frame that they have.

A lot of behavioural science research is pointing to the lesser the-better scenario. In his 2004 book, The Paradox of Choice - Why More is Less, American psychologist Barry Schwartz argues that eliminating consumer choices can greatly reduce anxiety for shoppers. The experience is no different when it comes to investors looking to invest in funds. Changing needs of investors has resulted in the birth of the Elite list. The OLM Elite aims to concentrate investors’ attention on a sensible number of high quality funds—a shorter menu containing what we believe are the best funds to suit investor profiles.

Fund selection

If you are already investing in the funds selected in the OLM Elite, it is a good time to check how your selection is faring. If you are encountering the list for the first time, it could just be the right time to pick a fund from a portfolio that matches your investor profile. To ensure funds are viewed with a minimum investment horizon of three years, you will find that the performance of the funds does not indicate a one-year return, which could give a very different picture compared to reality.

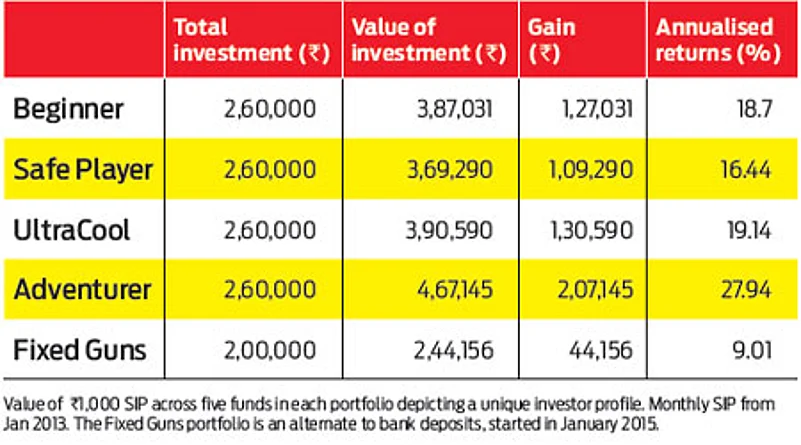

The systematic way to investing in mutual funds is well established and to benefit from that, we set about investing in the Elite list from January 1, 2013 to have a four-year history and performance built into the selected fund schemes. Each fund has a Rs 1,000 SIP in it, and the combined impact of the portfolio is there to see. Of course, the SIP route did not make sense to the Fixed Guns, who are actually looking for a substitute to bank deposits. In case of Fixed Guns, a lump sum investment of Rs 50,000 was considered starting on January 1, 2015.

A lot of rigour and testing went into the fund selection, which we have kept you out of, because what you need to know is a fund that will help you achieve your financial goal and not necessarily what it does. Every fund chosen has a minimum three-year history, with most having a much longer history. We have adhered to the mutual fund disclaimer on past performance and brought in an element of quality, based on our experience by speaking to fund managers to list funds that we think are most likely to outperform their peers in future.

All funds are in regular schemes and growth version. Each fund in the following pages reflects the basic data with its name and the fund’s performance over different time periods and the gain an SIP investment has made since starting these portfolios. One more thing that we have done away with is the mention to the fund classification of large-cap or mid-cap because such nomenclature varies across AMCs and mean little to investors. You will also not find any star ratings mentioned, because ratings are dynamic and change every month.

We believe the Elite list is like choosing from a fast food menu, we are sure of what we are offering. Our less-is-more approach to arriving at this list will be handy and useful without a doubt, something which will also find a more frequent update on our website in the coming months. Happy Investing!