While Indians love to invest in physical gold, even mutual funds offer the option, but in paper format. In India, gold funds are, typically, of two types—gold exchange-traded funds (ETFs) and gold fund of funds (FoFs). Gold ETFs track the price of gold and are backed by actual gold bullion, while gold FoFs invest in gold ETFs. A third type is World Gold FoF. It invests in stocks of companies involved in gold mining and production.

While you need a demat account to invest in gold ETFs, the other two options can be bought through fund houses directly.

Types of Gold Funds

Gold ETFs: These track the price of physical gold, which is the underlying asset. The concept of gold ETFs was first introduced in India by Benchmark Asset Management Co.

Gold FoFs: They invest in the units of gold ETFs, thereby eliminating the need for one to have a demat account, unlike in the case of gold ETFs, for which one will need a demat account. However, the fund management charge in gold FoFs may be a little higher than that on gold ETFs.

World Gold FoF: These invest in shares of gold mining companies across the world. So, just like in any other mutual fund, the net asset value (NAV) of this fund depends on the prices of stocks held in these mining companies.

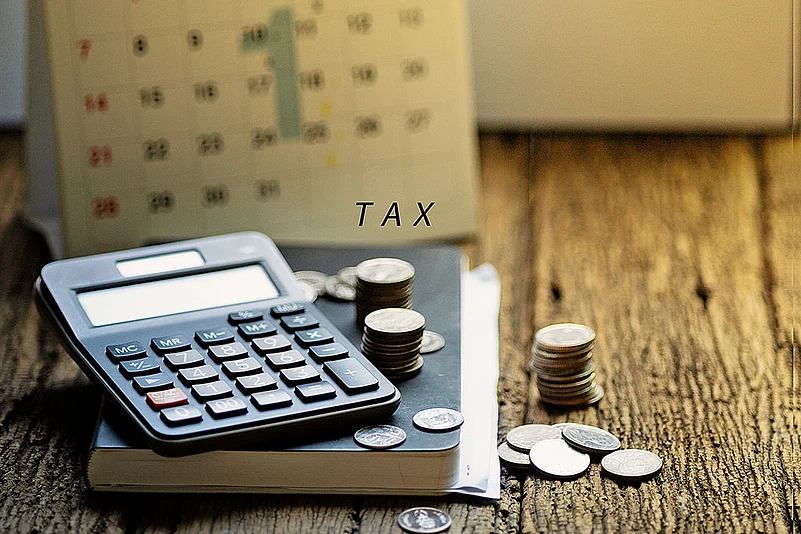

How Are Gold ETFs Taxed?

STCG Rule

Gains from units bought between April 1, 2023, and March 31, 2025, would be taxed at the tax slab.

Gains from gold ETFs bought after March 31, 2025, and sold within a year will be taxed at the slab rates. For gold FoFs, the holding period is 24 months.

LTCG Rule

Slab rates will apply on gains from gold ETFs bought between April 1, 2023 and March 31, 2025.

Gold ETFs bought after March 31, 2025, and sold after a year will invite 12.5 per cent tax on the gains. However, for Gold FoFs, the holding period is 24 months to qualify for LTCG.

Should You Invest in Gold ETFs?

Out of all the options, gold ETFs are the most popular because of the convenience they offer. There are several reasons for that.

One, their value is closest to the value of physical gold as they are backed by the asset.

Two, it’s a secure option that eliminates the potential for theft or loss, and saves the cost of maintaining a bank locker.

Three, it’s a liquid instrument compared to physical gold, as you are free to sell the units during market hours.

However, you should consider the expense ratio and tracking error before choosing a gold ETF.