This fund is contrarian, as is mentioned in its name. It basically means that the fund will not invest in popular sectors or themes of the day, but will go against the flow of the market. Investments are in out-of-favour themes, sectors and stocks based on the potential the fund foresees in such investments. In its ten year history, the fund has witnessed its share of downs and ups to have successfully gained over time.

The fund manager takes a valueoriented approach to investing, based on strong internal research and stock selection practices. Adequate care is taken to identify potentially undervalued stocks across sectors and then adopting a hold approach before these stocks find favour with the market and grow immensely in value. A peep into the portfolio indicates investments in stocks that are either in a turnaround phase or just below their fundamental value. Investments in Ramco Cements, MRF and VIP Industries are all that meet the contra criteria adopted by this fund.

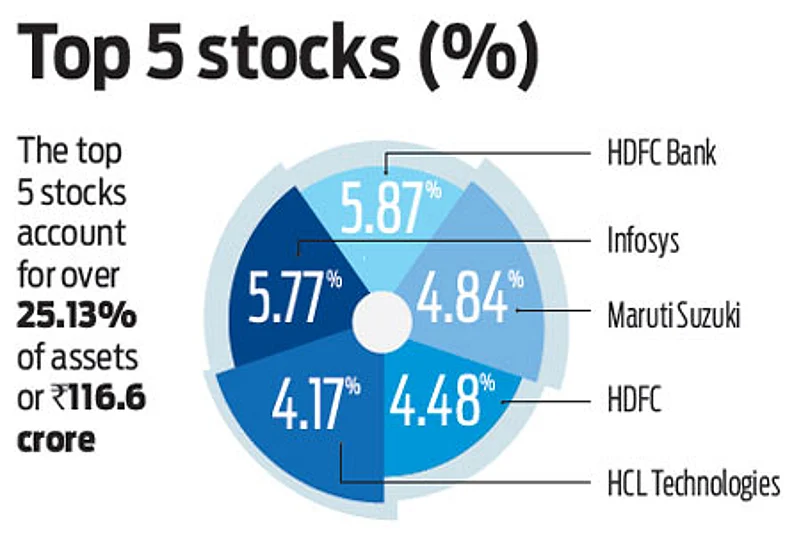

Finance, auto and software are the major sectors in which the fund invests with S&P BSE 500 as the benchmark. The fund manager has the flexibility to build a portfolio that is significantly different from that of its benchmark constituents. Analysis on the portfolio indicates that the stock and sector selection was based on the economic turnaround bet, which is yet to fully play out. At Rs 464 crore assets, the fund size is nimble for the contra bet to be exploited.

The returns of about 15 per cent since inception may not seem high given the risk associated with investing in such a fund. However, the fund made a debut in trying circumstances of the 2007 euphoria, only to face a poor market condition a year later, hampering its performance heavily in its initial years. The fund has braced well to changing market conditions and has created a unique position for itself in the past decade to consider investments with a long-term view.