By Dr. Arti Omar Chakraborty,

Cultural Significance of Gold

Gold has always possessed considerable cultural and economic significance in India. In Indian culture, gold symbolizes prosperity. With the impending festival season in India, notably Dhanteras and Diwali, the enthusiasm for gold escalates significantly. Traditionally, many Indians believe purchasing gold during Dhanteras and Diwali fosters prosperity and affluence. This cultural backdrop boosts physical gold sales. This article highlights how the interaction between cultural norms, market attitudes, and investment tactics within India's evolving financial landscape drives Gold ETF inflows.

Exchange-Traded Funds

Exchange-traded funds have become a prevalent contemporary investment option among investors. As more investors, especially millennials, embrace modern investment avenues, contemporary financial products offer a simple way to diversify their portfolios. Nonetheless, ETFs are also famous for their convenience and ease of trading. They are also well-known financial products that offer ample liquidity. Gold ETFs are one of the modern investment avenues, providing investors the opportunity to participate in the gold market without the hassles of storage and security associated with physical gold.

Market Sentiment and Gold ETFs

In a bullish market, investor confidence generally increases, leading to a transition from safe haven assets to equities and commodities, such as gold. The rising gold prices attract speculative investments. During Dhanteras and Diwali, this effect is magnified as traditional gold purchases spike significantly. A growing awareness of the advantages of Gold ETFs and ease of investment, coupled with the marketing efforts of financial institutions around Dhanteras and Diwali, creates fertile ground for Gold ETF inflows in India. Data has shown significant inflows in Gold ETFs during this festive period in recent years. The correlation between the festive season and Gold-ETFs' performance underscores the importance of cultural factors in shaping market dynamics.

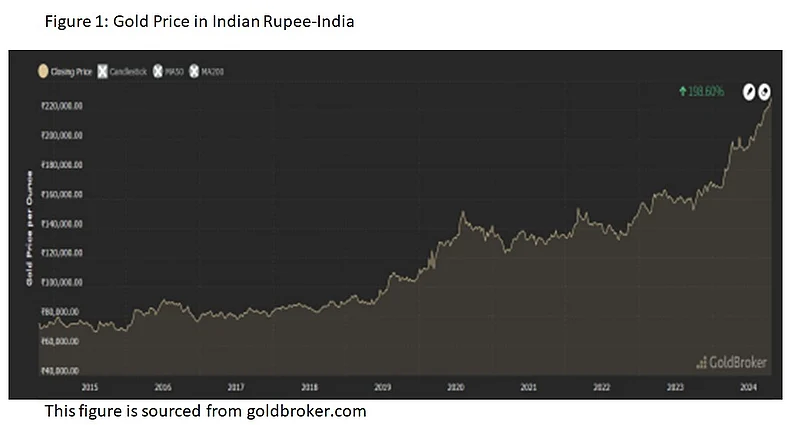

The historical performance of Gold ETFs has demonstrated resilience and substantial returns over the years, with a 5-year return of 10.15% and a long-term annualized return of 5.85%. Gold ETF inflows typically spike by 25–30% during October–November, coinciding with Dhanteras and Diwali, due to cultural practices and increased demand for gold. Gold ETFs have closely mirrored gold prices, offering an attractive investment option with lower volatility during economic uncertainties. Physical gold, while showing significant long-term price appreciation, demands attention to storage and security. Rising gold prices leading to these festivals do not deter investment in ETFs, reflecting solid cultural affinity and perceived investor attitude towards modern investment avenues.

Global Stimulus

The Ukraine-Russia war has had several impacts on Gold ETFs and the broader gold market. Economic sanctions and geopolitical risks have contributed to greater market volatility and currency fluctuations. The war has also impacted global supply chains and energy prices, leading to inflationary pressures. The inflationary conditions typically drive investors toward safe-haven assets. Gold is often seen as a hedge against inflation and uncertainty, further boosting Gold ETF performance and its attractiveness to investors. Prolonged conflicts between Ukraine and Russia and the United States presidential elections have changed long-term investor sentiment regarding economic stability. It has further spurred higher demand for gold and Gold ETFs among investors seeking diversification and hedging against inflation, currency fluctuations, and uncertainty.

Regulatory Support and Digitization

Other key factors driving Gold ETF inflows include regulatory support from the Indian government, which has implemented policies that promote financial inclusion and encourage investments in securities like ETFs. Simplified procedures for investing in Gold ETFs and tax benefits further enhance their appeal. Second, the rise of digital platforms has made buying and managing Gold ETFs easier for investors. Mobile apps and online trading platforms allow seamless transactions, attracting a tech-savvy generation eager to invest.

Concluding Remarks

The confluence of Dhanteras and Diwali, a bullish market, and global economic uncertainty create a unique environment for Gold ETFs in India. As the festive season unfolds, the blend of tradition, regulatory support, and technological advancements continues to drive investor interest. For many, riding the gold wave during this time represents a celebration of culture and a strategic investment move in a thriving economy. Gold ETFs are poised to play an increasingly vital role in the investment landscape as the market evolves, symbolizing wealth and modern financial acumen.

(The author is Faculty of Finance, FLAME University. Views expressed are personal and do not reflect the official position or policy of Outlook Media Group and/or its employees. The article is for information purpose only; please consult your financial planner/s before investing.)