The year 2017 has been favourable for the Indian stock markets with the Sensex up almost 18 per cent in the first six months. Coming back from the impact of demonetisation that impacted the last 50 days of 2016, the New Year has seen the markets factor in all the impact of the note ban move in a positive manner. The union budget, which was announced a month earlier than usual and although it did not have anything outstanding, it also did not have anything alarming to cause concern for the stock markets to react in a volatile manner.

Buoyed by the Bull Run, the primary markets are also cashing on the opportunity to tap the stock markets with several IPOs hitting the market. So far this year, over Rs 11,000 crore has been raised by new issues—the average deal size of the IPOs being Rs 906 crore. Incidentally, several IPOs are from companies in the financial services, such as the BSE, CDSL and more recently Au Small Finance Bank. This is a repeat of how financial sector companies raised monies from the markets even in 2016. Some of the IPOs have been from retail consumption-driven companies, such as Avenue Supermarts, the owner of DMart super market chain and Shankara Building Materials, a retail home equipment provider.

Several join the party

Unlike the rally of 2007, this time around investors are riding on the mutual fund route to investing in the stock markets. This is visible, going by the net inflows in equity mutual fund schemes in the past one year. According to AMFI data, equity funds including ELSS witnessed net inflows of Rs 10,739 crore in May 2017 alone, which was the highest net inflow in the equity mutual fund category since June 2015. What has been heartening is the increasing SIP route to stock market investing by the mutual funds.

Likewise, the increasing allocation to equities by the EPFO has also meant a steady inflow in the equity markets, which witnessed an increase in the commitment to invest in equities through ETFs, which is expected to have an annual incremental flow of about Rs 20,000 crore. If one adds the contribution through the NPS and the life insurance players, the retail investor participation in the markets has been on an upswing.

Worrying signs

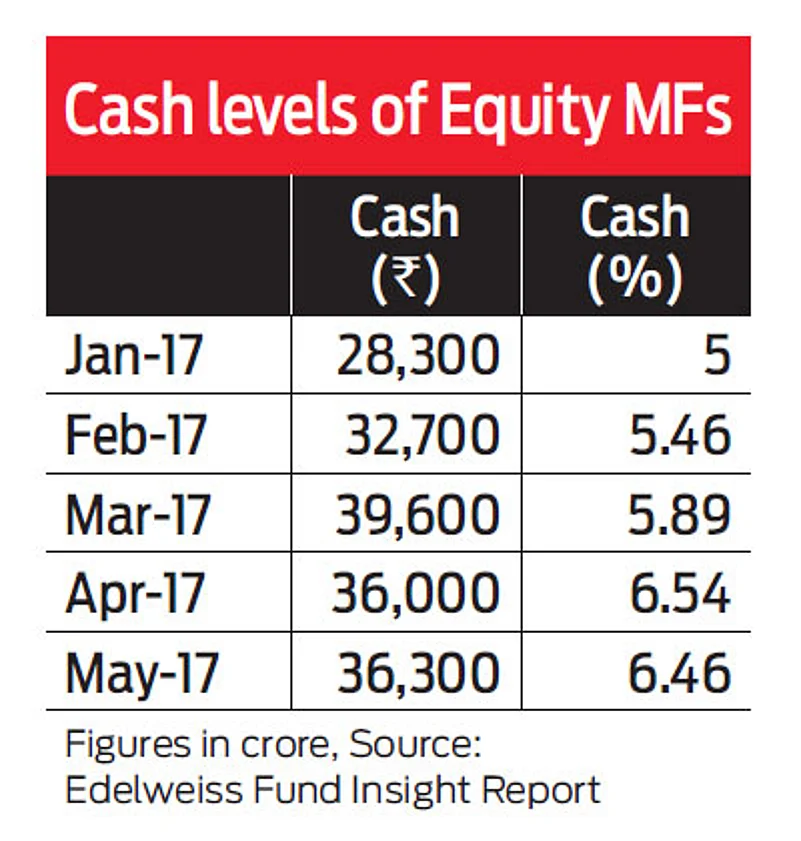

On the one hand, market analysts reiterate the depth in the Indian markets to absorb more equity inflows, there has been a pause in the speed at which mutual funds are now using their cash to invest in equities. The cash levels of equity funds are high, as several fund managers feel that the markets are highly valued and the opportunities at valuations comfortable to them is amiss. In May, the absolute cash component hit Rs 36,300 crore. Fund managers are working on ways to reduce the cash levels, but the appetite for more investors coming into equities through the mutual fund route is putting a strain on some funds.

In recent times, several fund schemes have stopped accepting lump sum investments and are insisting only on regular systematic investments to maintain their positions better. The concern of a heated and high value mid- and small-cap space is causing several fund managers to rethink the investment strategy for such funds. To hedge against volatility, the allocation to largecap is gaining and so is the tilt towards balanced funds, which maintain the allocation between equity and debt in a defined proportion.

GST Impact

More importantly, the second half of calendar 2017 will witness the impact of GST, which is yet to be factored in and understood. So far, the pre-GST sales and discounts are driving consumption driven boom, how things will pan out once the onenation, one-tax regime falls in place, needs to be experienced. Earnings growth is of concern and the positive impact of monsoons is yet to be fully internalised.

At the same time, the mass scale waiver of farm loans are a cause of concern, which could hit the economy badly and impact the gains made by the stock markets. While the first half has gone off well, the second half does not look bleak, but tread with caution, especially when professional fund managers are finding it a challenge to deploy funds. What is certain is the volatility in the markets. While the markets are currently trading at a lifetime high, there is already clamour among the pessimists about an imminent fall in the markets.

How the markets eventually pan out, only time will tell. What one can learn from the markets is the fact that it moves in cycles and there are phases when the markets gain a lot faster than it seems comfortable. The natural outcome of such fast speeds is also a possible correction, which should not overly impact the confidence of investors.